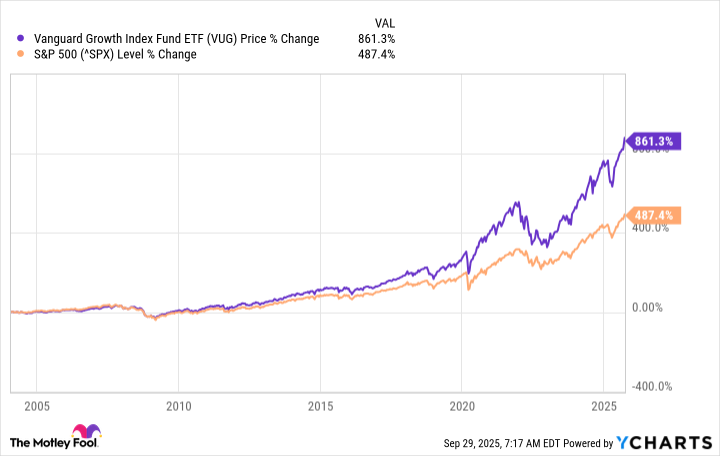

The S&P 500 (^GSPC), that bureaucratic ledger of market arithmetic, has recorded a return of 13.2% this year-a figure etched in the annals of financial history since 1957 with a mean of 10.5%. Yet here we are, confronted with a paradox: the Vanguard Growth ETF (VUG), a creature of the same system, has already bested this by 16.3%. Not a fluke, but a ritual. Since 2004, it has performed this act of quiet defiance annually, as though the market itself had conspired to validate its algorithmic dominion.

This is no mere portfolio. It is a mechanism. A self-perpetuating machine, calibrated not to logic but to the feverish pulse of growth stocks-the ones that hum with the electric promise of artificial intelligence. It is as if the market, in its infinite bureaucracy, has assigned these entities a weight so disproportionate they now orbit the fund like satellites in a corporate cosmos.

High exposure to America’s most prominent growth stocks

The Vanguard Growth ETF does not track the CRSP U.S. Large Cap Growth index. It obeys it. This index, in turn, does not invest in the top 85% of American listed companies by value. It ensures that 85% of the combined value of 3,508 companies is captured by 165 of them. A process so methodical it reads like a government decree, written in the language of spreadsheets and market capitalization.

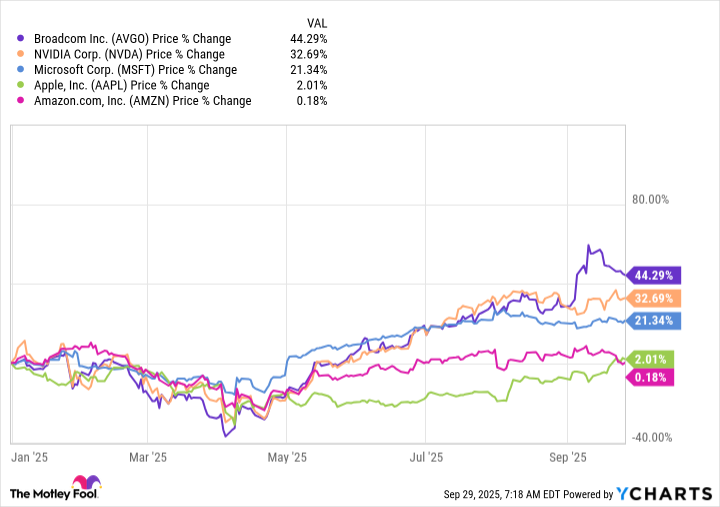

Consider the arithmetic: 165 stocks hold 85% of the value. The remaining 3,343? A footnote, a bureaucratic afterthought. The top five holdings alone-Nvidia, Microsoft, Apple, Amazon, Broadcom-carry a combined $15.8 trillion in market cap. Their weightings in the ETF are not allocations. They are mandates, decrees issued by an invisible hand that no one sees but all obey.

| Stock | Vanguard ETF Weighting | S&P 500 Weighting |

|---|---|---|

| 1. Nvidia | 12.29% | 7.75% |

| 2. Microsoft | 11.49% | 6.87% |

| 3. Apple | 10.53% | 6.32% |

| 4. Amazon | 6.53% | 3.95% |

| 5. Broadcom | 4.41% | 2.55% |

These five names, in their collective arrogance, have delivered 20% returns this year. The ETF, in its passive ruthlessness, mirrors their dominance. It does not question the logic of this. It does not ask why Nvidia’s Blackwell Ultra GPUs are the chosen vessels for AI’s apocalyptic ascent. It simply follows the rules. Rules written in code, in market cap, in the inexorable pull of algorithmic gravity.

Microsoft and Amazon, those twin titans of cloud and code, do not merely sell software. They administer it. Their platforms are not tools but tribunals, where developers kneel to access the raw power of Azure and AWS. The Vanguard ETF, in its infinite patience, holds these keys to the kingdom-not as a participant, but as a custodian of inevitability.

Meta, Alphabet, Palantir. Eli Lilly. Costco. McDonald’s. These names appear in the ETF’s portfolio like names on a census list, each granted a sliver of relevance by the algorithm’s indifferent gaze. Diversification? A myth. The fund’s architecture is a hierarchy of power, where the top 85% dictate the fate of the rest.

The Vanguard ETF could beat the S&P 500 again in 2026

Since 2004, the ETF has returned 11.9% annually. The S&P 500, that lumbering relic, lags at 10.4%. The difference is not a secret. It is a law of compounding, a bureaucratic edict that turns small advantages into towering monuments of wealth. Over time, the gap widens not with haste, but with the slow, inexorable grinding of gears in a machine no one understands.

The AI boom, that great bureaucratic delusion, will persist. Jensen Huang speaks of $4 trillion in data center spending by 2030. Cathie Wood, that oracle of the absurd, whispers of $13 trillion in software. The Vanguard ETF, in its mechanical wisdom, does not debate these numbers. It incorporates them. It is not a fund. It is a process, a chain of commands passed down from the algorithm to the shareholder, from the shareholder to the void.

Even if the AI revolution falters-if the Blackwell Ultra proves to be the last gasp of a dying star-the ETF will adjust. It does not mourn the fall of kings. It reorders the hierarchy, promotes the next set of titans, and continues its march. Sector-agnostic, it is a bureaucracy without borders, a system that transcends industry and ideology. Its logic is not human. It is arithmetic.

And so, in 2026, the ETF will outperform. Not because of strategy, but because of structure. Not because of insight, but because of obedience. The S&P 500 will watch, as always, from the margins of its own obsolescence. The market, in its infinite bureaucracy, will nod. And the cycle will begin again.

$

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- The Weight of First Steps

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2025-10-02 11:12