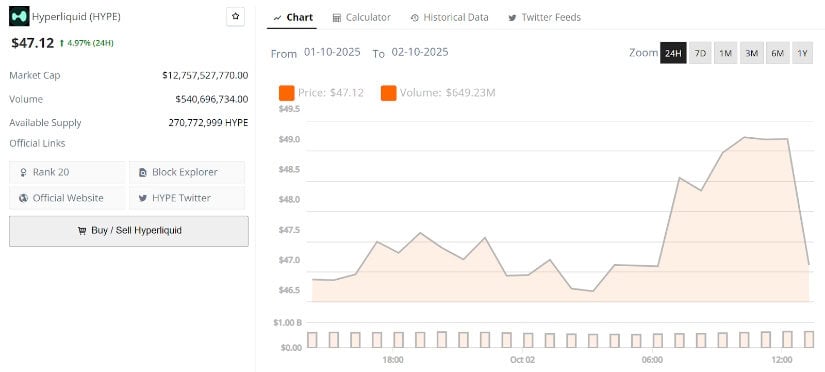

It is a truth universally acknowledged, that a digital asset in possession of a good reputation, must be in want of a favourable price prediction. And so, we turn our attention to Hyperliquid, currently trading at a respectable $47.12 – a rise of near five per cent in the last four and twenty hours, if one may be permitted to state the time in such a manner. A market capitalization exceeding twelve billion dollars, and a daily volume exceeding five hundred and forty million, does suggest a certain… enthusiasm amongst investors. One might even say, a liquidity most pleasing.

The Community’s Fondest Hopes

Mr. Tyler, with his charts, has revealed the community’s inclination towards sixty dollars; a sum which seems to have captured their imaginations. The price, after a rather undignified tumble, is now forming what one might term ‘higher lows’ – a most encouraging sign, and one which aligns conveniently with their aspirations. Such harmony between opinion and observation often breeds a momentum most agreeable when buying spirits are revived. 😊

Indeed, the pace of reclamation is notable, devoid of those excessive fluctuations which so unsettle the nerves. Should resistance around the mid-fifties be breezed past with appropriate volume, that $60 may cease to be a mere pleasantry and become, dare we say, a tangible reality.

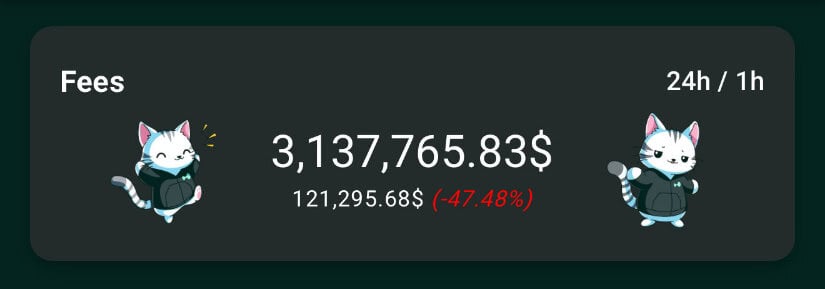

Fees – A Most Fortunate Resilience

Hyperliquid continues to collect approximately three million dollars in fees each day, despite the unwelcome attentions of ASTER. A clear indication, one trusts, of its capacity to withstand competition. Consistent and substantial fees are, of course, a bulwark against uncertainty, and Hyperliquid has demonstrated an aptitude for retaining its position. One appreciates a steady income, wouldn’t you agree?

Mr. Pajke whispers of a gentleman known as El Jefe, who may introduce some “levers” (a rather curious term) to increase fees to a staggering ten million dollars daily! Should this prove true – and one shudders to think of the complexity – the very landscape would be reshaped, leaving ASTER gasping in its wake. 😮

Observations on Technicalities

Mr. Cryptoceek assures us that so long as the price remains above forty-two dollars (a most sensible precaution, one would think), all is well. The moving averages, bless them, are starting to favour the bulls, and the RSI hints at further advances. Confidence, it appears, remains amongst those who engage in such trading matters.

Breakout levels to observe are forty-four to forty-nine dollars; closes at these marks would pave the way upwards. Failure to defend forty-two, however, may invite a spot of volatility. But the general sentiment, as far as one can discern, remains decidedly bullish. 🧐

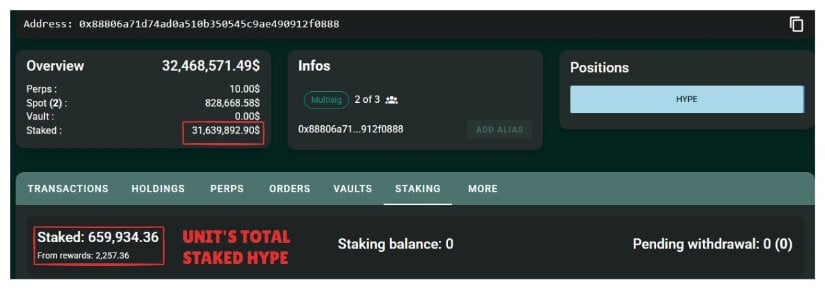

Staking and Redemptions – A Curious Arrangement

Data from Mr. Ray Tio reveals over six hundred and sixty thousand HYPE (a sum worth approximately thirty million dollars), currently staked, and the numbers continue to grow, owing to systematic redemptions. Such activity lessens the circulating supply, bolstering price resilience, even when trade slows. A most ingenious method, wouldn’t you say?

The effect is plain to see: more tokens are held fast, fewer are offered for sale, and each upward attempt meets with firmer support. Combined with the daily influx of fees, a most favourable cycle is created.

An Analysis of the Chart

The latest chart indicates a consolidation above forty-five dollars, with a support block at forty-six point one. Buyers, it seems, are consistently intervening to defend this position. A continuation here hints at a retest of the forty-eight to forty-nine range, the first hurdle for those of a bullish persuasion.

A ‘clean’ breakthrough above forty-nine – a phrase open to interpretation, of course – would shift opinions, potentially leading to the fifty-two to fifty-five dollar zone. Mr. HLProphet observes that the forty-six point one block is crucial; losing it risks a retreat towards forty-four. For the moment, caution tempered with optimism prevails, but a robust volume above forty-nine will be watched with intense scrutiny.

Final Reflections

Hyperliquid’s combination of fee revenue, expanding staking, and constructive technical conditions explain its enduring appeal despite newfound rivalry. The forty-six to forty-nine dollar range offers a point of contention, and how the price acts here may dictate the next movement. A successful breakout for the bulls could gain momentum quickly being towards the $55 to $60 range, bolstering the community’s anticipated fair value.

For the present, observers are paying attention to the match between robustness and danger. Losing the $46 block may cause short-term deterioration, but the general scenario still favours continuation with staking and buybacks tightening the market. 😄

With feeling, technology, and fundamentals all playing a role, Hyperliquid Price Prediction looks primed for another run at higher valuations.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- The Weight of First Steps

- Opendoor’s Stock Takes a Nose Dive (Again)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-10-02 13:10