Oh, what a splendid farce! Bitcoin, that digital chimera, soared to a fresh all-time high on October 6th, amidst the cacophony of ‘Uptober,’ as if the very calendar conspired with the whims of fate. Yet, staggeringly, not a single one of its thirty-odd auguries of bullish apogee has deigned to signal the summit. How droll, one might chuckle, if one were not weeping tears of gold. 💸😏

At the hour of this scribbling, the precious beast trades nigh on $120,988, a trifling 3.38% tumble from its diurnal zenith. And lo, a 17% eruption in trading fervor propelled $77 billion across the ether, courtesy of CoinMarketCap’s inscrutable ledger. One can only imagine the jolly good show at the exchanges, what? 📈🤡

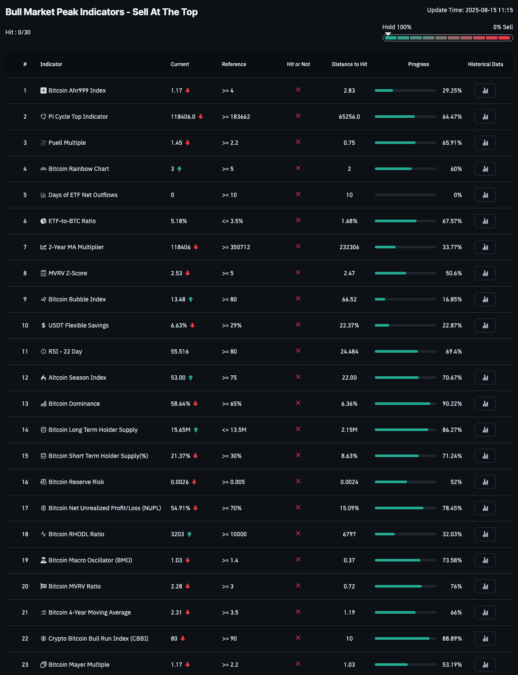

Nonetheless, the merry investors cling to their delusions-that the rally, far from expired, gasps for yet loftier heights. CoinGlass, in its infinite wisdom, proclaims Bitcoin a ‘hold 100%’ paragon, based on those thirty mystical indicators. Ah, the unwavering faith of the faithful! 🙌🤨

CoinGlass’s pantheon of thirty bullish oracles, a veritable dashboard of cycles, comprising the Pi Cycle Top, MVRVratio, and Ahr999 Index-encompassing price, on-chain antics, and sentimental vapourings-stands unanimous: no peak discerned, return ticket not punched. Thus, the ‘hold fast’ edict, hinting at ascensions to new stratospheres. How perfectly absurd, yet thrillingly so. 🚀😒

In an utterance to The CryptoTimes, Farzam Ehsani, CEO and Co-founder of VALR, opined-or shall we say pontificated?-that “Bitcoin’s new all-time high and surge past $125,000 is driven by the convergence of multiple tailwinds kicking into the market simultaneously. These converging factors are vital for understanding the trajectory of the market in Q4.” Tailwinds, indeed! One pictures cherubs with bellows, puffing the bubble ever greater. 🍃💨

Bitcoin and the Mercurial ‘Uptober’ Season

The recent inflationary revelry in Bitcoin’s value is, it seems, stoked by institutional moguls and macroeconomic tempests favouring such high-jinks assets. From this clamour, the soothsayers forecast a potential ascent to $135k ere the year’s end, as momentum pirouettes onward. Sarcasm aside, who wouldn’t chuckle at such precocious optimism? 💰🤭

“Seasonal strength is adding further fuel to the BTC’s rally fire,” Mr. Ehsani bemuses, appending, “Historically, Bitcoin has posted gains in 10 of the last 12 Octobers and 8 of the past 12 Q4s. This is setting expectations that the current breakout move, which saw BTC move from $110,000 to $125,000 in one week, could extend further and withstand the selling pressure and profit-taking usually triggered when Bitcoin hits a new all-time high.” Oh, the irony of history repeating as farcical farce! Historical precedents, how they soothe the nerves-or stir the embers. 📅🔥

Besides, the market’s mood sways ever more bullish, with the Crypto Fear and Greed Index nudging towards avarice. At 64 by CoinMarketCap’s reckoning, it bespeaks an investor populace brimming with foolish confidence. One wonders if Waugh himself might have penned a vaster irony. 😈🤗

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- Gold Rate Forecast

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

- Thinking Before Acting: A Self-Reflective AI for Safer Autonomous Driving

- Celebs Who Got Canceled for Questioning Pronoun Policies on Set

2025-10-07 22:47