Dear investor, if you’ve been fixated on the behemoths of the AI realm, you may find yourself in a bit of a pickle, for there are other, more sprightly companies to consider. Coupang, for instance, is a veritable paragon of innovation, and one might say it’s a bit of a jester in the grand parade of tech stocks.

With a market cap that, while not exactly a trifle, is notably less than a hundred billion, one might ponder whether Coupang is the more prudent choice for the discerning investor. After all, it is a company of considerable ambition, with its sights set on the AI revolution and its pockets deep in the cloud.

The answer, as clear as a bell, lies in the numbers.

World-class e-commerce in Korea, plus much more

Taking inspiration from the other e-commerce pioneers like Amazon, Coupang has built up a fortress business in South Korea defined by fast delivery, customer delight, and an ecosystem of retail offerings that trump all local competitors. Members of its online subscription service called Rocket Wow receive orders by 7 a.m. the next morning if ordered by midnight the night before, which is faster than most Amazon deliveries.

All of this is available for a small membership fee paid each month, which also provides discounts on food delivery through Coupang Eats, free delivery on grocery purchases, and a slew of other perks. It is no surprise, then, that Coupang has 23.9 million active customers in a country with a population of just 52 million. That is impressive penetration for a brand that is barely a decade old.

Now, Coupang is expanding even further as a technology and commerce provider. It acquired the distressed asset Farfetch to get a foothold in online fashion shopping, has expanded successfully into Taiwan, and recently revamped its cloud computing service focused on AI. Called the Coupang Intelligent Cloud, the company is aiming to take advantage of demand for AI workloads on data centers in Korea, especially as the government has proposed grants for homegrown data center builders.

Better growth, cheaper valuation

Coupang’s revenue, having grown by a sprightly 19% year over year, now stands at a tidy $8.5 billion, a pace that outstrips even the stately Amazon’s 10% growth in its retail operations. Other parts of Coupang’s business are growing much faster, such as its expansion into Taiwan, with over 100% year-over-year revenue growth. With $32 billion in trailing revenue, Coupang is at a much earlier phase of its business life than Amazon, which should give it a longer runway to grow, especially if it expands into new geographies. Not to mention the optionality with the cloud computing business.

When looking at other AI technology stocks, Coupang’s valuation is much more palatable. Nvidia, with its market cap, which is a veritable colossus, may find itself a bit of a laggard in the long run, despite its recent meteoric rise. Palantir, for all its charm, has a market cap of $424 billion and generates less than $3.44 billion in revenue.

Compare that to Coupang with a $59 billion market cap, $32 billion in revenue, and expanding profit margins that should help the company generate heaps of profits in the years to come. Coupang’s investments in automation, AI, and robotics at its fulfillment centers should start to bear huge efficiency gains, which will further help the company expand its profit margins. Taken together, all these factors give Coupang stock a cheaper valuation than some of the hotter AI stocks popular with investors right now.

Is Coupang stock a better buy?

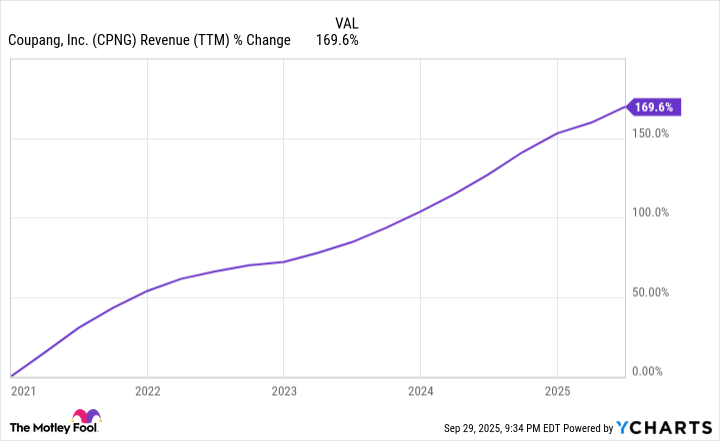

When looking at the combination of growth and size of the stock, Coupang looks like a better AI stock for investors hunting for big winners in their stock portfolio. The company’s revenue is up 170% since going public in 2021. Its market cap is just $59 billion vs. $32 billion in trailing revenue. It has plenty of irons in the fire to help revenue keep growing at a consistently strong pace over the next five years. Management is guiding for profit margins to expand to 10% or higher once the business matures.

Compare that to the huge market caps you have to buy with AI stocks like Palantir or Nvidia right now, and Coupang looks like a better buy for investors today.

And thus, with a dash of optimism and a sprinkle of data, one might say Coupang is the Jeeves to the investor’s Wooster. 📈

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- USD RUB PREDICTION

- Billionaire’s AI Shift: From Super Micro to Nvidia

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

2025-10-08 05:10