Bitcoin, that stubborn ledger stone, has climbed past $125,000, stamping a new all-time mark on the world’s chalkboard. The intraday peak-$125,708-looked less like luck and more like a mule finally creaking up the hill, with a grin and a shrug at the bear. And this rise isn’t some carnival trick; it’s the weathered weather of a market that’s learned to hold a line, or pretend it does. 😏💹

Instead, it mirrors the patient pattern of accumulation that shows up in old cycles-hands steady, pockets full of belief, money chasing something larger than a rumor.

Bitcoin Investors Are Optimistic

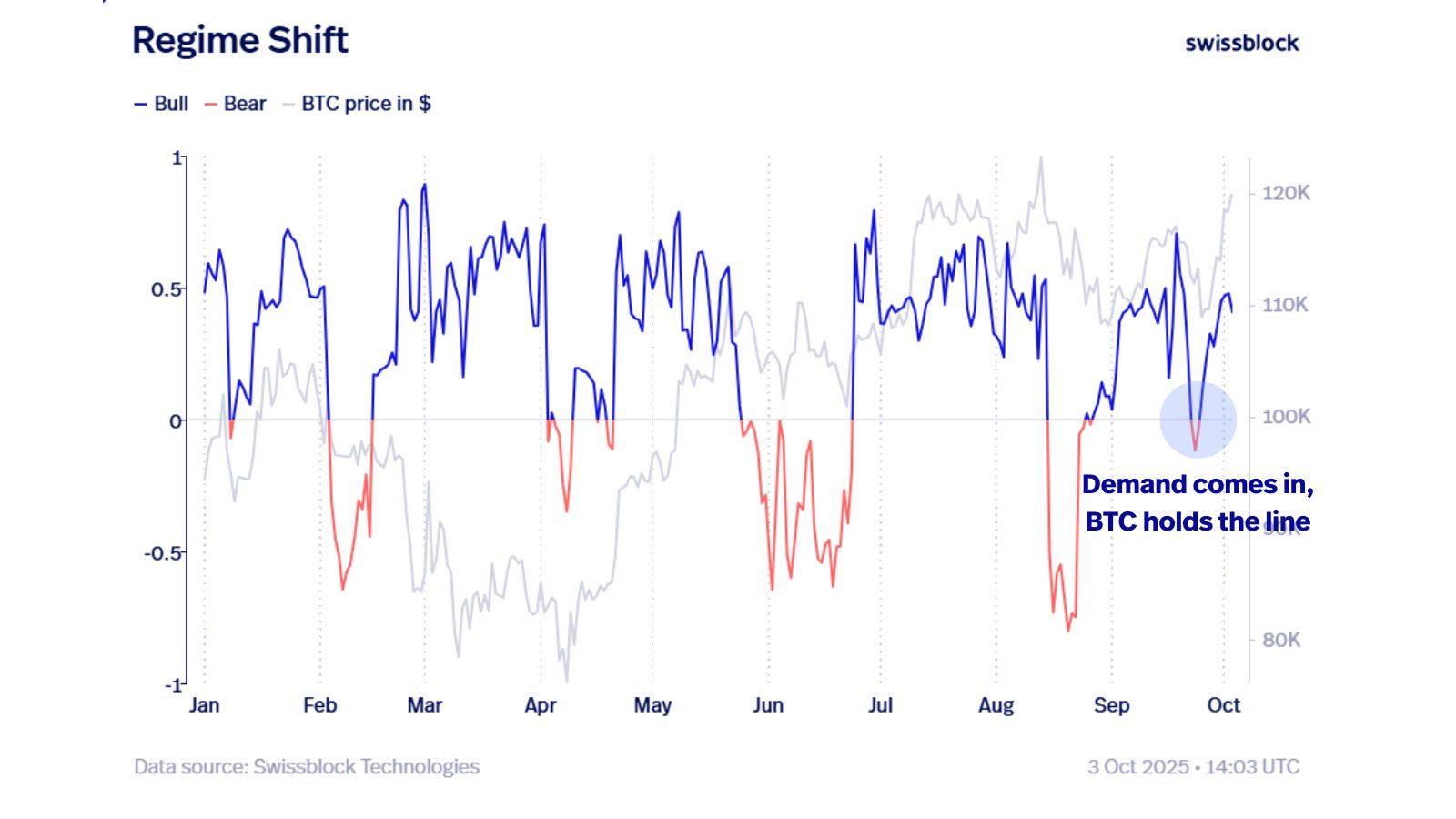

Swissblock, that ledger-keeper with more scalpels than secrets, shows through its Bull Bear Indicator that this rally drew strength from real demand rather than feverish gambling. 🤔📈

Even as the market corrected briefly before this surge, demand kept pace, swallowing supply like rain in dry earth. The Structure Shift stayed on the upswing through the dip, proof of stubborn conviction.

This steadiness suggests a healthy reset rather than fragility. Institutional interest and growing retail participation have fed a steady stream of capital into Bitcoin, like a river finding its banks. 💧💰

Such resilience marks a phase where pullbacks are seen as chances to buy, not alarms to sell. 👍

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

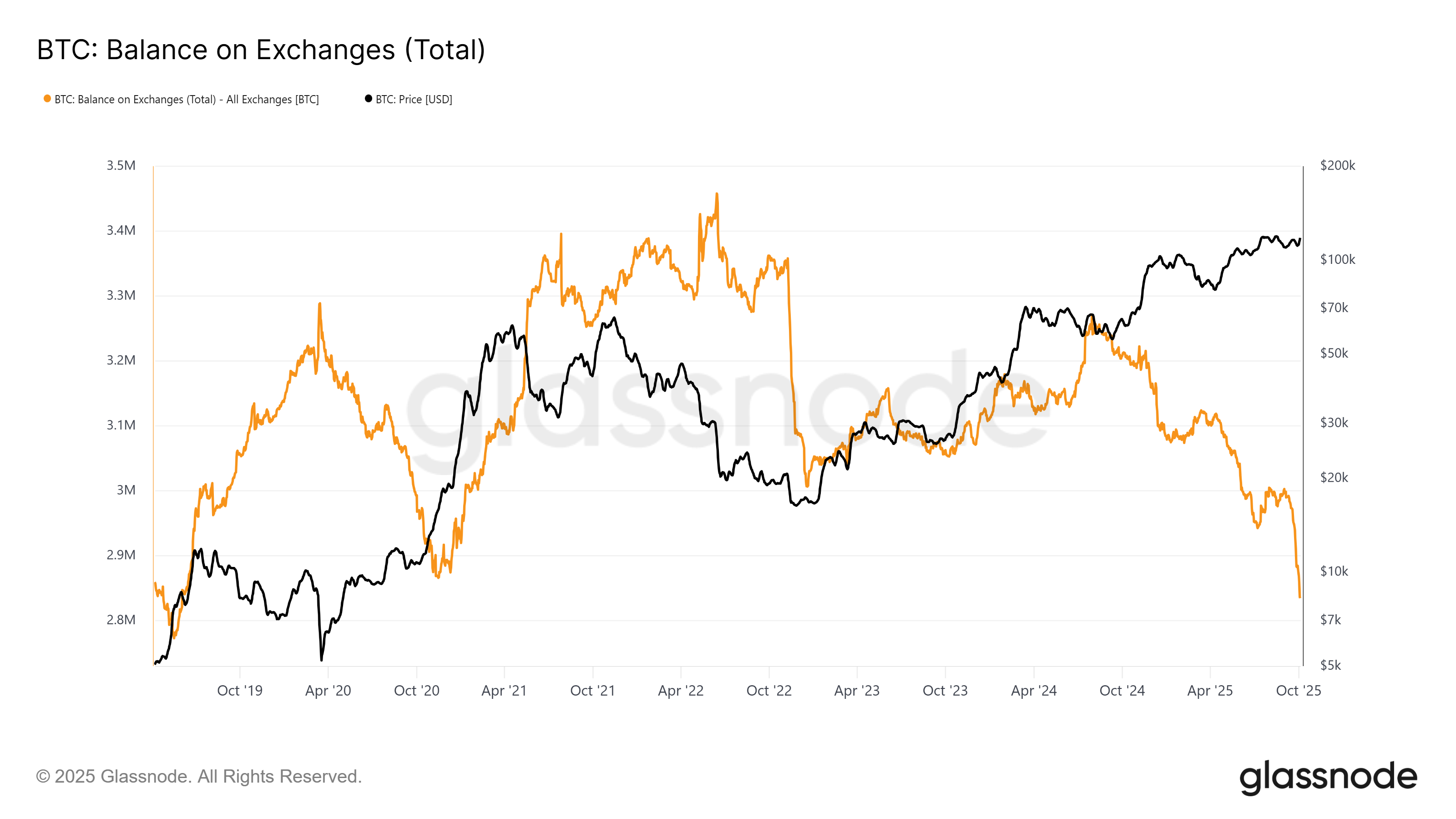

The macro picture for Bitcoin remains bullish. Exchange data shows BTC supply at a six-year low, with only 2.83 million coins available on exchanges. A sign that investors have been stocking up and keeping a wary eye on the door. This accumulation hints at long-haul confidence in the asset.

Lower exchange supply typically reduces selling pressure, a classic bullish note. The accumulation trend suggests participants saw the recent correction not as a wrecking ball but as a chance to stock up on a weathered horse. 🐎💼

BTC Price Forms New ATH

Bitcoin’s price struck a fresh peak at $125,708, then cooled to around $122,963. That pullback, scaled to the height of its climb, looks like a measured breath rather than a retreat. Staying above $122,000 feels like keeping a steady foot in the door of momentum.

The blend of stubborn demand, patient accumulation, and a lean supply could push Bitcoin toward another all-time high in the days ahead. If institutions keep tapping the keg, the drink could keep flowing. 🥂

However, if profit-taking grows louder, Bitcoin could drop below the $122,000 floor and drift toward $120,000 or lower. Such a drift would be a cooldown, perhaps delaying the next ascent but not extinguishing the road ahead. 🔄

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- The Best Actors Who Have Played Hamlet, Ranked

2025-10-05 21:47