Behold, dear investors, a tragicomedy most curious: the tale of Rivian Automotive, a company whose stock price dances like a marionette tugged by the strings of hubris and hubristic factory plans. Once lauded as the golden child of electric vehicles, it now stumbles through the third act of its financial opera, its shares trading near $15-a price that whispers of desperation rather than deliberation.

Rivian, in its current incarnation, remains a specter of profitability, haunting the halls of Wall Street with its persistent losses. Yet it boasts backers of grandeur and ambitions to expand its manufacturing footprint with the fervor of a playwright scripting a comeback. Alas, the stock’s rebound from its nadir feels less like a resurrection and more like a pause in the dirge.

With new factories rising like cathedrals to ambition, one wonders: has this stock finally struck rock bottom, or does it yet dig deeper into the abyss? Let us dissect this folly with the precision of a Molièrean farce.

Act I: The Rise and Fall of Electric Dreams

Rivian’s entrance onto the stage was grand: premiering its R1 models in 2022, a duo of SUVs and trucks that promised to electrify the masses. Alas, their price tags-$75,000 and beyond-rendered them as accessible as a noble’s estate to commoners. Even Amazon, that modern-day Midas, could not gild the lily enough to make these vehicles bloom in the mass market.

Deliveries, once a crescendo in 2023, now wane like a poorly composed aria. With but 10,000 vehicles per quarter, Rivian remains a footnote in the automotive symphony, its finances bleeding into the red. Yet, undeterred, it announces grand plans: new factories in Illinois and Georgia, edifices of hubris meant to birth cheaper models-R2 and R3-hoped to democratize its wares. One might call it a deus ex machina, if only the gods of capitalism were so generous.

For in this industry, scale is the sovereign, and profit the rare jewel. Tesla, that juggernaut, needed 100,000 vehicles per quarter to turn its ledger green. Rivian, with its meager output, remains a supplicant at the altar of profitability, clutching its expansion plans like a prayer.

Act II: The Arithmetic of Aspiration

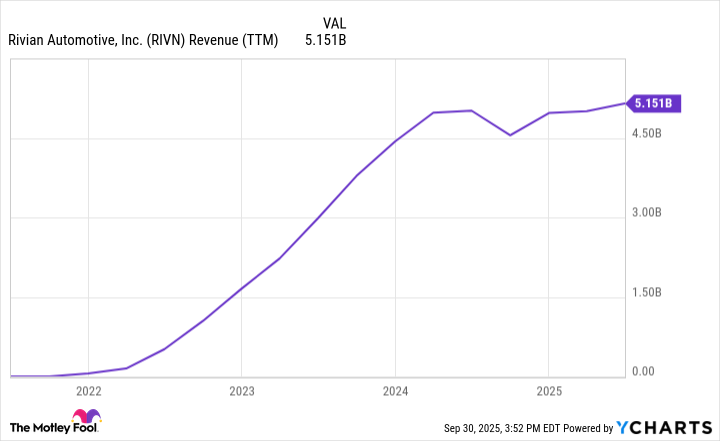

Rivian’s market cap, a paltry $17.7 billion, is a testament to investors’ skepticism. To value it by earnings or cash flow is folly, for both are negative. Yet we, like soothsayers, attempt to divine its future: if the R2 and R3 achieve scale, perhaps $20 billion in revenue by 2030? A 10% profit margin? A billion dollars in net income? Such projections are less financial analysis and more alchemy-turning base metals of hope into gold.

And yet, this is the theater in which we all perform. For if Rivian scales, its valuation may justify the current price. But if it falters? The factories become mausoleums, the stock a dirge. The risk, dear reader, is not merely financial but existential: a delusion so grand it could rival Molière’s The Imaginary Invalid.

Act III: The Final Curtain?

Is this stock’s nadir finally reached? The question is less about numbers and more about faith. At its current price, Rivian is a gamble-a bet that its factories will rise, its models sell, and its losses transform into gains. But history whispers caution: it has burned cash like a prodigal son, its margins as thin as a playwright’s purse.

To call it a “buy” is to invite the ghosts of failed ventures. Even if the share price doubles by 2030, the path is strewn with perils-production delays, price wars, the ever-looming shadow of Tesla. The juice, as the saying goes, may not justify the squeeze. For this portfolio manager, the lesson is clear: let others chase the delusion; I shall stick to dividends and dull but dependable arithmetic.

The curtain falls, and the stock remains… a farce. 🚩

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- USD RUB PREDICTION

- Billionaire’s AI Shift: From Super Micro to Nvidia

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

2025-10-06 04:36