The S&P 500, that venerable ledger of American capitalism, is a gatekeeper of sorts-a temple where only the most gilded names are enshrined. When Robinhood Markets (HOOD) replaced Caesars Entertainment in September 2024, it was not merely a stock ticker that changed hands, but a shift in the zeitgeist. The old gods of vice-casinos, slot machines, the theatricality of losing-had been dethroned by the new priesthood of digital democratization. Or so it seemed.

The Illusion of the Trump Windfall

Robinhood’s ascent this year, with a 208% gain, has outpaced even the gilded trajectories of Nvidia and Palantir. Yet beneath the veneer of triumph lies a story as old as the stock market itself: the fleeting promise of a silver bullet. The company’s transaction revenue, once buoyed by the Trump-era frenzy-when cryptocurrencies were hailed as the next Bitcoin and margin loans flowed like oil-has since turned to sand. In Q2 2025, crypto transaction revenue plummeted 55%, a stark reminder that the crowd’s euphoria is as fickle as the tides.

Consider Dogecoin, that Shiba Inu of digital assets, now down 63% from its peak. Even Bitcoin, the supposed digital gold, has lost 11% of its luster. For the everyday investor, this is not a market of heroes but of survivors-those who trade with their eyes open to the storm.

The Fragile Pillars of Net Interest Income

Falling interest rates, once a bane for Robinhood’s bottom line, have found a temporary ally in the swelling of margin loans and client cash balances. Yet this is a house of cards. The Federal Reserve’s rate cuts may have delayed the reckoning, but the arithmetic of inflation and economic uncertainty remains unsolved. When the market corrects-as it always does-investors will not merely pare their risk; they will flee it. Margin loans will evaporate, and cash balances will be siphoned to feed the daily grind.

Robinhood’s net interest income, though rising in Q2 2025, is a mirage. The company’s margin loan book, at $9.5 billion, is a fragile edifice. A single economic tremor could reduce it to rubble.

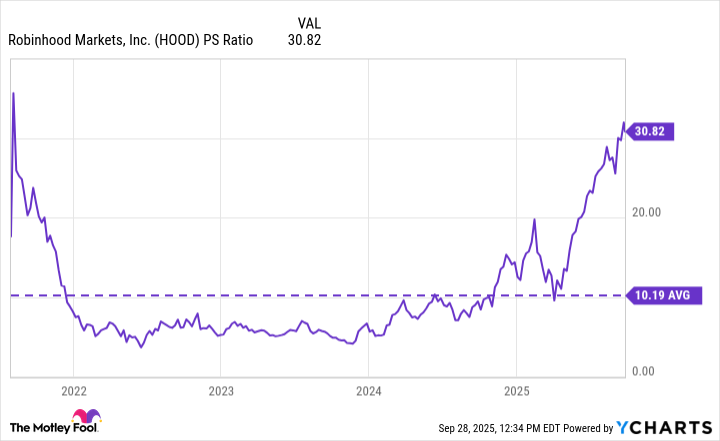

A P/S Ratio Built on Sand

The stock’s price-to-sales ratio now stands at 30.8, a figure that defies the logic of value investing. This is not a triumph of innovation but a speculative fever. To return to its 2021 average of 10.2, the stock would need to shed two-thirds of its value. History offers a grim precedent: after the 2021 crypto bubble, Robinhood’s shares collapsed by 80%. The cycle repeats, and the common investor, ever the last to flee, pays the price.

For the working man-the gig worker, the part-timer, the dreamer-Robinhood was once a beacon of financial autonomy. Now it is a cautionary tale. The market, in its infinite cruelty, does not reward the naive. It devours them. 🐺

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 10 Hulu Originals You’re Missing Out On

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- Top Actors Of Color Who Were Snubbed At The Oscars

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

2025-10-01 12:48