Well, well, well. Here we are again, staring at the crypto market that seems to have all the emotional maturity of a teenager deciding whether to buy a new iPhone. With the digital assets stubbornly clinging to a $4 trillion valuation and Bitcoin having a good old romp past its previous all-time high, we’re seeing two fear-and-greed indexes waving around like cocktail napkins at a dinner party-one saying “neutral,” the other whispering “temptation.” And, as we know, temptation is the perfect setting for an investor to lose all sense of reason. But don’t panic, just yet-this isn’t quite the frothy chaos that will leave you hiding under your bed just yet.

Crypto Market Tiptoes Into the Greedy Territory

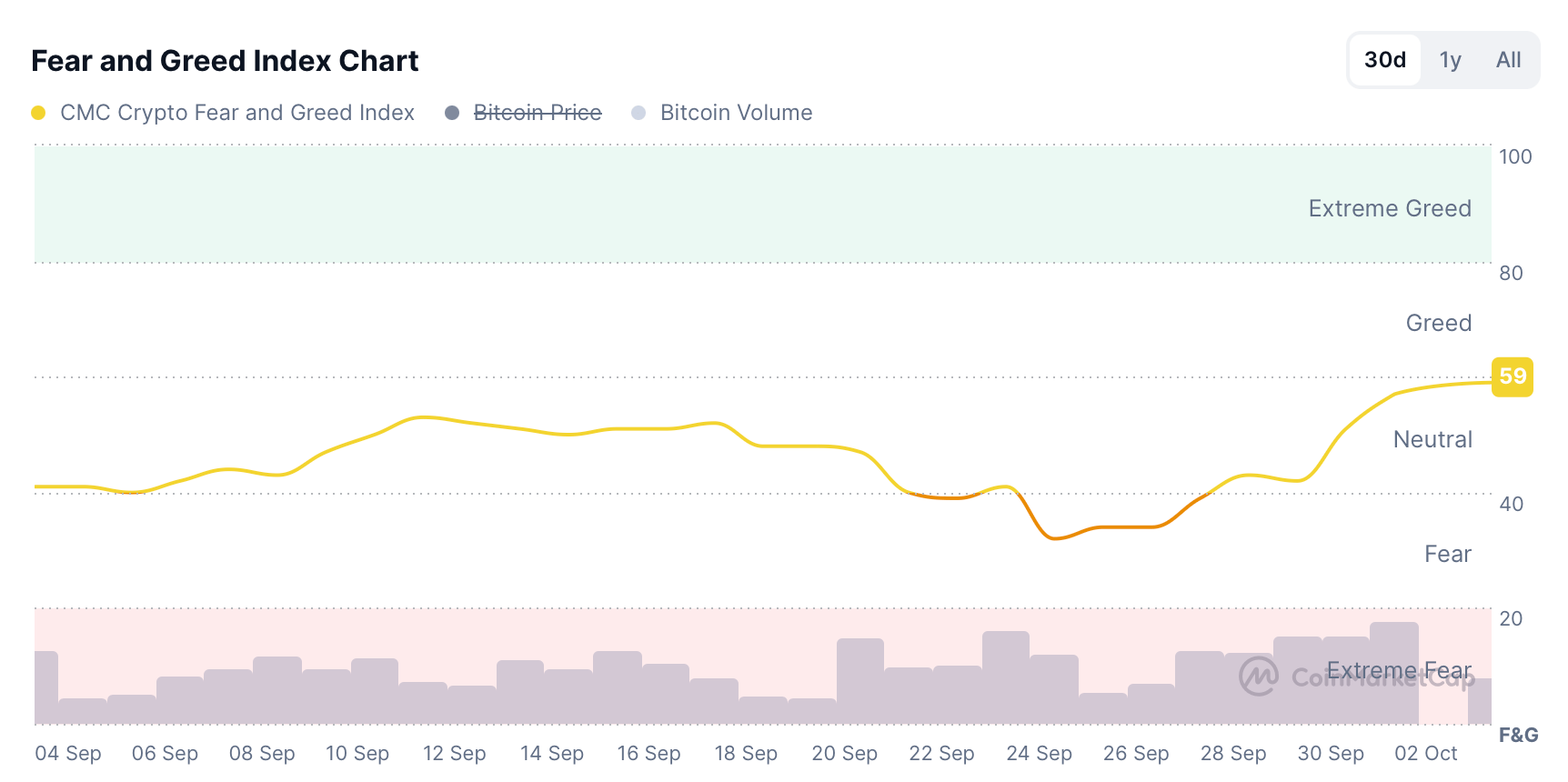

The digital asset economy has done what it always does-kick upward like a toddler who’s just had a sugar rush. Bulls appear to be raring to keep the ride going, but what’s really more intriguing than the price is how fickle our dear Fear and Greed Index is feeling today. It’s 59 out of 100, technically a “neutral” zone, but let’s be honest, it’s the sort of neutrality that’s already eyeing up a cocktail at the bar. Neutral, my foot.

Now, back in the dreamy haze of October 1st, that number was a meager 51, poor thing. But blink, and by Oct. 4th, it’s shot up by 15.69%. It’s practically done a somersault. CMC’s Fear and Greed Index (CMC FGI) is like crypto’s very own mood ring-low? “Fear.” High? “Greed.” Think of it as the mood swings of your cousin at a family gathering. If the index drops too low, someone might need a hug; if it rises too high, perhaps a stern warning is in order.

Now, you may wonder-how does CMC conjure this mystical number? Well, let’s just say it takes a healthy dose of price momentum, volatility, derivatives action (yawn, I know), and-wait for it-social trend searches. Yes, that’s right-this is as much about hashtags as it is about financial data. CMC even uses their own proprietary data to get this magic recipe just right. But the recipe for success is almost always better with a little social media spice, wouldn’t you agree?

The index also uses social trend keyword searches and user engagement metrics to capture market sentiment, retail interest, and emerging trends.

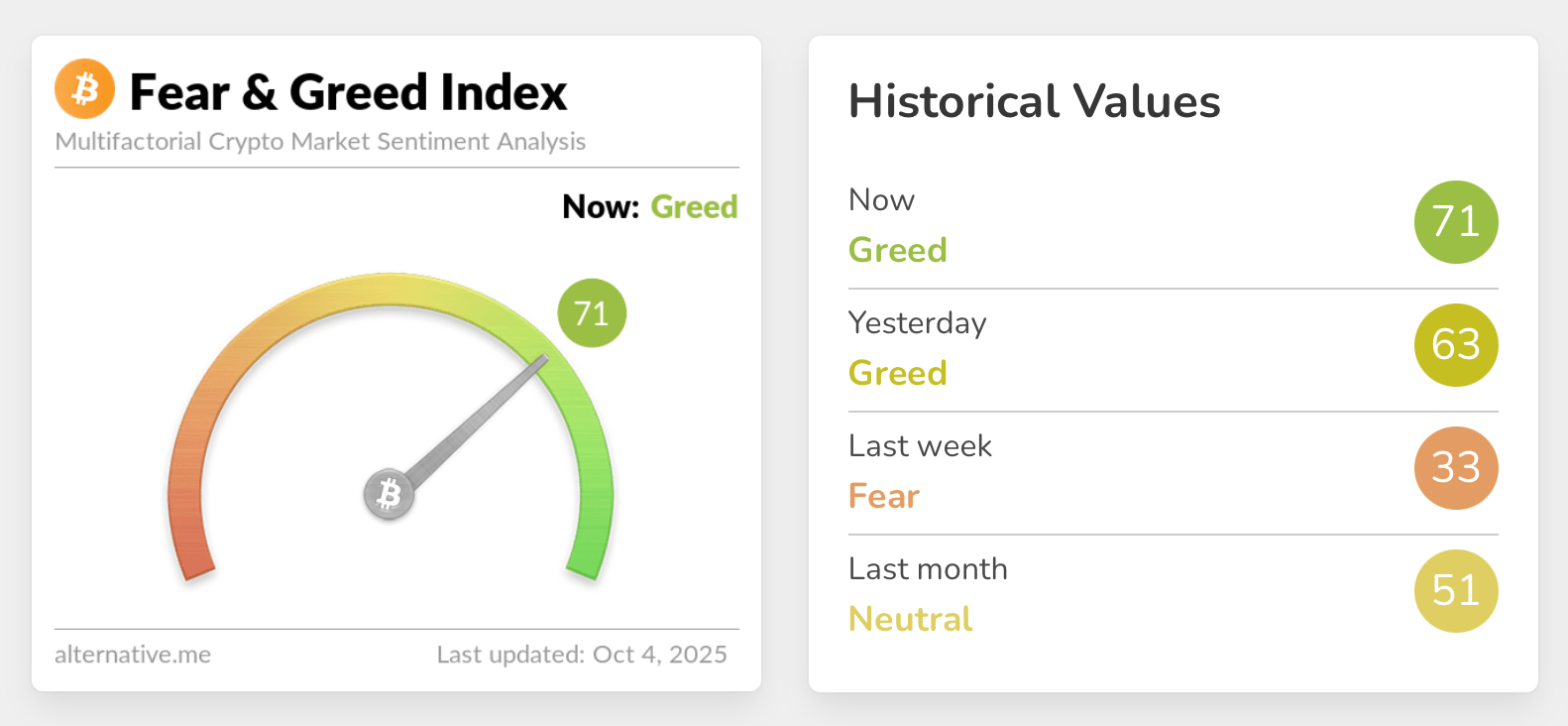

Meanwhile, the Crypto Fear and Greed Index (CFGI) over at alternative.me has decided to skip the social anxiety and take the “greed” plunge-it’s sitting at a spicy 71 today, compared to yesterday’s 63. Not too shabby! It was practically limping along at a meager 33 just last week. It’s almost as if the CFGI went on a holiday and came back with a tan and a sense of confidence. Greed, thy name is crypto.

This rapid jump from fear to greed is like watching a cat go from sitting calmly in your lap to attacking your shoelaces in under 30 seconds. But here’s the thing-CFGI says that when investors get too greedy, it’s basically a neon sign flashing “Warning: Potential Crash Ahead!” But for now, we’re safely out of “extreme greed” territory, thank you very much. We’re still in the *thrill but not meltdown* zone, folks.

So, where does all this leave us? Well, somewhere between “hold on tight” and “maybe don’t quit your day job.” Bitcoin and its digital comrades are strutting their stuff on the charts, while sentiment gently nudges them onward like a slightly tipsy partygoer trying to keep their balance.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Best Ways to Farm Prestige in Kingdom Come: Deliverance 2

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-10-05 20:33