In the grand tapestry of financial endeavors, some stocks shimmer like stars, their value unyielding even as the cosmos tilts. The Coca-Cola Company (KO), that venerable serpent of the beverage realm, has long been a paragon of such constancy. To purchase its shares when the price dips, and to cradle them like a monk’s prayer, is to partake in a ritual as ancient as the hills.

Consider, if you will, the case of this soda monarch. A favored child of Warren Buffett, whose wisdom is as revered as the Kremlin’s walls, Coca-Cola has, for decades, raised its dividend with the precision of a clockmaker’s hand. To hold its stock and let dividends compound is to play a game of patience, where the board is strewn with the bones of impatient investors.

Today, the stock languishes 10% below its zenith, a sullen shadow of its former self. Yet, behold the alchemy of its enduring charm. The question is not why one should buy, but why one would not, when the dragon’s hoard lies dormant, waiting to be claimed.

The Tyrant of the Beverage Bazaar

One need not be a scholar of geopolitics to know Coca-Cola. Its name is etched into the annals of global culture, a brand so ubiquitous it is both a household name and a bureaucratic decree. The company, a colossus of 2.2 billion servings daily, operates in a world where the beverage market is a labyrinth of flavors and ambitions, yet its dominion is but a whisper in the grand scheme.

Despite its gargantuan scale, Coca-Cola’s market share is a paltry 14% in developed lands and 7% in the wilds of emerging markets. Yet, in this fragmented realm, it wields the sword of distribution, the shield of economies of scale, and the crown of brand recognition. To displace its products from shelves is to defy the very laws of commerce, for they are as entrenched as the Kremlin’s foundations.

The stock’s chart, a serpentine line of resilience, defies the whims of market fickle as a bureaucrat’s ledger. It is unlikely that any rival, no matter how cunning, could wrest its place on the shelf. And so, Coca-Cola, with the patience of a monk, continues to weave its magic through pricing, innovation, or the slow erosion of competitors.

Its growth, though modest, is a testament to the power of consistency. Analysts, those modern-day oracles, predict mid-single-digit gains-a forecast as unexciting as a government report, yet cumulative in its might.

The Enchantment of the Dividend

Coca-Cola, that paragon of profitability, transforms nearly 20 cents of every dollar into free cash flow, a treasure trove for its shareholders. This wealth is not hoarded but dispensed in quarterly installments, a ritual as sacred as the Kremlin’s rituals.

The true magic lies in its dividend, a tradition of 62 consecutive years of increases. A 5% annual rise, even through wars, pandemics, and the caprices of the market, is a feat as improbable as a bureaucrat’s honesty. It is a testament to the company’s unyielding spirit, a phoenix rising from the ashes of every crisis.

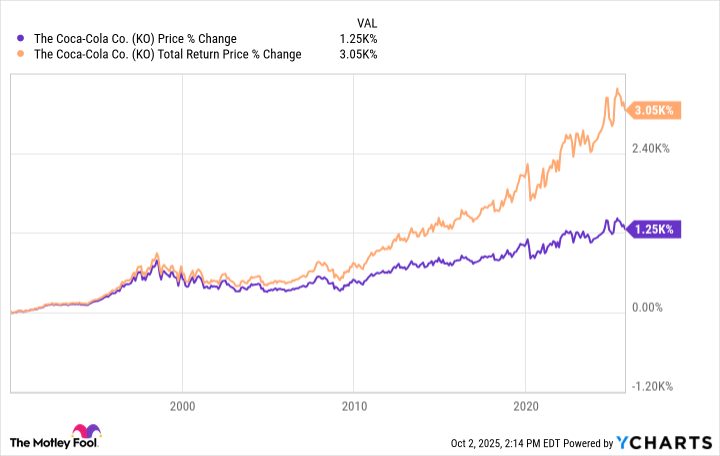

Its stock, a relic of bygone eras, has seen its price swell not merely through earnings but through the alchemy of reinvested dividends. The difference between price appreciation and total returns is a tale as old as time, yet one that rewards the patient.

The Unshakable Doctrine of Patience

To own Coca-Cola is to embrace a philosophy of endurance. History has shown that time, that great equalizer, can transform modest investments into fortunes. The company, though a mere fraction of the global beverage empire, remains a beacon of steady growth, its potential as vast as the Siberian tundra.

Dividend yields, that modern-day oracle, suggest the stock is fairly valued. A 3% yield, though not a bargain, is a promise of stability. One might dream of a discount, but in the realm of finance, even a fair price is a triumph.

Analysts, those scribes of the future, foresee 6.5% annual earnings growth. If the stock mirrors this, total returns of 9-10% await. A doubling of investment every seven years is a feat as improbable as a bureaucrat’s efficiency, yet within reach for those who wait.

Thus, the case for Coca-Cola is as clear as a bureaucrat’s ledger. A stock to buy, hold, and let the years do the rest. A dragon, perhaps, but one whose hoard is as enduring as the Kremlin itself. 🍬

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

- Celebs Who Got Canceled for Questioning Pronoun Policies on Set

- Ethereum Flips Netflix: Crypto Drama Beats Binge-Watching! 🎬💰

2025-10-07 04:55