Well, hello there, Bitcoin enthusiasts! Seems like our favorite digital currency is trying to decide whether it wants to break out or break down-like that awkward moment when you can’t decide between sushi and pizza for dinner. 😅

Bitcoin

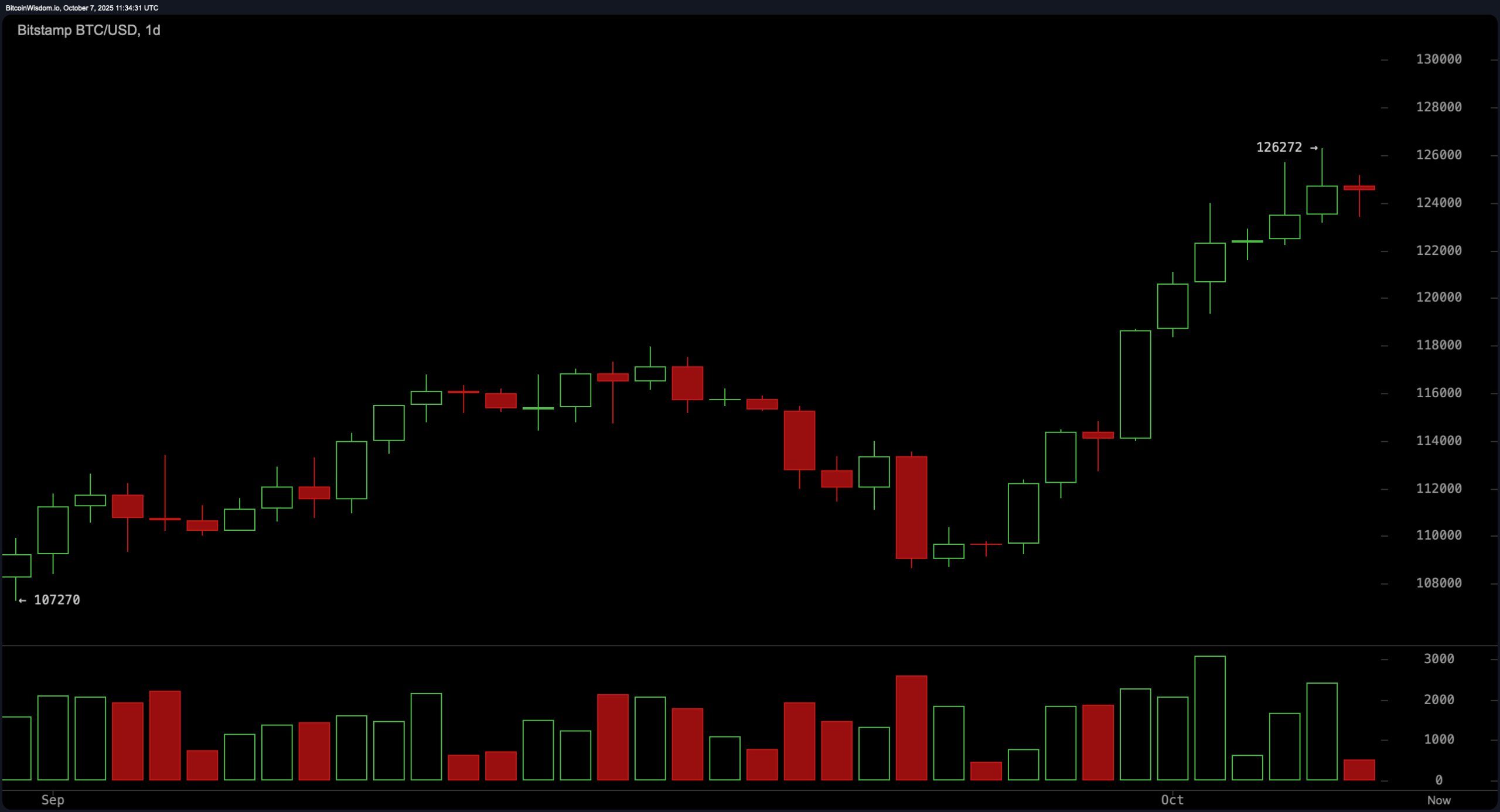

On the daily chart, Bitcoin is still basking in the glow of its recent $126,000 celebration, but it’s now taking a breather like a runner who just crossed the finish line. The trend is still bullish, but the candles are starting to look like they’re in a mid-life crisis-indecisive, and a little unsure of themselves.

Support’s chilling around $124,000, and if the price retraces to the $122,000-$123,000 range, that could be the moment when the bulls start showing up like a party with free drinks. But watch out, resistance is still lurking at $126,000-$127,000, like that one person who shows up to your party and doesn’t know when to leave. Without something big to push it further, Bitcoin might be stuck playing the waiting game for now.

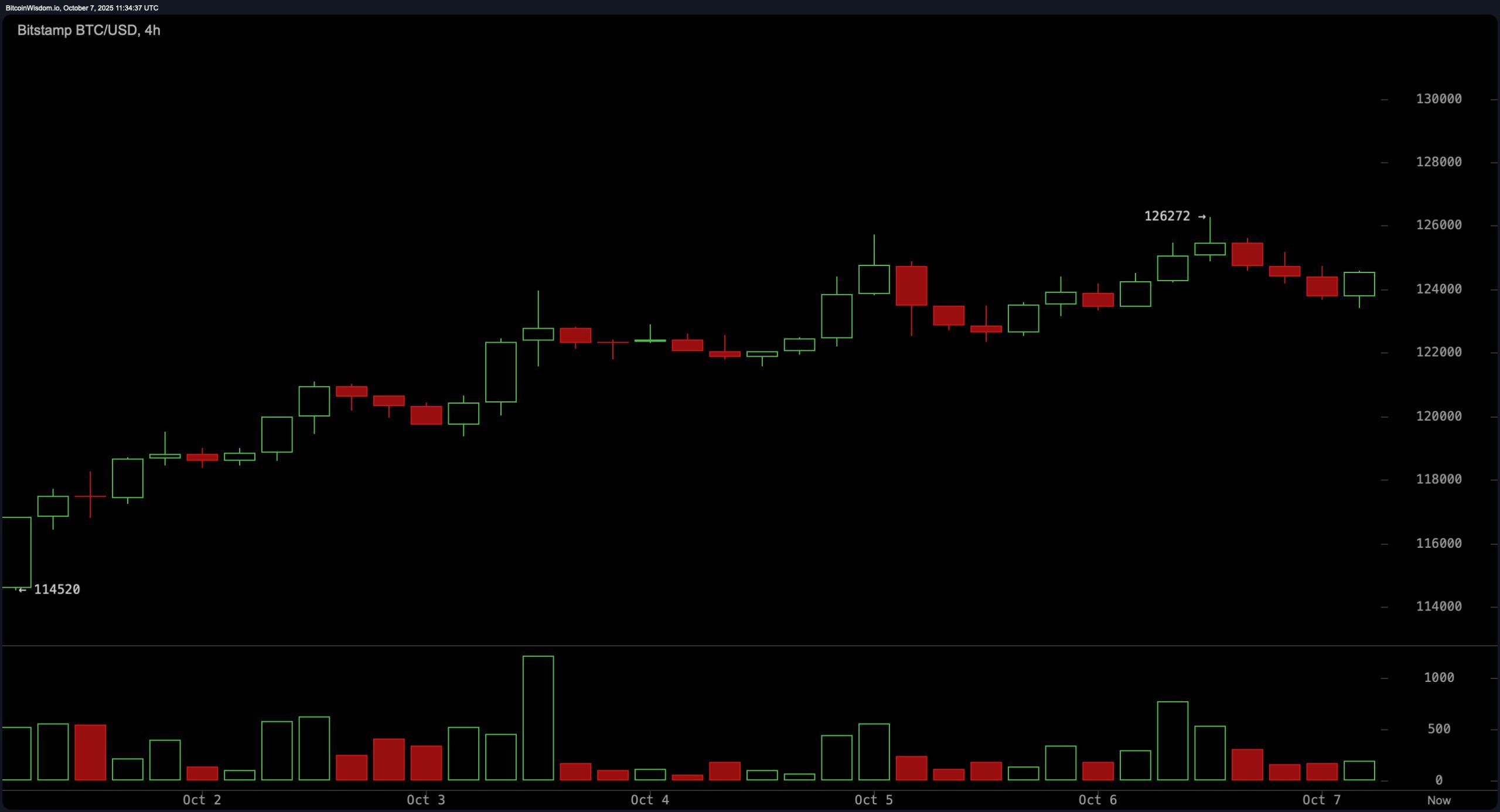

Now, on the 4-hour chart, things are getting a little spicy. We’re seeing a rising wedge breakdown, like a bad date that you just know isn’t going anywhere. After peaking at $126,272, Bitcoin’s been doing this awkward dance of lower highs and lower lows-volume’s weak, and the market is kinda like, “I’m not sure what to do with my life.”

If Bitcoin dips below $124,000 with some decent volume, it could roll downhill to $122,500. But, if it manages to pull itself together and goes above $125,500, then it’s game on for the bulls again. We’re in classic breakdown territory here, so don’t blink-this could turn into a rollercoaster ride real fast. 🎢

On the 1-hour chart, Bitcoin’s gearing up for its next big move-brace yourselves! It’s been forming a downtrend, lower highs, and lower lows… and it’s like, “What do I do now?” But wait, it’s found some footing above $124,000-will this be the spark that ignites a price rally? If we get a bullish engulfing candle off this support, expect a quick jump towards $125,500. But, if $125,000-$125,300 becomes a resistance zone, the bears will be out in full force, ready for their next snack. 🐻

So, what’s the deal with the oscillators? They’re sending us some mixed signals-kinda like that friend who’s always confusing you with their relationship status. The RSI is flashing red with a bearish vibe, but the Stochastic is staying neutral. Meanwhile, the CCI and momentum are all like, “Sell! Sell! Sell!” But the MACD? It’s still waving the “bullish” flag like it’s 1999. 🙃

Let’s talk about moving averages, shall we? All the major EMAs and SMAs from the 10-day to the 200-day are still flashing “bullish”-that’s a sign of a structurally strong market. If the price holds above the key support zones, we’ll keep this bullish train rolling. But the bulls better get their act together and show some conviction soon-otherwise, things might get real wobbly. 😬

Bull Verdict:

Okay, so if you’re betting on the bulls, you’ve got a decent chance. The major moving averages are in full “buy” mode, and price action is chilling above key support-no crashing below it (yet). A bounce off the $124,000 support could lead us back to $126,000 or higher, especially if the volume kicks in like it should. For now, this pullback is just a breather, not the end of the world.

Bear Verdict:

But the bears are not ready to call it quits! That rising wedge on the 4-hour chart is cracking like an old phone screen, and the indicators are flashing warning signs like a glitchy Netflix login. The RSI, momentum, and CCI are all screaming “SELL!” If Bitcoin breaks below $124,000 with some serious volume, we could see a plunge toward $122,000 or even worse. 🐻⛔

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Leaked Set Footage Offers First Look at “Legend of Zelda” Live-Action Film

2025-10-07 15:28