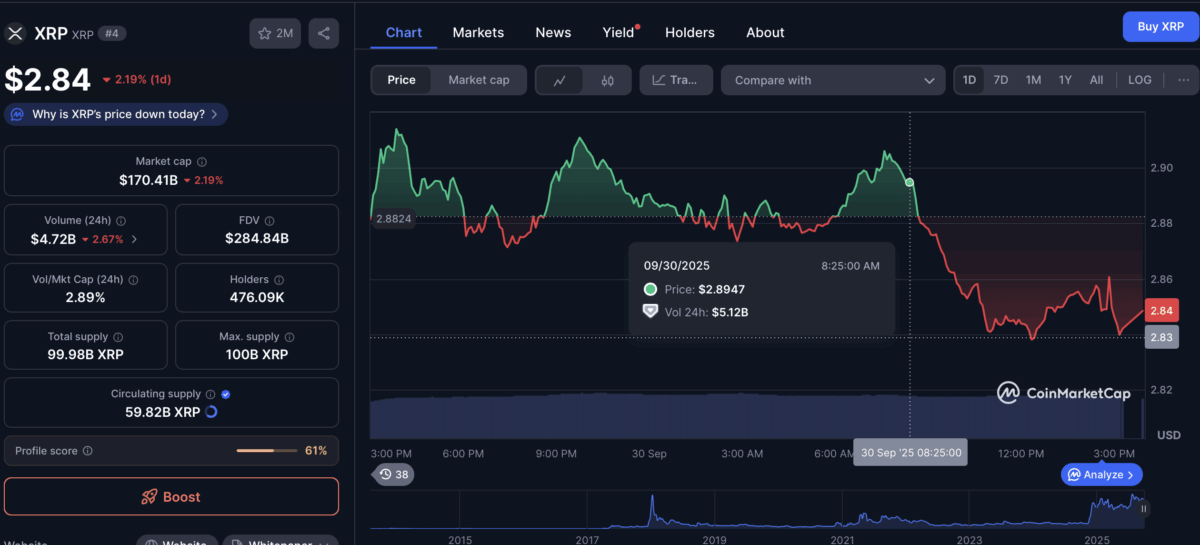

Dear Reader, let us address the matter of XRP, that most enigmatic of tokens. Presently, it trades at a modest $2.84, a figure that whispers of both resilience and regret. One might say it’s as if Ripple’s native asset has been caught mid-yawn, having lost 15.79% of its vigor in recent weeks. How very… relatable.

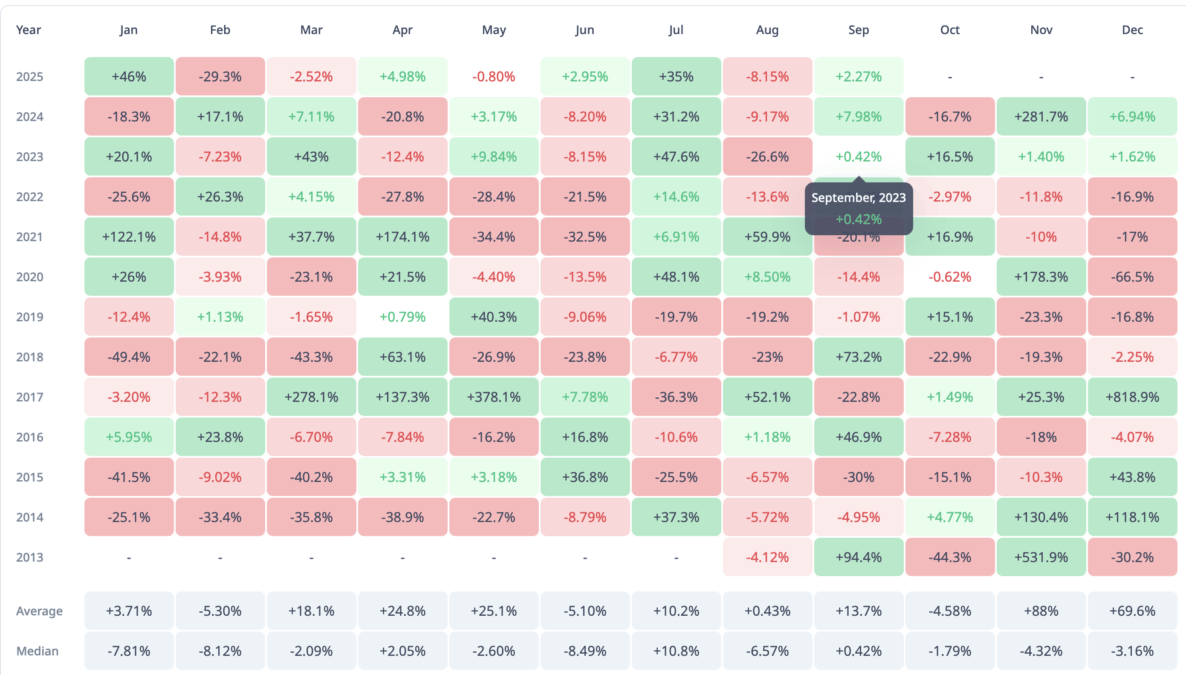

Now, October-ah, October! Dubbed “Uptober” by crypto’s most optimistic enthusiasts-is a month that dances between hope and heartbreak. History, that fickle friend, offers mixed signals. Will this be the year XRP breaks its October curse? Or shall we all be treated to another performance of “The Long Suffering Investor”? Only time will tell, but let us prepare our tea and monocles.

The $2.75 Level: A Love Letter or a Divorce Proceeding?

Perusing the chart, one discovers a pivotal figure: $2.75. A level as significant as a well-tailored waistcoat, marking both the Sept. 1 open and the lower boundary of a symmetrical triangle. Should XRP cling to this number, it may yet flirt with $2.86, the 100-day moving average, and perhaps even waltz toward $3.62. But should it falter? Well, $2.00 awaits with the warmth of a soggy umbrella.

Glassnode’s data reveals a curious tale: 1.58 billion XRP were hoarded between $2.72 and $2.75. Strong demand, indeed, though one suspects the supply at $2.81 is plotting mischief. A recovery? Perhaps. But not without a few dramatic pauses for effect.

October: The Month That Loves a Tragedy

Let us not mince words: October has been less than kind to XRP. Since 2013, seven out of twelve Octobers ended in red, averaging a dismal -4.58%. Yet, as any seasoned theatregoer knows, the final act is where the magic happens. From October to December, XRP transforms into a Christmas panto villain, averaging 51% gains. In 2024, it soared 240%! Even in bear markets, Q4 delivers drama-be it -39% in 2018 or -29% in 2022. A holiday special, indeed.

And what of the ETF ballet? Franklin Templeton, Grayscale, and their ilk are due to file decisions like a well-rehearsed ballet. November 14, October 18-dates etched in crypto’s calendar. Six ETFs await judgment. Analysts whisper of $4-$8 billion infusions, though one suspects the market has already priced in the excitement. A “sell the news” reaction? Perhaps. After all, nothing ruins a party like the guests arriving early.

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- Bitcoin and XRP Dips: Normal Corrections or Market Fatigue?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

- Is Kalshi the New Polymarket? 🤔💡

2025-09-30 20:36