The greatest error of investors is to fixate solely on yield, as if the golden grain were the sole measure of the harvest. Yet true wealth lies not in the fleeting spark of a high number, but in the quiet, steady flow of cash that nourishes the roots of a company’s future.

Consider the dividend stocks that do not merely pay, but grow-like trees that stretch toward the sun, their branches bearing fruit each season. These are the guardians of capital, their dividends a testament to the fertile soil of their operations. Here are two such vessels, poised to carry their shareholders through the coming years.

This stock could pay huge dividends in the coming years

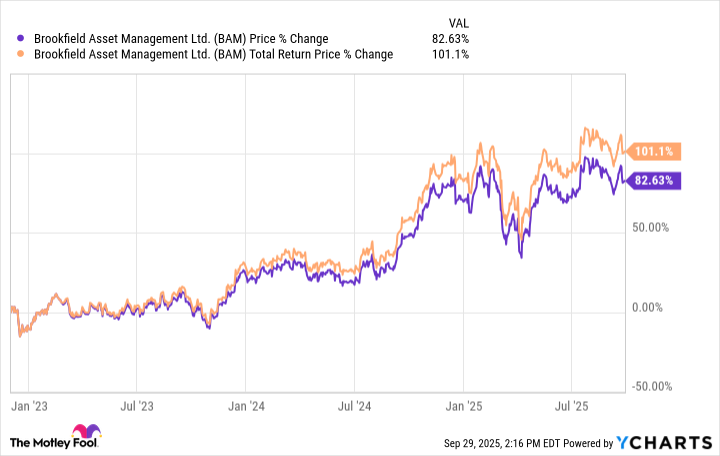

Brookfield Asset Management, a titan of alternative assets, flows with the currents of global markets, its roots deep in the soil of stable fees. Since its birth in 2022, it has not merely distributed dividends but woven them into the fabric of its existence, each increase a thread in the tapestry of growth. With reinvested gains, its stock has doubled, a slow, deliberate bloom.

Its strength lies in the quiet rhythm of its business: a symphony of infrastructure, renewables, and real estate, where fee-based capital hums like a river beneath the surface. By 2030, it aims to double its fee-bearing capital, a promise etched in the stone of its ambitions. Such growth is not a gamble, but a certainty written in the language of compounding.

A 3% yield, paired with a 15% dividend hike in 2024, speaks of a company that understands the art of patience. Its dividends, like the thaw of spring, are neither abrupt nor fleeting, but the result of long winters of careful planning.

This 7.5% yield looks very reliable

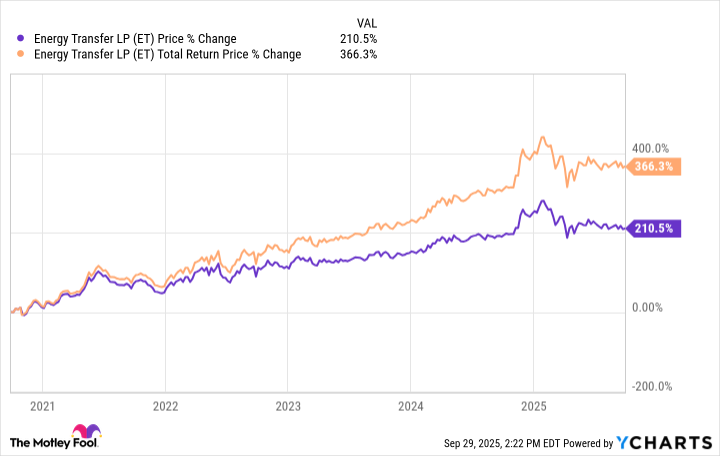

Energy Transfer, a colossus of pipelines, channels the lifeblood of energy across the land. Its 7.5% yield is not a siren’s call, but a lighthouse for those who see the tides of demand rising. With data centers thirsting for power and natural gas as their fuel, it stands at the crossroads of necessity and opportunity.

Its projects-expansions in the Permian Basin, the Hugh Branson pipeline, the Nederland Flexport terminal-are not mere constructions, but the roots of a forest yet to grow. Each dollar invested is a seed, and the returns, a harvest yet to be reaped.

With $5 billion in annual investments, it is not merely adapting to the future, but shaping it. Its dividend growth targets are not promises, but the natural progression of a company that understands the seasons of capital.

These two stocks, like twin stars in the night sky, offer not just light, but direction. To invest in them is to trust in the slow, patient dance of markets-a dance as old as the earth itself.

🌳

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Banks & Shadows: A 2026 Outlook

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-10-01 03:19