Oh, honey, Bitcoin’s derivatives engine just hit the gas pedal and floored it! Futures open interest is now a cool $91.59 billion, while the spot price is chilling at $123,142 as of 9:30 a.m. Sunday. Someone call the fire department, because this market is *lit* 🔥.

Bitcoin’s Futures Stack Meets Call-Heavy Options Frenzy: A Match Made in Crypto Heaven (or Hell?)

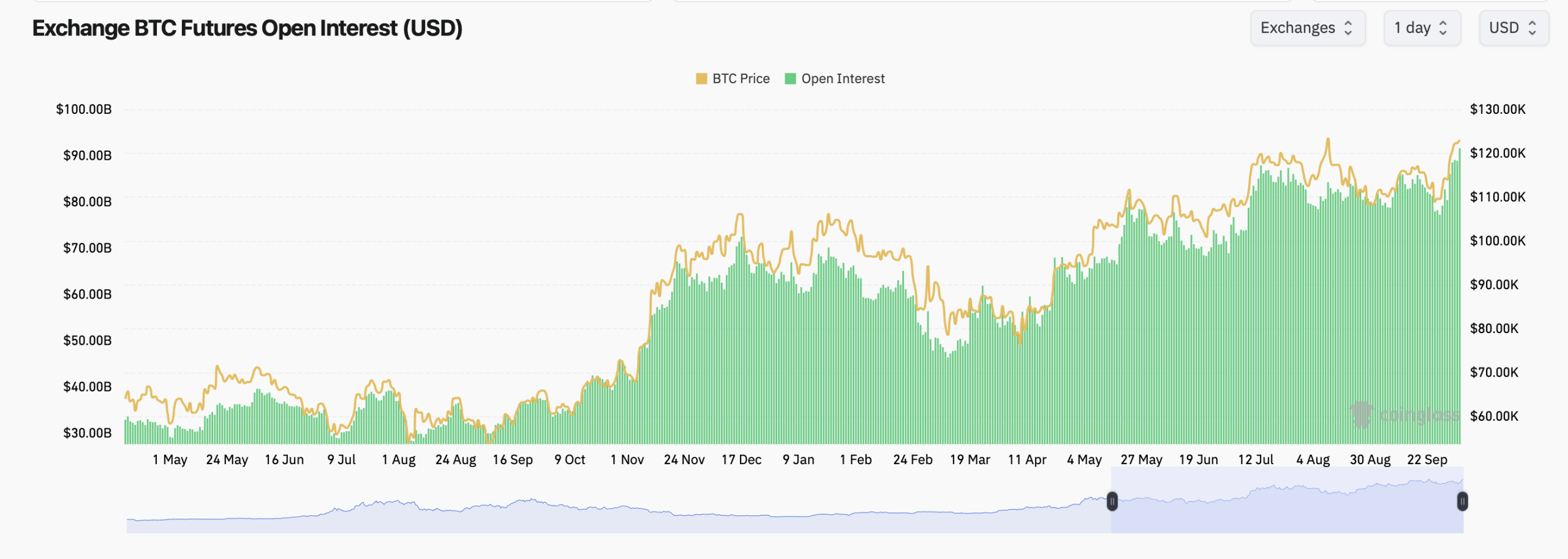

At the index level, Bitcoin flirted with $125,725 this week before settling at $123,142, and the derivatives crowd was like, “Hold my latte.” Aggregate futures open interest (OI) figures from coinglass.com hit an all-time high near $91.59 billion, up 2.04% on the day. Translation: traders are throwing caution to the wind and doubling down on their bets. The casino is open 24/7, and the chips are stacked higher than a Jenga tower after three mimosas 🍾.

CME is still wearing the crown 👑 with $18.19 billion in OI (19.85% of the pile), and 147.8K BTC worth of exposure. Binance is right behind with $16.44 billion (17.94%), followed by Bybit at $10.13 billion (11.06%) and Gate at $9.44 billion (10.3%). OKX has $4.96 billion (5.41%), while Bitget is holding $6.09 billion (6.64%). Rounding out the top ten are MEXC ($4.04 billion; 4.4%), WhiteBIT ($2.94 billion; 3.21%), BingX ($1.78 billion; 1.94%), and Kucoin ($1.24 billion; 1.35%). It’s like a crypto prom, and everyone’s showing up in their fanciest tuxedos 💼.

The 24-hour movers are spicier than a TikTok dance challenge. Kucoin’s OI jumped a jaw-dropping 65.79%, Bitget added 5.95%, and WhiteBIT tacked on 4.25%. Binance climbed 3.06%, OKX 2.83%, and CME’s institutional lane edged up 0.89%. Meanwhile, Bybit, Gate, BingX, and MEXC slipped modestly-probably just taking a quick nap 😴. One more tell: CME’s OI-to-volume ratio near 2.47 suggests traders are in it for the long haul, like a marathon runner who’s already carb-loaded on pasta 🍝.

Options traders are leaning optimistically-shocker! Calls make up 60.26% of options OI versus 39.74% for puts, and the past 24 hours skewed similarly, with calls at 58.05% of volume. The leaderboard is stacked with upside strikes: Deribit’s Dec. 26 $140,000 call leads with about 9,893.9 BTC of OI, followed by the Dec. 26 $200,000 call at 8,522 BTC and the Oct. 31 $124,000 call at 7,210.9 BTC. December’s $120,000 and $150,000 calls also carry chunky interest. It’s like everyone’s betting on Bitcoin to hit the moon-or at least the next SpaceX launch 🚀.

Max pain-the level where buyers and sellers collectively feel the least joy-clusters around six figures. Near-dated expiries gravitate toward $115,000, while later in Q4 hover closer to $120,000-$125,000 on Deribit’s curve. With spot orbiting $123,000, dealers’ hedging flows around those nodes can add chop, especially as month-end rolls in. It’s like a financial soap opera, but with more spreadsheets 📊.

Put together, Bitcoin’s futures and options boards say participation is broad and funded. Bulls can point to record futures OI, call-heavy options skew, and a max-pain band that sits just beneath the spot price. Bears could argue crowded upside calls and a high OI stack leave room for squeezes the other way. Either way, derivatives are setting the stage-and Bitcoin rarely misses its cue. Now, if you’ll excuse me, I’m off to buy a lottery ticket and a fire extinguisher, just in case 🔥🎟️.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Top 15 Insanely Popular Android Games

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2025-10-05 17:58