BigBear.ai (BBAI) – a name that conjures images of lumbering beasts and honeyed dreams – has pirouetted through the market’s caprices with all the grace of a courtier in a bear pit. Though the stock currently boasts a 57% pirouette from its 2025 nadir, it now languishes in the shadow of its former self, down 28.5% from the giddy heights of mid-February. Yet here we are, dear reader, contemplating whether to wade into these murky waters, where the siren song of Palantir-esque aspirations beckons like a bureaucratic clerk promising riches from a ledger of ghosts.

Let us dissect this creature of silicon and speculation with the precision of a coroner examining a particularly perplexing corpse.

BigBear.ai and the Infinite Regress of Unfunded Dreams

Like Palantir, BigBear.ai peddles digital incantations – AI spells to conjure efficiency from chaos, cybersecurity charms to ward off the goblins of data theft, and digital twin talismans to mirror reality in the looking glass of cyberspace. The market for such sorcery, we are told, shall swell to $153 billion by 2028, a golden mountain of revenue yet to be mined. But BigBear.ai, it seems, has brought a sieve to a gold rush.

Consider the spectacle of its quarterly performance: revenue collapsed like a deflated soufflé to $32.5 million, while the gross margin shrank with the dignity of a retreating tide. Adjusted EBITDA? A yawning abyss of $8.5 million, more than double its former depth. Yet behold! The company boasts a $380 million backlog – a vault of promises, or rather, a theater of the absurd where contracts play the role of phantom patrons.

Of this backlog, only 4% is funded – the rest exists in the purgatory of “unfunded” or “unexercised” whimsy, where government contracts linger like half-remembered decrees from a Tsar long since turned to dust. One might say BigBear.ai is building castles in the sky with bricks of vapor, a bureaucratic ballet of “maybe” and “perhaps.”

The Navy, the Airport, and the Delicate Art of Hope

Recent whispers tell of a maritime exercise with the U.S. Navy and a passenger-processing deployment at Nashville International Airport – events that sent the stock soaring like a sparrow startled from a bush. Yet these tidings arrive with the weight of a feather, for in the realm of BigBear.ai, even a feather might tip the scales of solvency. The question lingers: are these crumbs of progress enough to nourish a famished investor?

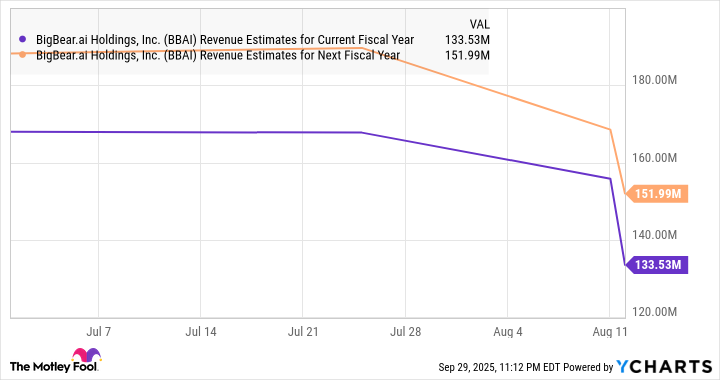

Analysts, those modern-day prophets of spreadsheets, have set a median price target of $6 – a 7% descent from current levels. The company’s valuation, at 12x sales, floats above the Nasdaq’s pedestrian 5x like a balloon at a funeral. And with revenue forecasts slashed by 19%, one suspects the market has already cast its verdict: this is no phoenix, but a paper lantern sputtering in the wind.

In the end, BigBear.ai offers not a buying opportunity but a cautionary fable – a Gogolian farce where promises dissolve like sugar in the rain, and the emperor’s new software glimmers only in the imagination. 🎭

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-10-03 11:44