Intel, a corporation once synonymous with the steady pulse of technological progress, now finds itself adrift in a sea of speculation. Its stock, having ascended 77% year-to-date, behaves less like a financial instrument and more like a character in a parable about the futility of grasping at certainty. Investors, armed with spreadsheets and the fragile hope of redemption, cling to the faintest pretexts of optimism-government stakes, strategic infusions of capital-as if grasping at threads in a tapestry woven by unseen hands.

The U.S. Treasury, in a gesture of bureaucratic paternalism, has claimed a 10% share in the enterprise, while Nvidia, that colossus of silicon ambition, has pledged $5 billion to the cause. One might ask: does this mark the beginning of a renaissance, or merely the next act in a theater of the absurd?

How important is the Nvidia investment?

The timing of Nvidia’s gesture arrives like a communiqué from an inscrutable bureaucracy-a document stamped with approval yet devoid of context. The U.S. government, having recently inscribed itself into Intel’s ledger, now watches as its favored child, Nvidia, performs a ritualistic offering. This transaction, a labyrinthine dance choreographed by unseen regulators, may serve less as a lifeline than as a ritual to placate the gods of domestic semiconductor sovereignty.

Consider the paradox at its core: Nvidia’s CEO, Jensen Huang, a man whose every utterance carries the weight of oracle, has declared Intel’s foundry fit for… contemplation. Not collaboration, mind you, but contemplation-a Sisyphean task for a division already burdened by $10.9 billion of negative cash flow. The absence of a binding commitment from Nvidia transforms the $5 billion into a mirage: generous in appearance, evaporating under scrutiny.

For Nvidia, this sum is a footnote in a ledger swollen with $87 billion of profit. For Intel, it is a lifeline tethered to no concrete obligation-a gesture as hollow as the circuits etched into its struggling wafers.

Investors shouldn’t ignore Intel’s worrisome fundamentals

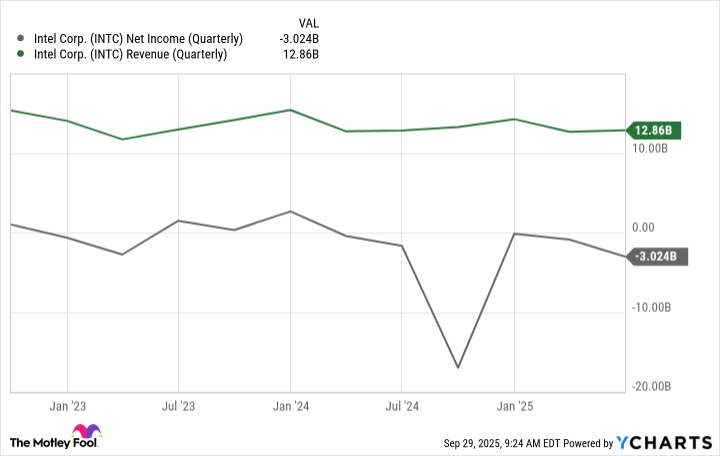

Beneath the noise of strategic theater lies a truth as immutable as the laws of thermodynamics: Intel’s financial statements resemble a palimpsest of despair. Years of stagnation, red ink, and precarious breakeven points suggest a company trapped in a recursive loop, forever revising its own obituary. The foundry division, that vaunted engine of future growth, contends not only with the shadow of its parent’s missteps but with the specter of Taiwan Semiconductor-a rival whose existence is itself a rebuke to the notion that excellence can be willed into being on American soil.

Herein lies the rub: Intel’s fate hinges on a question no executive can answer definitively. Can a labyrinthine bureaucracy, staffed by engineers and bureaucrats alike, conjure profitability from the void? Or is this merely the prelude to a more elaborate bankruptcy proceeding, disguised as innovation?

Why Intel’s rally may not last

The market, that capricious arbiter of value, reacts to stimuli with the logic of a dream. A government stake, a cash infusion-these are talismans waved before the eyes of investors, who, like Kafka’s K., wander a landscape where signals and meaning diverge. The rally may persist, sustained by the momentum of collective delusion, but reality, relentless and unyielding, will demand its due.

For Nvidia, this is a footnote. For the individual investor, it is a gamble with dice loaded by forces beyond their comprehension. Intel’s boardrooms, like the Castle in Kafka’s parable, remain inaccessible, their deliberations opaque. One would be wise to recall that in such systems, the most rational course is often to refrain from choosing at all. 🎲

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 10 Hulu Originals You’re Missing Out On

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Is Kalshi the New Polymarket? 🤔💡

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

2025-10-01 13:27