Let us not pretend that the alchemy of dividend stocks is a science, but rather a game of mirrors played in a hall of whispers. For those who fancy themselves connoisseurs of income, or perhaps mere victims of a Pavlovian craving for quarterly checks, two names emerge from the fog like phantoms: Stanley Black & Decker and Bath & Body Works. Their yields, a siren song, but their stories, a labyrinth of contradictions.

Margin Improvements: A Slick Illusion

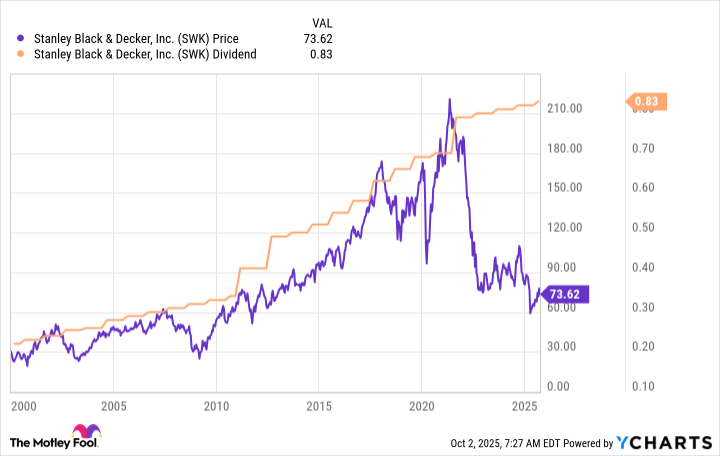

Stanley Black & Decker (SWK), that industrial leviathan with a penchant for power tools and the occasional hand-saw, has lately been touting its margin-enhancing initiatives as though they were the Rosetta Stone of profitability. Its dividend increase-a paltry $0.01 per share-has been hailed as a triumph, yet one cannot help but notice the faint scent of desperation in its 4.5% yield. After all, what is a dividend but a deferred promise, a check written on a future that may or may not arrive?

The company’s CEO, in a press release that read like a love letter to the NYSE, waxed poetic about “long-term organic growth” and “margin expansion.” But let us dissect this with the precision of a jeweler’s loupe. The $2 billion in cost savings by 2025? A band-aid on a festering wound. The 35%+ gross margin target? A mirage in a desert where water is scarce and the sun is a fickle god.

One might argue that Stanley’s dividend is a lighthouse in a storm, but lighthouses, too, can be extinguished. The real question is not whether the dividend will persist, but whether the company’s culture of cost-cutting will erode the very products that make its brands synonymous with reliability. For a company that sells tools, it is ironic that its most valuable asset-trust-may be the first to rust.

Expansion: A Quixotic Endeavor

Bath & Body Works (BBWI), that purveyor of lavender-scented serenity, offers a 3.1% yield, a modest offering compared to its industrial counterpart. Yet its ambitions are nothing short of audacious. The company plans to expand into haircare, lip products, and laundry-categories as disparate as a sonnet and a spreadsheet. One might say it is trying to become the Jack-of-all-trades in a world that rewards specialists.

Its international expansion, meanwhile, is a tale of two halves. While the company boasts a 500th store in London, the majority of its sales still cling to North America like barnacles to a ship’s hull. Morningstar’s forecasts of 5% international growth are as comforting as a lullaby to a soldier. The truth is, global markets are a minefield of tariffs, tariffs, and tariffs-each more treacherous than the last.

And let us not forget the digital frontier, where Bath & Body Works’ e-commerce growth is projected at 3%. In an age where Amazon can sell a candle that smells like “nostalgia,” is this not a Pyrrhic victory? The company’s product pipeline is a symphony of potential, but symphonies require conductors, not just composers. Who, one wonders, will conduct this opus of expansion without losing the audience’s attention?

Are They Buys? A Contrarian’s Dilemma

To the unwary, Stanley Black & Decker and Bath & Body Works appear as twin beacons of stability. Yet stability, in the world of investing, is often a synonym for stagnation. Stanley’s dividend history is a tapestry of persistence, but persistence is not a substitute for innovation. Bath & Body Works’ growth potential is a siren’s call, but sirens drown more sailors than they save.

Contrarian investors, of course, are not swayed by dividends or growth. We are seduced by the gaps in the narrative, the cracks in the facade. Stanley’s cost-cutting may be a temporary salve, but it is a salve applied to a wound that may never close. Bath & Body Works’ expansion is a house of cards, each new product a card that could bring the whole structure crashing down.

So, to the reader who seeks not safety but opportunity, I offer this: the market is a game of chess, not checkers. Play it with the eyes of a poet and the mind of a strategist. 🪙

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- USD RUB PREDICTION

- Billionaire’s AI Shift: From Super Micro to Nvidia

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

2025-10-07 05:38