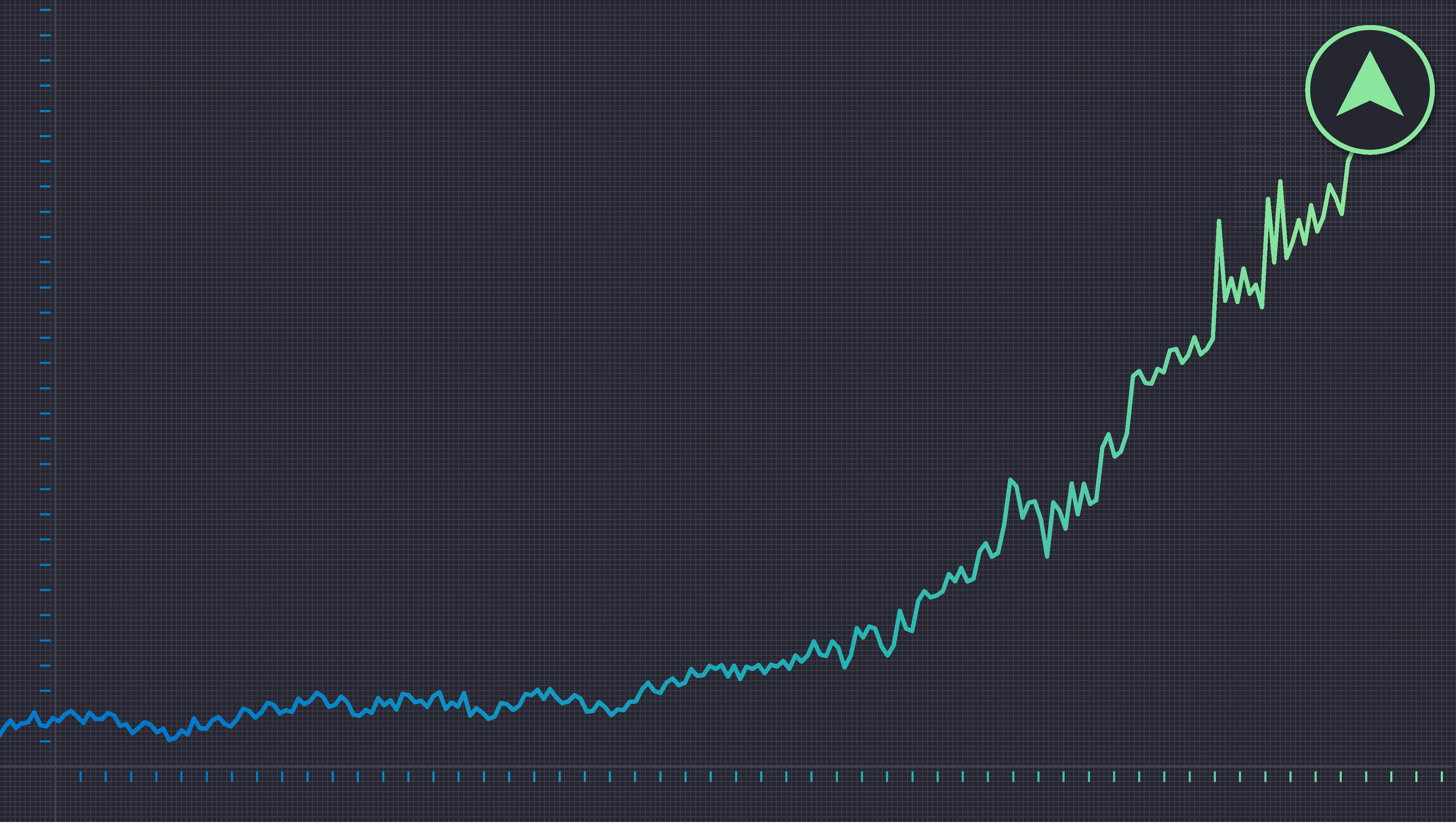

The month of September saw AppLovin (APP) attain an unsettling 50.1% rise in its stock value. One could hardly ignore the relentless ascent, driven by the promise of its October 1 product event, which heralded the arrival of a self-serve advertising platform, designed to capture the meager aspirations of e-commerce and non-gaming advertisers, all the while resting on a foundation forged in gaming dominance. It is a development that should not be embraced with enthusiasm, for the swelling of stock prices, like any swift, unchecked tide, has its roots in disquieting currents.

As the date of the event neared, an inevitable chorus of bullish analysts raised their voices, their jubilant optimism shaping the expectations of the ever-gullible investor. The rhetoric was simple-an increase in price targets for the stock, mingled with a hasty endorsement of the platform’s expansion. They spoke of an era of growth, but their assurances bore the familiar mark of a well-rehearsed play. In truth, this enthusiasm seemed less an appreciation for AppLovin’s actual potential and more a product of superficial excitement.

Expanding the Reach of an Artificial Empire

As the analysts, those presiding arbiters of market sentiment, grew increasingly effusive, one could not help but notice the familiar undertone in their analyses-a yearning to inflate the company’s addressable market. And so, AppLovin, in a bid for further conquest, unveiled its “Axon Ads Manager,” a self-serve tool that was designed to eliminate the burden of manual onboarding and to cast a wider net across the fractured landscape of e-commerce. As expected, the company’s high-flying promises centered around Axon as the cutting-edge artificial intelligence (AI) solution poised to steer advertisers toward efficiency. This was to be their salvation-a tool not just for advertisers but, in the same breath, for AppLovin itself, as it widened its reach into unfamiliar, non-gaming territory.

On October 1, in a well-timed release meant to capture the last remnants of the holiday-season advertising budgets, AppLovin began distributing Axon Ads Manager on a selective, referral-only basis. A move that, to those attuned to the cynical rhythms of the market, seemed little more than a calculated step to make non-gaming advertisers feel included-just as artificial as the platform’s purported AI engine.

But let us not forget the fundamental aspect of AppLovin’s surge: it is not borne of innovation alone, but of the summer’s sturdy financial report. AppLovin had reported a 77% year-over-year increase in its second-quarter revenue, and net income margins expanded from 44% to a staggering 65%. The company’s bottom line soared by 164%, a phenomenon that defied rational explanation in its sheer magnitude. But as with all such growth, one is left to ponder-at what cost to the investor’s soul?

The Calm Before the Fall?

AppLovin’s meteoric rise has, of course, resulted in a valuation that borders on the absurd. At a price-to-earnings ratio of 88, it is clear that expectations have been inflated to an unsustainable level. The future now hinges upon Axon’s ability to capture the market’s interest and to endure the strain of non-gaming advertisers. But this is a fragile hope-there is, after all, the small matter of execution.

Investors would be wise to watch three key elements closely: first, the pace of Axon Ads Manager’s rollout, particularly how quickly the referral-only access expands and whether enough non-gaming advertisers can be coaxed to embrace the platform. Second, the fundamentals-the continued growth of revenue and free cash flow in the holiday quarter and beyond. And third, the competitive forces that will soon be unleashed, as rival companies, equally eager to devour e-commerce budgets, begin deploying their own AI-assisted tools. Should Axon’s uptake be slower than expected, or should the macroeconomic climate tighten advertising budgets, AppLovin’s high-flying valuation will falter under its own weight. There is little margin for error in such a market, and even less for delusion.

The investor is caught in a familiar bind-the allure of quick riches from a rapidly growing company, now valued far beyond its intrinsic worth. But history teaches us that these fevered climbs often precede sharp falls, and the brave or foolish will find themselves exposed when the tide of optimism recedes.

It is a testament to the human condition that in this race for wealth, we often find ourselves staring at the distant horizon, ignoring the muddy path that brought us here. 🚨

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 39th Developer Notes: 2.5th Anniversary Update

- 15 Western TV Series That Flip the Genre on Its Head

- Rewriting the Future: Removing Unwanted Knowledge from AI Models

- Doom creator John Romero’s canceled game is now a “much smaller game,” but it “will be new to people, the way that going through Elden Ring was a really new experience”

2025-10-02 21:12