Ah, 2023-a year wherein the stock market has donned its greased finery, a benevolent Jester delighting both the patient and the impatient investors alike. Despite brief squalls induced by the tempest of tariffs that swept over March and April, the indicatives of Wall Street-the venerable S&P 500 (^GSPC), the time-honored Dow Jones Industrial Average (^DJI), and the audaciously ambitious Nasdaq Composite (^IXIC)-have managed to ascend to heights not even dreamed by the plebeians.

There lies a cornucopia of phenomena for the astute investor to relish: the meteoric rise of artificial intelligence, the ominous whispers of quantum computing, the tantalizing prospect of interest rate reductions, and the labyrinthine resolution to the saga of President Donald Trump’s tariffs. Indeed, anything that coagulates uncertainty into predictability is a precious jewel in the eyes of Wall Street’s denizens.

Yet, I must implore you: let us not overlook the shadow lurking behind such radiant jubilation. We have been graced with a rare historical occurrence, one that has transpired merely thrice since the fall of the Napoleonic Empire in 1871. The specter haunting this phenomenon, however, holds portents that are decidedly grim for our investiture in the forthcoming quarters or years.

A Historic Achievement Unbeknownst to the Sane

While the echoes of record highs for the S&P 500, the Dow, and the Nasdaq reverberate through the opulent halls of financial news, two balancing scales must be weighed-performance and valuation, those perennial foes in the grand amphitheater of economics.

Now, fret not, dear reader, a one-size-fits-all guide to stock valuation exists not among the fabled tomes. Every investor bears their idiosyncratic lens, filtering what might seem a bargain to some as a veritable poison to others, thus rendering the market a veritable charade of unpredictability.

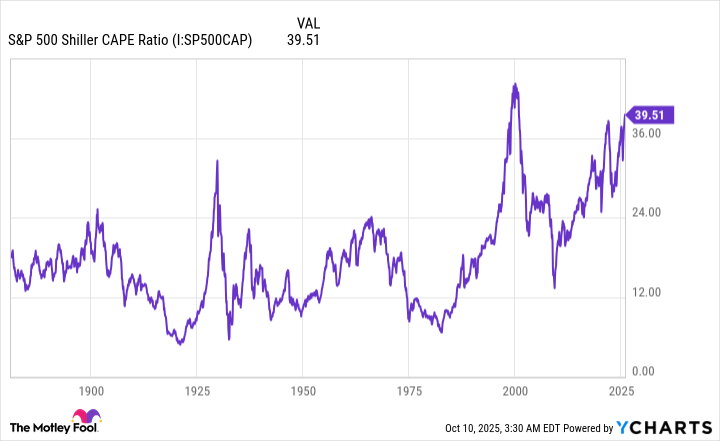

However, allow me to introduce a certain metric, a valiant knight in battered armor, devoid of the slightest margin for error. The Shiller price-to-earnings (P/E) ratio-or as the initiated call it, the cyclically adjusted P/E (CAPE Ratio)-gleams like a a historical compass, guiding through 150 years of capricious market whims.

Unlike the traditional P/E, resting delicately on a mere twelve months of earnings, the Shiller P/E excavates the past, evaluating a decade’s inflation-adjusted earnings, crafting a tapestry resilient to the ruthless machinations of shock events and cyclical downturns.

Tracing back to January of 1871, we find the S&P 500’s Shiller P/E blossoming around a joyful 17.29, a stately average reflecting the joyous democratization of information and the languorous decline of interest rates echoing through the 2010s. Alas, it seems all good things must come to an end, as the highs begin to breach sanity.

On the 8th of October, the Shiller P/E reprimanded empirical knowledge and closed upon an extravagant 40.32, the summit of our current bull run that started three years past-the 133% premium to the historical average marks the edges of madness.

Yet, our focus must pivot to the spectral peaks luring us closer: only thrice since 1871 has the S&P 500 dared to flirt with such heights:

- In the tail-end of December 1999, intoxicated by the exhilarating rush of the Internet’s birth pangs, the Shiller P/E soared to an apoplectic 44.19.

- In early January of the gloriously misguided 2022, fueled by governmental largess, it just brushed against the 40-mark.

- Now, on that fateful October day of 2025, it lingered at 40.32.

From the mists of time and folly, we glean discerning lessons. The aftermath of the December 1999 peak left the S&P 500 and Nasdaq Composite wounded severely, with losses of 49% and 78%, respectively, by 2002. Similarly, in the bear-market waltz of 2022, the S&P 500 saw a decline of 25%.

Five instances since 1871 where the Shiller P/E flirted with 30 during a bull market were followed by declines that ranged from dire to disaster, spanning 20% to an appalling 89%.

Inescapable Doom or Resplendent Hope?

As we cast our gaze toward the grim tapestry woven by such historical precedents, the meandering path of Wall Street’s indices may seem destined for ruin. That being said, the Shiller P/E may not divulge the elusive timing of market corrections, but it undoubtedly underscores that inflated valuations often lead to inevitable introspection-and heartbreak.

Nevertheless, history proves a dual-edged sword; it not only reveals perils but also glimmers glimpses of hope. The cyclical nature of stocks bequeaths us corrections and bear markets as a reminder that we are but moths near a flame, drawn irrationally to the luminous glow of capital.

Radiating from close to a century of scrutiny, the most harrowing downdrafts-those declines exceeding 20%-have morphed to resemble fleeting affairs, ephemeral horrors upon the horizon. Upon the entrance of our current bull market in June 2023, one could hardly ignore the diligent research by Bespoke Investment Group, illuminating the twisting labyrinth of time between bull and bear markets since the ghastly Great Depression.

Loading…

–

In their meticulous evaluations of historical sequences-27 bear markets contrasted with 27 bull markets-a striking disparity arose. The bear markets averaged a woeful existence of merely 9.5 months while the generous bull markets-ever hopeful-lasted around two years and nine months, or 1,011 days, as of June 2023.

Though one must account for the longest S&P 500 bear market post-1929, which endured 630 days, the current bull market will likely defy those dreary limits, burgeoning far beyond historical measures, seeking its own destiny amidst the ruins.

So, while disaster might frolic in the shadows of short-term forecasts, history compellingly suggests that long-term investors-daring souls armed with fortitude-remain well positioned to bask in the riches of their patience. 🐦

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- PLURIBUS’ Best Moments Are Also Its Smallest

- 39th Developer Notes: 2.5th Anniversary Update

- Leaked Set Footage Offers First Look at “Legend of Zelda” Live-Action Film

- Stellar Blade Is Right To Leave Its PlayStation Exclusivity Behind, And Here’s Why

- XRP’s $2 Woes: Bulls in Despair, Bears in Charge! 💸🐻

2025-10-12 10:12