Rocket Companies (RKT), with its humble debut in 2020, had the gall to present itself as a promising titan in the world of retail mortgages, a domain governed by laws as incomprehensible and foreboding as those of a distant empire. Initially lifted by the insubstantial winds of a pandemic-fueled refinancing surge, it reached a height of $43 per share in March 2021. Yet, as the days turned to months and the years threatened to dissolve all certainty, it plummeted-a steep descent that mirrored the fall of all things that once seemed secure. In 2022, amidst rising interest rates, the housing market slowed, taking the stock to an all-time low of $6. Such is the fate of those who place faith in the vicissitudes of the market. However, like an insect emerging from a chrysalis, it has since bounced back to a current price of $18-still 58% off its peak. Why, then, does this stock merit our attention?

The Tyranny of Interest Rates

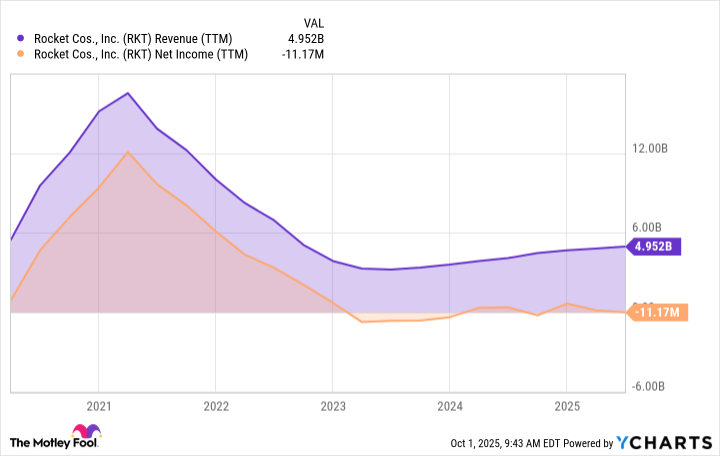

The ascent of Rocket Companies into the realm of mortgage origination was not unlike a bureaucratic machine springing to life under the most convenient of circumstances. With low interest rates and a temporary boom in mortgage refinancing, the company surged forward, reporting strong earnings, basking in the glow of seemingly inevitable success. But, like all fragile constructs built on the whims of chance, this too collapsed under the weight of the inevitable. The Federal Reserve, a faceless entity whose rules are as alien to the common man as the laws of some obscure totalitarian state, raised interest rates in response to inflation. In doing so, it strangled the demand for mortgages, and with it, Rocket’s once-unassailable earnings.

The company’s operating earnings fell sharply, exposing a deep, underlying truth: it was built upon the ever-fluctuating waves of mortgage origination, a cyclical process as unpredictable and arbitrary as the decisions of a distant, all-knowing committee. As demand for mortgages dwindled, investors grew wary, the stock languished, and those who once viewed Rocket as a symbol of success now found themselves trapped in a bewildering scenario that no amount of reason could untangle.

In the face of this cyclical trap, the company made several moves in the past years that would, on the surface, appear to be attempts to escape the labyrinth of its own making. Diversification was the key, and in this complex web of acquisitions, Rocket sought to transcend its humble beginnings as a mere mortgage originator. Instead, it aspired to something greater: a platform company, an all-encompassing force controlling every aspect of the home-buying experience, from the initial search to the closing of the deal. To endure, one must absorb, must consume, must become the very system it once sought to navigate.

The Absurdities of Resilience

In the past years, Rocket made two significant acquisitions-an unsettling and perhaps self-aware pivot toward a broader goal. The first, Mr. Cooper Group, a mortgage servicing platform, was acquired in early October, granting Rocket control over more than $2.1 trillion in unpaid mortgage balances. This acquisition brought with it a strange stability-recurring fees that, for all their unremarkable predictability, might serve as a lifeline in the ever-volatile world of home loans. It was a move to bolster a weakened structure, but did it truly provide security? Or merely a new set of chains, more binding than the last?

Additionally, the acquisition of Redfin, a real estate search platform and brokerage, added a curious dimension to Rocket’s growing empire. By pulling in millions of potential homebuyers, Redfin granted Rocket a fresh supply of customers-an endless stream, like some corporate machine devouring everything in its path. This vertical integration, which merges home-buying, financing, and managing into a seamless process, theoretically should improve margins, yet one cannot help but feel that this mere addition of complexity is nothing but an elaborate dance-a performance meant to convince investors that something truly significant is happening.

The Unyielding Machinery

In the grand scheme, Rocket’s business remains tethered to the capricious fluctuations of the interest rate system, that enigmatic and unyielding machinery of economic control. The acquisitions-Mr. Cooper and Redfin-have given the company an aura of resilience, but can it truly escape the cyclical forces that govern its industry? Should one place faith in a company that attempts to disguise its fragility with acquisition after acquisition, each a piece of the puzzle that leads to nowhere? Perhaps, should interest rates eventually decline, the thawing of the housing market will bring a brief resurgence, a temporary boom that will be as short-lived as it is inevitable. The refinancing boom, too, might appear-but how long can one live off the erratic generosity of the market?

Thus, with its growing scale, digital platform, and recurring revenue streams, Rocket appears to be a “one-stop shop” for its customers. Yet, the question lingers: Is this truly progress, or merely the mechanical necessity of a system designed to maintain its existence through endless, convoluted transactions?

As I contemplate this, I am reminded that perhaps the greatest irony lies in the fact that even as Rocket continues its labyrinthine dance of acquisitions and diversification, it remains as susceptible as ever to the same volatile forces that initially brought it to its knees. And yet, we are told this is a good thing-a “solid buy.” Is it truly? Or are we simply trapped, waiting for the next inevitable twist in this strange, corporate nightmare? 🤔

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Opendoor’s Stock Takes a Nose Dive (Again)

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- The Weight of First Steps

2025-10-05 12:42