It is a truth universally acknowledged, that a single investor in possession of a good fortune must be in want of dividends. Yet while the crowd flocks to the glittering ballrooms of speculative excess, where fortunes are won and lost with the flick of a trading screen, there exists a quieter assembly: those who seek the steady rhythm of quarterly payouts. Here, in the $30-trillion realm of dividend-paying equities, one ETF conducts the orchestra with particular aplomb.

The Schwab US Dividend Equity ETF (SCHD), though scarcely mentioned in the drawing rooms of financial media, has the manners to exclude the vulgarly fashionable. No speculative tech darlings here-only firms with a decade of unbroken dividend increases, a lineage as pedigreed as any Bennet heir. Even the REITs, those charming but fickle companions with their tax-advantaged wiles, are politely shown the door. One might call it a society of substance over spectacle.

Consider its selection process: a marriage of prudence and calculation. Each candidate is weighed not merely by the size of its purse, but by the steadiness of its cash flow, the elegance of its return on equity, and the grace of its dividend growth. Only the top 100, those with the finest composite scores, are invited to the ball. And like a well-bred guest list, the weighting favors the established titans-though they may change their coats with the seasons, the family silver remains untouched.

At 0.06% expense ratio, the stewardship costs less than a new bonnet. One might almost suspect the fund managers of philanthropy, were it not for the quiet efficiency with which they mirror the Dow Jones U.S. Dividend 100 Index. Annual updates ensure the guest list remains au courant, sparing investors the indignity of clinging to yesterday’s favorites.

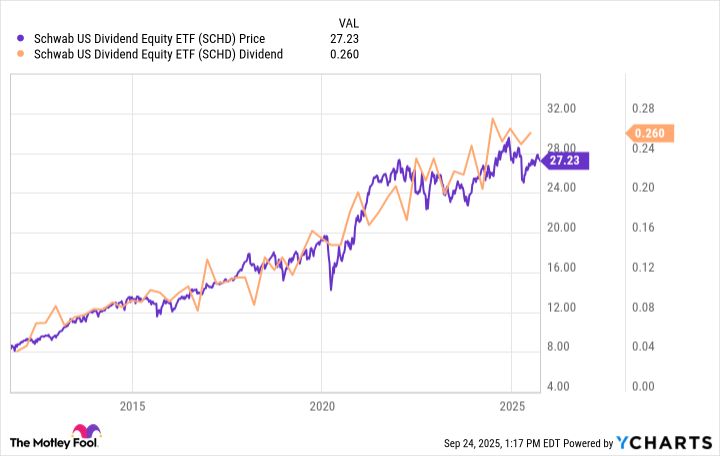

Admittedly, the yield-3.7% as of this writing-may strike some as insufficiently romantic. Why, the S&P 500’s 1.2% seems positively stingy by comparison, though one wonders if such parsimony might not be a virtue in leaner times. And while SCHD’s price appreciation lacks the drama of a Gothic novel, its slow, upward trajectory since 2011 suggests the enduring charm of a well-made character.

Some may protest that higher yields exist, or more thrilling growth prospects. Yet is it not better to marry a company (or an ETF) whose virtues are proven, rather than chasing the whispered rumors of speculative fortunes? The market, like Meryton society, often mistakes noise for substance. SCHD’s quiet diligence-its refusal to chase fads or tolerate financial impropriety-may well prove the better part of valor.

In a world where every investor fancies themselves a revolutionary, there is contrarian courage in choosing continuity. Let others dance with the trend-chasers; the discerning mind will find its match here, among the 100 most steadfast dividend payers. After all, as any Austen heroine might observe: a fortune well-managed is its own reward. 🌹

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- USD RUB PREDICTION

- Billionaire’s AI Shift: From Super Micro to Nvidia

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

2025-09-30 13:09