The madness is back. Tariffs-the giant bureaucratic guillotine of global trade-have returned to Wall Street’s fever-dream, slicing through supply chains like a drunk accountant with a chainsaw. While AI and crypto play dress-up as saviors, the real action lies in companies that can survive the carnage. Let’s dissect two unlikely heroes: Netflix and Coca-Cola. Buckle up. This ain’t a seminar-it’s a hallucinogenic ride through the tar sands of economic lunacy.

1. Netflix: Streaming’s Digital Ghost

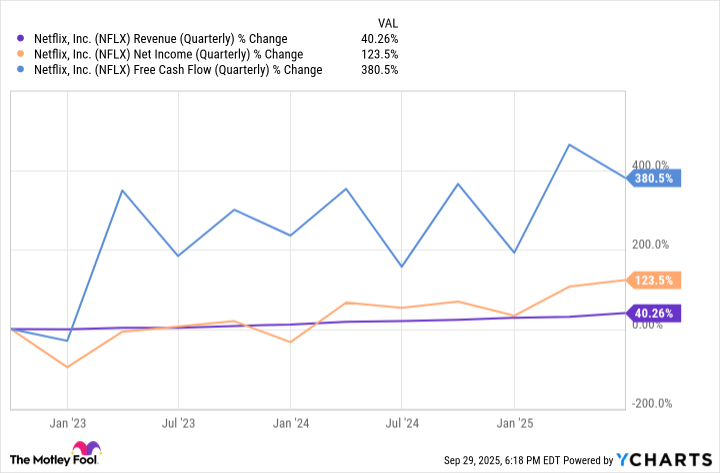

Netflix is the phantom limb of capitalism. It doesn’t ship boxes, build factories, or care about tariffs. It’s a digital phantasm, flickering across screens like a possessed VCR tape. But don’t let the “streaming” buzzword fool you-this is a beast with teeth. Its revenue? Growing like a weed in a nuclear fallout zone. Earnings? Climbing Mount Everest in flip-flops. Free cash flow? A rocket ship fueled by binge-watching and existential dread.

Here’s the kicker: Netflix isn’t just surviving; it’s weaponizing the chaos. With ads now in its arsenal, it’s turning its data hoard into a goldmine. What do people watch? When do they click? How long do they stare into the void before crying? Netflix knows. It’s not just a platform-it’s a goddamn oracle, and tariffs can’t touch it. Unless, of course, the government bans Wi-Fi. Then we’re all doomed. But that’s another story.

Streaming’s still a fledgling empire, and Netflix? It’s the emperor with no clothes. Or is it? August’s numbers show it’s capturing just 8.7% of U.S. TV time-enough to make you want to scream. But remember: the market is a circus, and Netflix is the ringmaster. Even if tariffs trigger a meltdown, this company’s moat is deeper than a black hole. Buy it. Pray it doesn’t collapse under the weight of its own ambition. And hope the algorithms don’t start recommending 1984 in your sleep.

2. Coca-Cola: The Old God of the Marketplace

Coca-Cola is the grizzled veteran in a war of greenhorns. It’s been here since before tariffs were a twinkle in Reagan’s eye. Why? Because people will always drink. Always. Even when the sky falls. This isn’t a stock-it’s a covenant. A 63-year dividend streak. Sixty-three. That’s not just resilience; it’s a goddamn monument to stubbornness. If the world ends tomorrow, someone will still crack open a Coke to drown their sorrows. Probably in a nuclear bunker. Probably with a straw.

But here’s the real secret sauce: Coca-Cola’s a localist. It brews its elixir where the people are. No need to import. No need to fret about tariffs. Just pour, package, and pray. And when the economy stumbles? The dividend keeps flowing like a river of sweet, sticky inevitability. Volatility? Pfft. Coca-Cola’s got a moat wider than the Grand Canyon and a brand that could sell water to a fish.

And let’s talk about evolution. This isn’t 1920. Coca-Cola’s not just soda anymore. It’s zero-sugar, it’s energy drinks, it’s coffee, it’s whatever the hell people crave. It’s a chameleon in a suit, adapting to every flavor of madness. Tariffs? Inflation? Global pandemics? Coca-Cola shrugs, adjusts the recipe, and keeps selling. It’s the market’s version of a cockroach. Kill the world, and it’ll still be there, humming a jingle.

So here’s the bottom line: In a world gone mad, these two stocks are your life rafts. Netflix, the digital prophet, and Coca-Cola, the old-world titan. One dances with data; the other with sugar. Together, they’re the last sane voices in a screaming room. Or maybe just the loudest. Either way, hold on tight. The ride’s about to get real.

🚀

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

- Games That Faced Bans in Countries Over Political Themes

2025-10-01 10:38