At first glance, it may appear that Kohl’s (KSS) stock is a bargain, its price reminiscent of that slippery clearance rack. With a valuation of merely 0.11 times sales and a modest 8.6 times trailing earnings, one might hastily conclude it is either a prudent investment or merely the husk of a failed enterprise.

However, it is crucial to remember that sometimes, low prices reflect deserved poverty. Over the years, Kohl’s has seen a persistent decline in both sales and earnings, culminating in a meager net profit margin of just 1.3%. One could liken it to a metaphorical falling knife, with edges sharp enough to inflict financial harm.

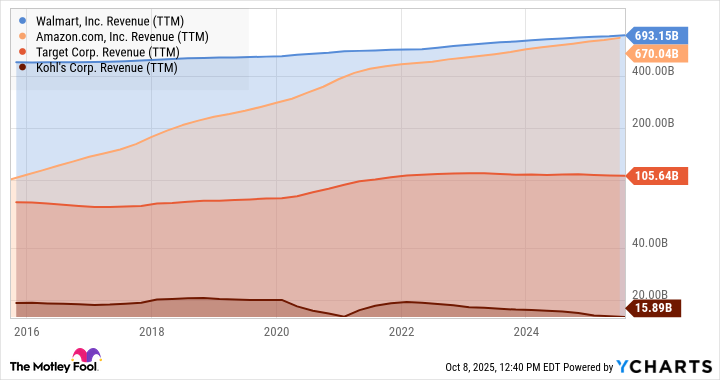

In stark contrast, other “expensive” retailers are not merely surviving-they are flourishing, cultivated growth sustaining an enviable yield for shareholders.

In the realm of retail investment, I find myself inclined to endorse the unstoppable variety over the irredeemable. Therefore, let us consider three alternatives: Walmart (WMT), Amazon (AMZN), and Target (TGT) as prudent acquisitions come October 2025.

Walmart: A Transformation Beyond Nostalgia

The retail landscape harbors approximately 4,600 Walmart stores alongside 600 Sam’s Club locations in the United States, yet the company boasts an even larger footprint internationally with over 5,600 outlets.

What is striking, however, is that Walmart is not merely resting on the hard-earned laurels of its extensive network. Instead, it is embracing contemporary retail technology with surprising vigor. A staggering 94% of American households can now order goods from Walmart with same-day delivery, and 25% of these rapid deliveries are made within 30 minutes of order placement. Customers choosing this delivery method tend to spend more than twice as much per order.

As the shipping system evolves towards greater automation, aided by a consumer-facing artificial intelligence shopping assistant-dubbed Sparky-Walmart’s e-commerce sales surged by 26% over the past year. The inclusion of high-margin operations such as advertising services and the Walmart+ shopping portal is further fattening profit margins. The retail titan so famously initiated by Sam Walton possesses a vigor that belies its age.

Walmart’s stock is not without its cost; having doubled in value over two years while Kohl’s struggled for relevance. However, the store’s continuous growth and evolution justifies the premium price attached to it.

Amazon: Undeterred in a Quest for Dominance

Amazon continues to redefine expectations of delivery speed, even in the absence of large retail establishments. Recently, the company marked a milestone by deploying its millionth warehouse robot, integrating this marvel into an increasingly automated shipping system. To add to its arsenal, drone-based deliveries commenced in the spring of 2024. A clearly asset-light approach shines through: 62% of Amazon’s sales came from third-party sellers over the past year.

The company’s recent foray into pharmacy services, which slashed $620 million off CVS Health’s market capitalization, is but one example of Amazon’s capacity for disruption. A benign introduction of vending machines in selected healthcare clinics in Los Angeles hints at the grander shake-up technology can orchestrate within the pharmacy sector.

No opportunity is too trivial-Amazon is poised to invest over $1 billion to enhance its shipping network in Belgium, a nation with a GDP on par with Colorado, yet among the ten largest economies in Europe.

In the second quarter, North American sales escalated by 11% year over year, while international retail revenue swelled by 16%. Yet, the pièce de résistance of Amazon’s offerings remains its Amazon Web Services (AWS), a dominant force fueling the AI renaissance.

Apologies for my apparent fervor, but the sheer breadth of Amazon’s advantages necessitates emphasis without mere repetition of hackneyed phrases. Notably, the stock trades at a P/E ratio lower than Walmart’s-a rarity that positions Amazon as an appealing value investment.

Target: Striving Towards Renewal

Target, the quintessential embodiment of style and affordability, is emerging from its struggles, setting itself apart from Kohl’s with a distinctly promising path forward.

It has earned its whimsical moniker, “Tar-zhay,” by mastering the art of convincing consumers that budget-friendly shopping can possess an air of sophistication. Unlike Kohl’s, Target truly delivers through its network of over 45 store brands raking in more than $30 billion in annual revenue.

Despite concerns surrounding Target’s modest top-line growth prompting share prices to descend by 33% year to date, one may find irony in its P/E ratio of 10.6, placing it alongside Kohl’s in the proverbial bargain bin.

Incoming CEO Michael Fiddelke faces undeniable challenges but appears primed for the task ahead. “I know we’re not realizing our full potential right now,” he remarked during August’s Q2 earnings call. “We’re a retailer that believes that an elevated experience is every bit as important as product.”

This philosophy serves as the secret ingredient allowing Target to command slightly higher prices than Walmart or Kohl’s, while still generating foot traffic for an enhanced shopping atmosphere. While all turnaround endeavors bear inherent uncertainties, I would place my bets on Target in today’s retail expanse.

💡

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

2025-10-11 22:12