If there’s one thing I know about the stock market, it’s that it’s a bit like a cruise ship-everyone wants to be on it, but no one wants to read the fine print. 🚢 Let’s cut through the hullabaloo: Carnival (CCL) and Royal Caribbean (RCL) are the Titanic and the *Queen Mary* of the cruise industry. Both are sinking in debt, but one’s still selling commemorative mugs. Jack Welch, the GE legend, always went for No. 1 or No. 2 in an industry. Maybe he was just bad at swimming. Either way, these two are your lifeboats-or your albatrosses.

Both companies lost billions during the pandemic, then borrowed more money to get their ships out of dry dock. It’s like borrowing petrol to put out a fire, but with cocktails and a steel band. Over time, they’ve filled cabins beyond capacity-because nothing says “financial stability” like cramming 110% of humanity into a stateroom. They’ve added ships, but not fast enough to keep up with bookings. Carnival’s 2026 reservations are already overflowing, which is either a triumph or a cry for help. I can’t tell; I once invested in a pet rock.

A look at both businesses

Carnival’s got 42% of the cruise market, according to Cruise Market Watch. Royal Caribbean? 27%. They’re like siblings-one’s the golden child, the other’s the one who still uses a pacifier. Both are riding the same wave: full ships, sky-high occupancy rates, and a collective delusion that this time, it’ll last. Royal Caribbean hit 110% occupancy in Q2 2025; Carnival’s at 112%. If this were a movie, they’d be the ones betting their fortunes on a high-stakes poker game while the deck cracks in half.

How some key financial metrics compare

Debt. The real captain of this ship. Carnival’s got $26.5 billion in total debt, down from $28.9 billion. Royal Caribbean’s at $19 billion, down from $21.1 billion. They’re both scrubbing the decks to pay it off, but Royal Caribbean’s debt-to-equity ratio (2.0) is slightly better than Carnival’s (2.2). It’s the difference between a tense game of Jenga and a catastrophic collapse. Royal Caribbean even reinstated its dividend in 2024-three raises later, it’s giving shareholders a 1% yield. Carnival? Still figuring out how to spell “dividend.”

Don’t get me wrong-Carnival’s P/E ratio of 15 is cheaper than Royal Caribbean’s 24. But the S&P 500’s average P/E is 31, so we’re all just buying confetti at this point. Royal Caribbean’s higher valuation? That’s the market whispering, “We trust this ship not to sink.” Or it’s just drunk. I can’t decide.

Carnival or Royal Caribbean?

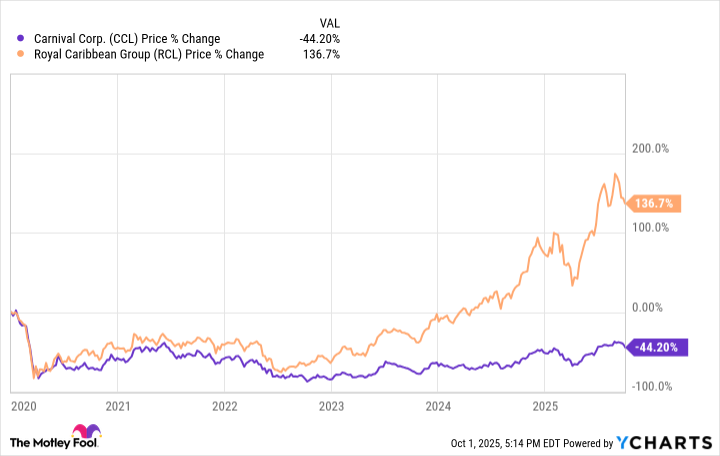

Here’s the verdict: Royal Caribbean’s more likely to give you a decent return. Lower debt, dividends, and a stock that’s already outperformed Carnival since 2020. But Carnival’s not a bad bet. Its lower P/E and ability to fill cabins could mean a rebound to pre-pandemic levels. Maybe it’ll even surpass Royal Caribbean. But let’s be real-who wants to bet their life savings on a company that can’t even give shareholders a life vest?

Still, I get it. Investing’s a gamble. You could end up with a yacht or a sinking ship. Just don’t blame me when the *Titanic* of your portfolio hits an iceberg. 😉

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Top 15 Insanely Popular Android Games

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2025-10-05 11:14