Ah, behold the grand ballet of the markets, where the coin, UNI, prances upon the stage of support and resistance, a level so critical it would make even the most stoic of traders blush with anticipation! 🕺 Market participants, those ever-watchful eyes, gaze upon this zone with the fervor of a suitor at a masquerade, for it has, time and again, dictated the coin’s whimsical dance. Some analysts, with their quills and charts, proclaim it a haven for long-term buyers, a risk-to-reward setup so favorable it borders on the absurd! 😏

The Pivotal Farce Unfolds

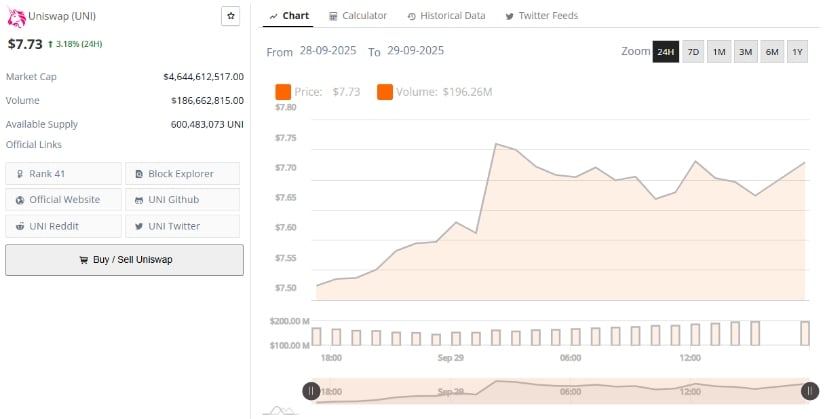

Pray, cast thine eyes upon the chart, a masterpiece shared by the esteemed Part-Time Trader, wherein UNI’s antics within a long-term ascending channel are laid bare. Lo, the coin has respected this channel with the fidelity of a courtier to his king, establishing a framework so structural it could rival the grandest of palaces! 🏰 At present, the asset lingers upon a zone of support and resistance, $7.36-$7.73, a level so pivotal it hath dictated directional shifts with the whimsy of a playwright’s pen.

The analyst, with a flourish of their quill, suggests this zone may serve as a springboard for accumulation, a launching pad for the coin’s ascent to $15, should buyers summon their courage. Yet, this mid-range level hath been a formidable foe, repelling bullish advances with the stubbornness of a miser guarding his gold! 🛡️ A break above $15, they say, would herald strength, paving the way to $25-$26, where the channel’s upper trendline awaits like a grand finale. But alas, the coin’s fate hangs in the balance, teetering between triumph and prolonged consolidation.

Risk and Opportunity: A Comedy of Errors

Mark well, dear reader, Uniswap, with its market cap of $4.64 billion and daily trading volume of $196 million, remains a liquid darling of the DeFi sector, a star in the firmament of crypto. 🌟 Its ascending channel offers clarity, yet caution is the watchword, for near-term weakness is as undeniable as a fool’s folly. Traders, ever divided, debate between awaiting confirmation of strength and daring early entries, a spectacle as entertaining as a Molière play!

For the bulls, the path is clear: reclaim $8.84, march to $15, and dream of $25-$26. But the bears, ever lurking, eye the $7.00 level as their battleground, a breakdown there threatening to shatter the bullish structure like a glass slipper at midnight. 🦹♂️ Until this standoff resolves, the token sits at a pivot point, accumulation strategies clashing with bearish sentiment in a drama fit for the stage.

Technical Pressure: A Corrective Interlude

Yet, fear not, for higher-timeframe structures remain constructive, like a well-crafted plot twist. The daily chart reveals UNI in a corrective phase, descending from $12.30 to its current $7.73, slipping below the Bollinger Bands’ midline at $8.84. This slide, a testament to sustained selling momentum, brings the coin closer to the lower band at $7.01, a level that oft signals oversold conditions, a potential relief bounce awaiting the buyers’ intervention. 🌊

Add to this the Chaikin Money Flow (CMF), a modestly positive 0.06, suggesting capital inflows have not entirely vanished, even as prices weaken. Such divergences, like a clever aside in a play, sometimes herald rebounds, hinting at underlying demand. Should CMF hold above zero and volume swell, the asset might recover toward the $10.66 upper band. But, alas, failure to reclaim $8.84 risks dragging the price into extended consolidation near $7.00, a fate as dreary as a poorly written monologue. 😔

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Zack Snyder Shares New Ben Affleck Batman Image: ‘No Question — This Man Is Batman’

- Games That Faced Bans in Countries Over Political Themes

2025-09-29 23:04