One often cannot resist the allure of a Rocky film – it is the very epitome of triumph against adversity, a narrative arc as predictable as it is resonant. Who could fail to cheer as our resilient hero rises from the ashes of defeat, a testament to the indomitable human spirit? Today, I find myself drawing a rather amusing parallel between this cinematic saga and the current predicament of Lockheed Martin (LMT), a defense stock which has perhaps seen better days.

Indeed, Lockheed’s last quarter was marred by a rather spectacular $1.6 billion debacle – a tumble that has left earnings gasping for breath, much like the eponymous character whose very existence is contingent upon a robust comeback. Stock performance thus far in the year can best be described as lackluster; a veritable flatline, and a steep 15% decline from twelve months prior. Yet, I maintain my belief that the narrative is far from over; in Lockheed, I perceive a similar stirring of vigor as one might find in the moments leading up to a climactic battle.

In a straightforward appraisal, a judicious investment of $5,000 into LMT might yield fruitful rewards in the coming years, provided one possesses both patience and an eye for the long game.

Understanding Lockheed Martin

Lockheed Martin holds the dubious distinction of being the world’s most formidable purveyor of defense solutions, conjoined with governmental machinations and aspirations of grandeur. Renowned for its military aircraft, the company boasts an impressive lineage that includes the F-35 Lightning, the F-16 Fighting Falcon, and the illustrious F-22 Raptor.

The enterprise is comprised of four operational units: Aeronautics, commandeering tactical aircraft; Missiles and Fire Control, the heart of weaponry; Rotary and Mission Systems, which ensures our helicopters take to the skies; and Space, presiding over the civil and military realms, dabbling in defense systems and even weather satellites.

The quarterly report announced a revenue uptick to $18.2 billion, a modest improvement from the previous year’s $18.1 billion. However, net earnings plummeted to a paltry $342 million, translating to $1.46 per share – a stark contrast to the $1.6 billion and $6.85 per share reported the year before. The dismal fall can be attributed chiefly to the substantial program losses, particularly in the beleaguered Aeronautics sector, where management has been forced to rectify a rather unfortunate misalignment of design and testing strategies, resulting in a writedown of $950 million. To add insult to injury, Sikorsky’s ambitious helicopter projects in Canada and Turkey recorded further losses amounting to $665 million.

In the words of CFO Evan Scott:

“We have a focused team engaged with these programs on a daily basis. Actively implementing our adjusted approach and working to prevent charges like this going forward. We continue to learn, and the fact is these are important, although challenging programs, and Lockheed Martin has a long legacy of innovation and navigating complex issues.”

If Lockheed Were a Boxing Montage

If we are to continue with the Rocky metaphor, what we are witnessing now is akin to the training montage – the preparatory phase before the grand showdown. The company, with an almost preposterous determination, has rallied from its setbacks. Manifestations of this resilience are evident in recent victories: a lucrative $10.8 billion contract for up to 99 helicopters for the Marines, a $9.8 billion deal from the Army for nearly 2,000 Patriot defense missiles, and an avant-garde prototype agreement with the Army to create command systems that ostensibly promise to enhance decision-making capabilities.

As of the second quarter’s close, Lockheed boasted an enviable backlog amounting to a staggering $166.5 billion, having successfully dispatched 50 F-35s and 24 helicopters to various governmental entities during the quarter.

Emerging Victorious

The daunting $1.6 billion write-down certainly casts a shadow over Lockheed Martin’s stock, giving it a veneer of trepidation. However, one must interrogate whether this superficial blemish belies a deeper, more enduring potential. The price-to-earnings ratio stands at 27.6, a seemingly extravagant figure when juxtaposed against its ten-year historical mean of 20. Yet, it is crucial to note that this inflated ratio largely stems from the aforementioned write-off strangling earnings. The forward P/E ratio of 22.4 offers a more reassuring perspective, aligning more closely to Lockheed’s historical valuations.

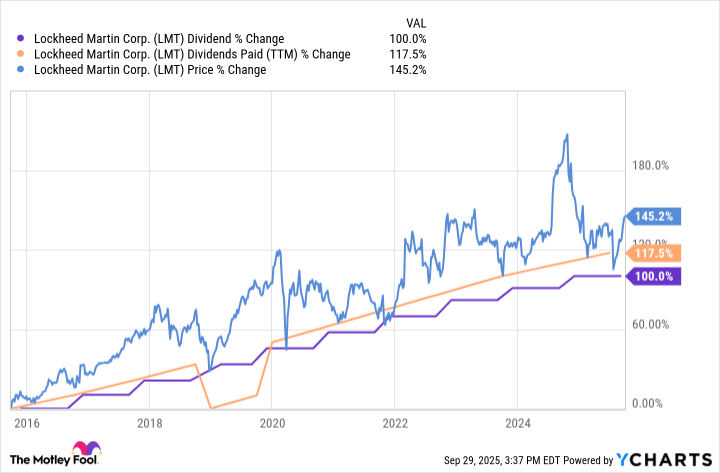

Moreover, the company has sustained a commendable dividend policy, currently distributing $13.20 annually per share, achieving a yield of 2.7%. This dividend has consistently grown, doubling across the past decade – a noteworthy feat amidst a market that often embroils itself in capriciousness.

Looking ahead, Lockheed Martin projects an annual growth rate of 5% for this current fiscal year, tapering to 4% by 2026. Assuming a conservative outlook-that this rate of growth is maintained alongside a 2.7% dividend yield-investors could anticipate a compounded total return of approximately 6.7% annually. This forecast does not appear far-fetched, particularly considering the 70% surge in net income observed over the past decade.

Thus, one might conclude that a modest $5,000 investment in Lockheed Martin could be poised to double over the course of a mere decade. In summary, the company is indeed weathering some punishing jabs. Yet, akin to our heroic fighter, it is ever equipped to endure and emerge from the fray, a consummate fighter forged through the crucible of both excellence and folly. 🥊

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Banks & Shadows: A 2026 Outlook

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-10-04 10:44