The shares of AST SpaceMobile (ASTS) underwent an inexplicable 12.1% ascent by 11:04 a.m. ET on Wednesday, a movement precipitated by the British financial entity Barclays’ pronouncement elevating its price target by 62% to $60 per share-an edict issued from the upper echelons of capital’s celestial bureaucracy.

The Oracle of Barclays

Mathieu Robilliard, an analyst ensnared in the Sisyphean task of deciphering market signals, observed that SpaceX and T-Mobile had already inaugurated a text-only direct-to-cell (DTC) service at $10 monthly-a system operating with the ruthless efficiency of a machine whose gears grind the dreams of competitors to dust. AST, by contrast, remains in a state of prenatal development, its commercial offerings still gestating in the womb of regulatory purgatory.

Yet Robilliard posits, in a missive disseminated through TheFly.com, that AST’s prospective service might possess superior allure-a chimera of “text, call, and broadband” that could theoretically command higher tolls from subscribers, though this promise exists in a realm of hypothetical phantoms, suspended between ambition and impossibility.

The Infinite Assembly Line

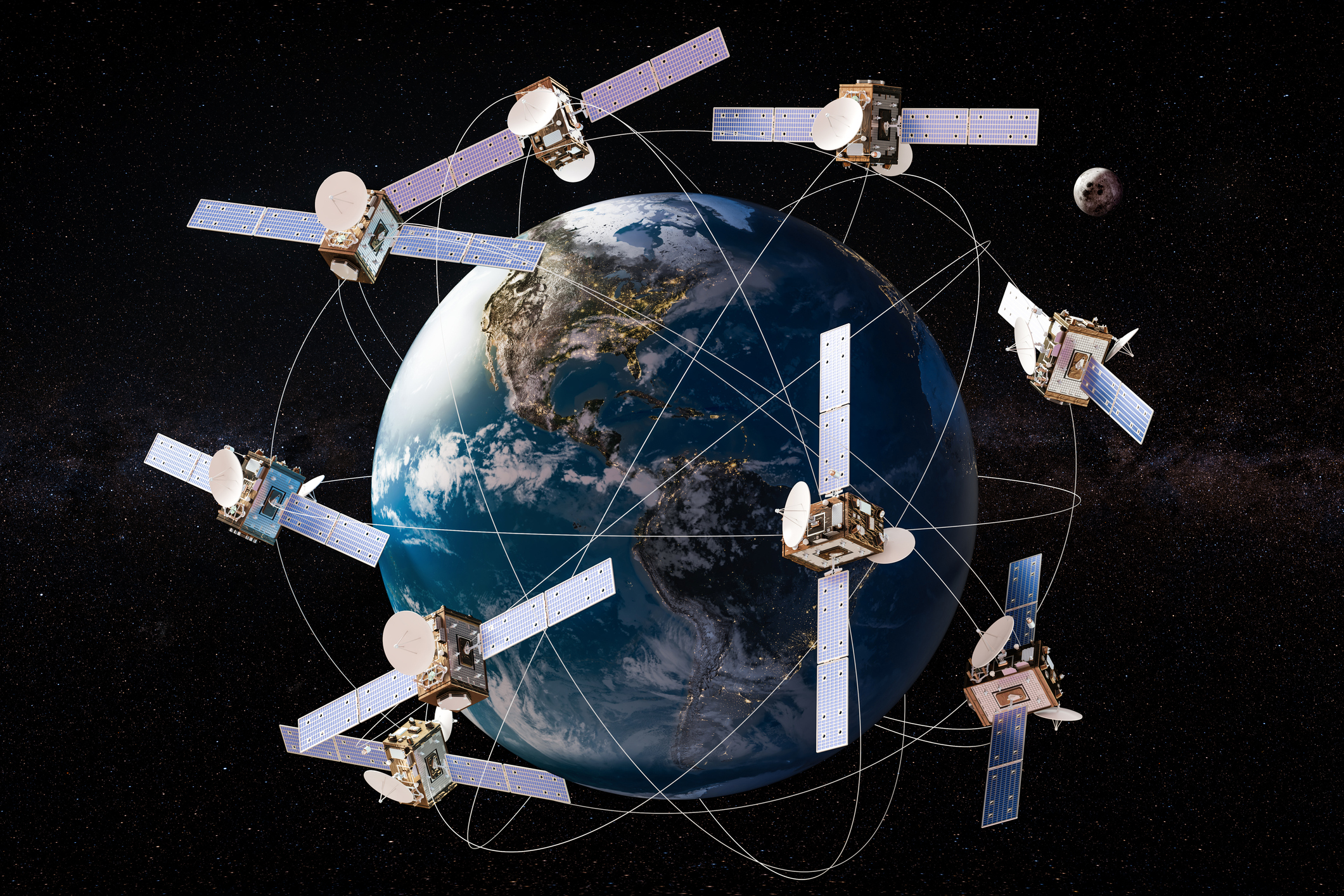

Before AST may levy its envisioned tariffs, it must first breach the threshold of operational reality-a task it approaches with the deliberate slowness of a clockwork mechanism corroded by time. Five satellites drift in orbit like existential questions, while BigBird 6, having emerged fully assembled from the factory’s maw, awaits shipment. BigBird 7 shall follow, its launch partner poised like a priest awaiting sacrificial rites.

The company’s proclamation, delivered via tweet-a medium of modern oracle-reveals nine satellites in various stages of gestation, their launches scheduled at intervals of 1-2 months until 2026, when 60 mechanical sentinels shall circle the globe. Yet these projections, etched in the ephemeral ink of corporate prophecy, remain subject to the caprices of orbital mechanics and fiscal entropy.

Loading…

–

The roadmap, a document of sacred and contradictory truths, demands unwavering faith. Revenue shall flow when satellites outnumber constellations; profitability, that elusive specter, is prophesied to materialize no sooner than 2027-a date as distant and nebulous as the event horizon of a black hole. Until then, investors wander a maze of half-realized potential, their compasses spinning in the magnetic field of speculation.

In this labyrinth of capital and cosmic ambition, the wealth builder must weigh the calculus of risk against the inertia of inevitability. To buy or not to buy-that question echoes unanswered through the void. 📉

Read More

- TON PREDICTION. TON cryptocurrency

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Gold Rate Forecast

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Here Are All the TV Shows Coming to Disney+ This Week, Including ‘Limitless’

2025-10-01 19:02