In an utterly shocking turn of events that totally didn’t have everyone checking their watches, Bitcoin and Ether ETFs decided to throw a comeback party on Monday, scooping up over $1 billion in combined inflows. Bitcoin nonchalantly added $522 million, while Ether strutted in with $547 million-like financial celebrities at a cosmic buffet.

Crypto ETFs Bounce Back: Bitcoin Bags $522 Million, Ether Floats Higher With $547 Million

After a painfully awkward week filled with redemptions faster than you can say “blockchain buzzkill,” Bitcoin and Ether ETFs suddenly remembered how to be fun on Monday, Sept. 29, welcoming back more than $1 billion in inflows like it’s an open bar. This surprise rally is basically the crypto equivalent of your favorite sitcom character returning from a mysterious season hiatus-strong, dramatic, but still weirdly expected.

Bitcoin ETFs, led by Fidelity’s FBTC flexing a cool $298.70 million, recorded exactly $521.95 million in inflows. Not to be outdone, Ark 21Shares’ ARKB danced in with $62.18 million, Bitwise’s BITB strutted up with $47.16 million, and Grayscale’s Bitcoin Mini Trust politely contributed $47.09 million, because sharing is caring, right?

Invesco’s BTCO and Vaneck’s HODL chipped in $35.34 million and $30.66 million, respectively, while Grayscale’s GBTC jumped on the bandwagon with $26.91 million. Franklin’s EZBC tossed in $16.51 million, and Valkyrie’s BRRR made a modest $4.03 million appearance. Meanwhile, BlackRock’s IBIT sulked in the corner with a $46.64 million outflow-because someone’s got to be the party pooper. Despite that, total trading volume skyrocketed to $4.61 billion, pushing Bitcoin ETF net assets to an eye-popping $150.41 billion. Cha-ching!

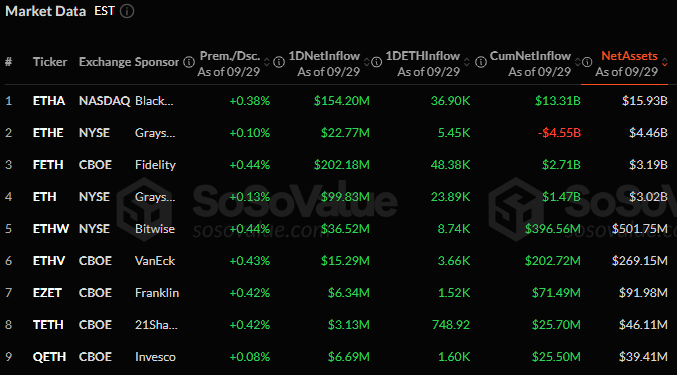

Ether ETFs decided to one-up Bitcoin’s little party by pulling in a combined $546.96 million. Every single fund crossed the finish line waving a green flag. Fidelity’s FETH and BlackRock’s ETHA hogged the spotlight with $202.18 million and $154.20 million, respectively, like financial reality show stars. Grayscale’s Ether Mini Trust was no wallflower either, throwing in $99.83 million, while Bitwise’s ETHW pitched $36.52 million, and Grayscale’s ETHE added $22.77 million with all the flair of a well-practiced jazz hand.

Vaneck’s ETHV contributed $15.29 million, with the smaller but still cool kids from Invesco’s QETH ($6.69 million), Franklin’s EZET ($6.34 million), and 21Shares’ TETH ($3.13 million) joining the happy dance. Ether ETFs’ trading volume catapulted to $1.89 billion, inflating net assets to a respectable $27.54 billion. Not too shabby for a digital currency better known for causing existential crises than calm investment strategies.

This beautiful, synchronized surge across both Bitcoin and Ether ETFs is like seeing two polar opposites finally agree to have a tea party-it marks a dramatic, eyebrow-raising reversal of last week’s “sell everything, run for hills” vibe. Clearly, the institutions are back, cozying up to crypto once more and probably whispering sweet blockchain nothings to each other.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

2025-09-30 22:15