The mighty temples of Centralized Exchanges, once hallowed halls of trade, now fumble with fancy suits and IPO dreams. They parade app features and bow to regulators, while Decentralized Exchanges quietly sprint past $2.6 trillion in trades-like mischievous children with too much sugar and no babysitter. 😏

This dance matters. Will the CEXs rise as grand banking cathedrals or crumble under the nimble feet of DEXs, custody-free and lightning fast?

IPOs: The New Church Bells of Exchange Power

Latest Gossip

Kraken snatched $500 million to speed its IPO, hoping to charm the old finance world. Gemini, swarmed by eager hands, capped at $425 million. Revolut dreams big-$75 billion dual London-New York debut. Imagine ringing the FTSE100 and NYSE bells simultaneously! 🎉

Backstory for the Curious

Revolut, decked with 65 million users (12 million Brits included), raised $3.77 billion to frolic in crypto, brokerage, and banking. A cheeky UK rule now lets giants hop into the FTSE100 within five days-index demand be damned! Shift Markets whispers that exchanges are now multi-service juggernauts, and Animoca Brands smirks that CEXs are becoming your payment and ID portals too. 🤹

Exchanges Evolve Into Super-Apps (Yes, Really)

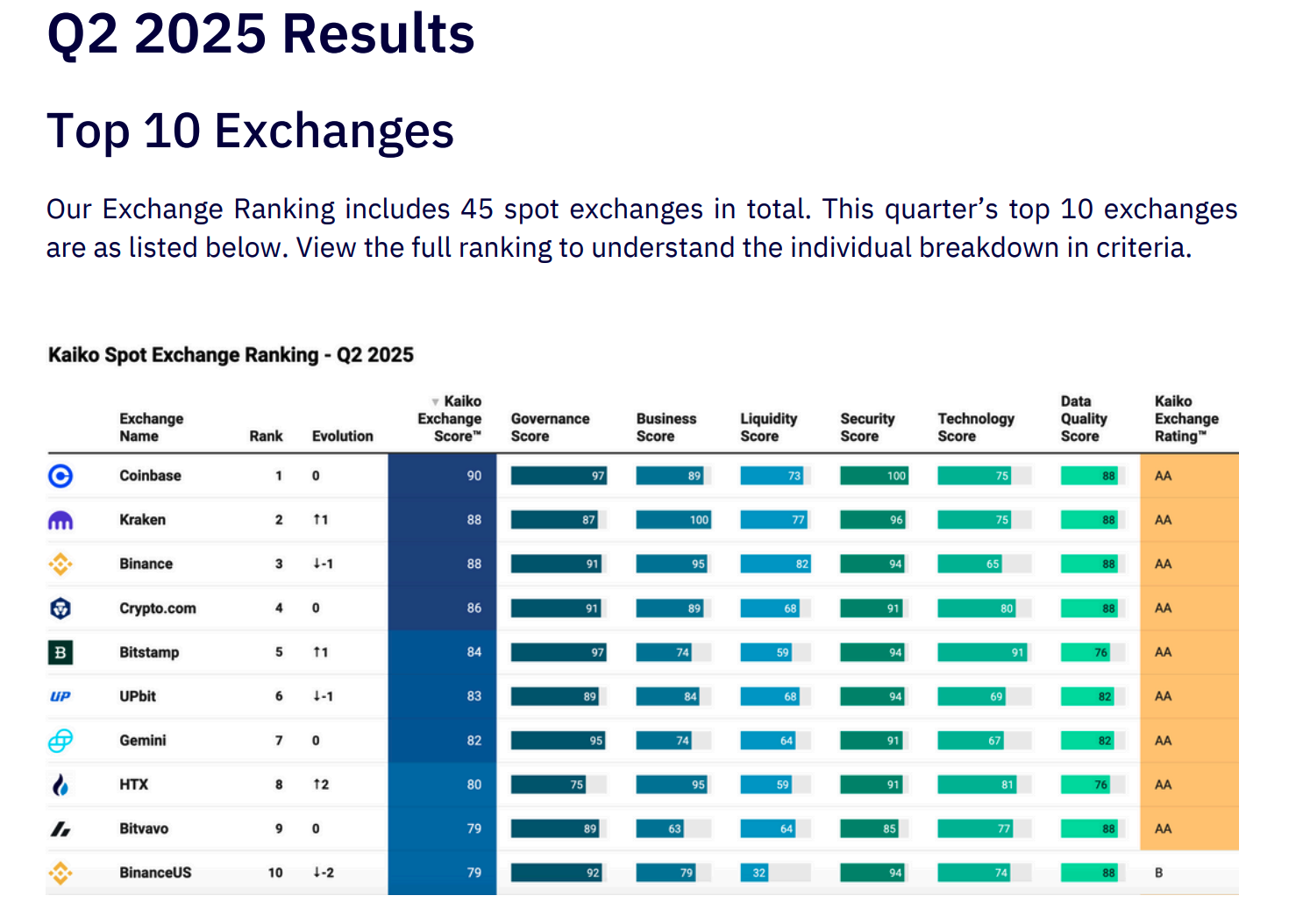

Kaiko reports liquidity hogs are still the top five venues, while ambitious challengers sprout new regional services.

Coin Metrics confirms CEXs cling to volume supremacy even as on-chain settlement crawls forward. Bitwise notes institutions cozy up to regulated exchanges for custody and risk-because apparently, even grown-ups like rules.

Behind the Curtain

Coinbase birthed Base App, blending trading, payments, and social feeds. Asia counters with LINE NEXT and Kaia’s Unify for stablecoin delights. CEXs now chase super-app glory, courting daily users-not just traders-but hey, who knew finance could be so social? 😅

Crossroads of Fate: Regulation, Risk, and Reputation

The Ripple Effect

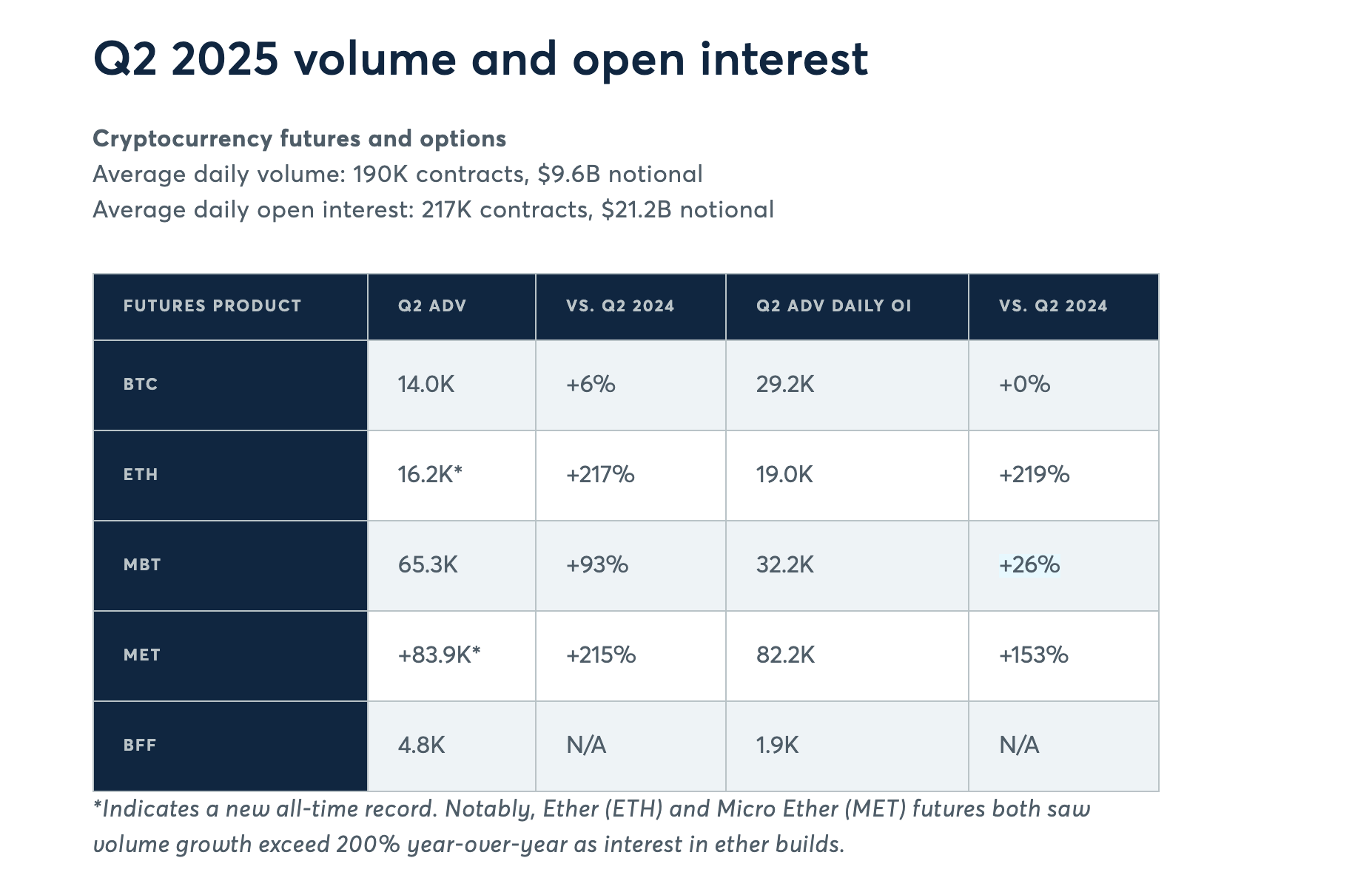

CME reports soaring institutional appetite for derivatives, favoring exchanges that juggle spot, futures, and tokenized delights.

PwC warns of converging custody, capital, and disclosure rules. CEXs may become “systemically important”-a polite way of saying: bank-level stress, higher bills, but more respect. 💸

Storm Clouds Ahead

Cross-border chaos, compliance costs, and nimble DEX competitors are relentless. Yet, CEXs dabble in payments, tokenization, and identity, hoping to milk extra revenue. Analysts caution: the legal and custody game will decide who survives. Meanwhile, DEXs grow like weeds, reminding CEXs to run faster-or face migration. 🌱

Words from the Wise

“Exchanges can no longer be just trading venues. They must act as bridges between centralized and decentralized worlds,” quipped Gracy Chen, Bitget CEO, probably over too much coffee.

“[Data] shows exchanges are transforming from mere liquidity pools into grand cultural and financial gateways,” said Ming Ruan of Animoca Brands, perhaps while stroking his beard thoughtfully. 🧐

“CEX stand at a cliff; adapt and they become full-service financial monsters,” warned a Kaiko analyst.

From IPOs to super-apps and stricter rules, CEXs are remaking themselves into modern financial beasts. Investors may ride IPO waves; regulators might demand bank-level manners. DEXs creep forward, users peek over the fence, and the future rests on innovation, oversight, and keeping crypto both thrilling and somewhat safe. 🎢

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- Bitcoin and XRP Dips: Normal Corrections or Market Fatigue?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

- Is Kalshi the New Polymarket? 🤔💡

2025-09-30 18:56