Dear Diary,

Units of Cryptocurrency Lost: 12. Hours Spent Watching Charts: 9. Number of Panicked Texts to Friends: 24.

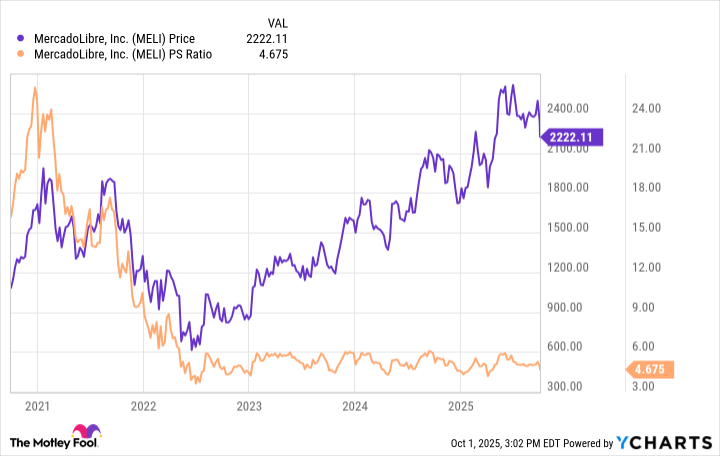

Today’s obsession: MercadoLibre (MELI) trading at $2,200 per share. Some folks whisper, “That’s a four-digit price tag, darling!” But I say, “Darling, context is everything-and I’ve brought a calculator, a espresso, and a suspiciously cheerful attitude.” Let’s dissect this.

The first rule of stock markets, learned the hard way (read: after buying 100 shares of a “sure thing” that turned into a deflated balloon): Price per share is a red herring unless you know how many shares exist. Imagine MercadoLibre had only 10 shares. Suddenly, $2,200/share feels like a garage sale where you can buy a company for $22,000. And this company? It’s making $2 billion a year. Yes, really. It’s like buying a lemonade stand that fills Olympic-sized pools with lemonade. But with fewer lemons and more logistics networks.

So why does the market frown at MELI? Let’s list the concerns, shall we?

1. CEO Transition Drama: Marcos Galperin, the man who’s run MercadoLibre like a Latin American startup royalty for 20 years, is stepping down in 2025. New CEO Ariel Szarfsztejn? He’s not some corporate interloper-they’ve been in the MercadoLibre family since 2005. It’s like swapping out your trusty butler for his equally competent nephew.

2. Profit Margins: They dropped from 10.5% to 7.7% between Q2 2024 and Q2 2025. That’s $200 million less in profit-a lot, yes, but also… well, I could spend that on 40 million lattes. Or, you know, a vacation. But let’s not panic-sell our shares over a coffee habit.

Now, let’s address the elephant in the boardroom: Why is the margin shrinking?

• Exchange Rates: MercadoLibre does business in Latin America, where the U.S. dollar is a moody ex who fluctuates wildly.

• Free Shipping Shenanigans: They lowered Brazil’s free shipping threshold, which is like offering a free slice of pizza to get you hooked on the whole pie. It costs money now, but the long-term payoff? More customers, more loyalty, more potential.

It’s not a crisis-it’s a calculated gamble. And I’ll take calculated over reckless any day.

Why do I still think MELI is a buy? Let’s get giddy.

• 71 Million Active Buyers: That’s more people than live in Canada. And 55% of their commerce revenue comes from Brazil alone. With 40 million active buyers there and a population four times that, there’s plenty of room to grow.

• Advertising Goldmine: MercadoLibre is building an ad business to rival the digital titans. Free shipping losses? They might get swallowed by ad revenue. It’s like trading your old scarf for a new one-same neck, flashier fabric.

• Valuation: The stock trades at less than 5 times sales. That’s cheaper than my therapist’s hourly rate. And yet, I’m still paying her. Investing is weird.

Why MercadoLibre is a buy

In conclusion, MercadoLibre isn’t a four-digit price tag-it’s a four-letter word for opportunity. The margin dip? Temporary. The CEO change? Manageable. The long-term growth? Still on track. And the valuation? Cheap enough to make Warren Buffett raise an eyebrow.

So, diary, what’s my takeaway? Sometimes the stock that looks like a luxury yacht is really just a canoe with a fancy bow. And this canoe? It’s headed toward a sea of growth. 🚤

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- The Weight of First Steps

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Opendoor’s Stock Takes a Nose Dive (Again)

2025-10-05 12:53