Palantir Technologies has become a ghost haunting the halls of Wall Street-a specter of ambition cloaked in algorithms. Three years ago, it was merely a whisper in the SaaS sector; now, it demands attention, though whether it deserves it remains an open question.

Skeptics, like the old man who counts his coins before sleep, mutter about valuations that defy gravity. Bulls, meanwhile, wave their charts like religious icons, insisting the company’s contracts with governments and corporations are proof of divine favor. Yet for the dividend hunter, the true measure lies not in multiples but in the quiet reliability of cash flow-something Palantir has yet to deliver.

This week, Mariana Perez Mora of Bank of America raised her price target to $215, a 20% leap from recent levels. It is the kind of call that makes one sip tea with trembling hands, hoping the kettle doesn’t boil over.

In this analysis, I will dissect Mora’s logic, trace its echoes in the market’s fever dreams, and ask whether Palantir’s stock is a gamble worth making-or a mirage best left untouched.

Why Wall Street’s Love Affair with Palantir

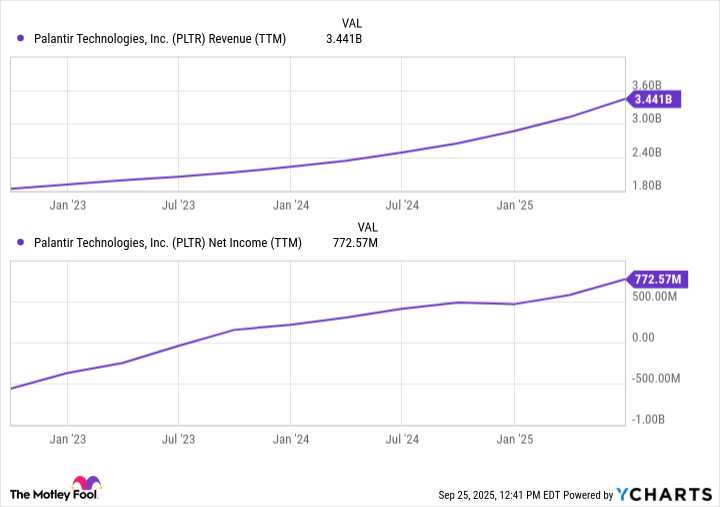

The company’s revenue growth is a river in flood, carving new paths through the desert of software markets. Yet for the dividend hunter, the real intrigue lies in the soil beneath the surface. Palantir’s AI tools-Foundry, Gotham, Apollo-are the seeds planted in fertile ground, but even the most promising saplings require seasons to bear fruit.

Deals with the U.S. Army ($10 billion), the U.S. Military ($1.3 billion), and NATO ($1.5 billion) are the kind of headlines that make analysts weep into their spreadsheets. Yet contracts, like promises, are only as good as the ink that binds them. Revenue visibility is a luxury, but cash flow durability is a necessity-and the latter remains elusive.

Mora’s defense of Palantir’s valuation-“if it works, it’s not expensive”-is a sly retort to Marc Benioff’s criticisms. It is the market’s way of saying, “We are not here to debate pricing; we are here to chase outcomes.” Yet outcomes, like dividends, are rarely guaranteed.

Jim Cramer’s Rule of 40 argument is a curious alchemy, blending growth and profitability into a potion that appeals to the gullible. For the dividend hunter, however, the elixir is bitter without a drop of yield.

Valuation: A Dance with Ghosts

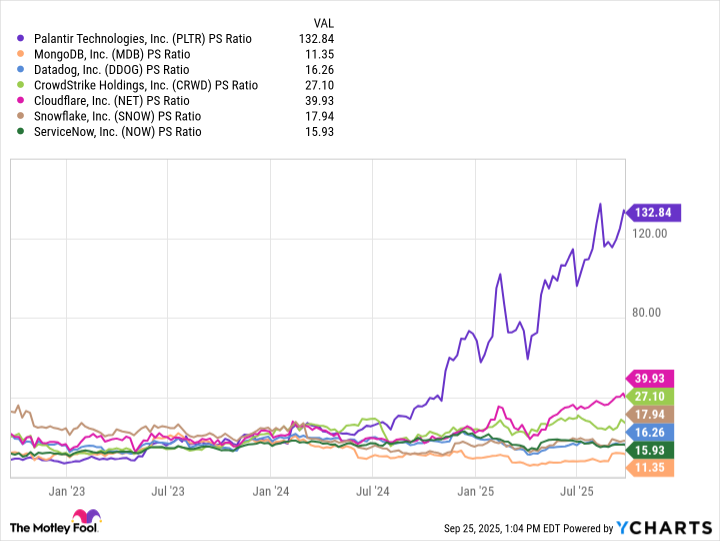

Palantir’s price-to-sales ratio of 133 is a number that haunts the minds of value investors. It is the price of admission to a party where everyone wears a mask. The chart below reveals a landscape where multiples tower over peers like crumbling cathedrals-monuments to ambition.

Even if the company meets its revenue forecasts of $5.6 billion in 2026 and $7.6 billion in 2027, the implied forward P/S multiples (76.8 and 56.6) suggest a future still priced beyond reason. Growth, like a candle in the wind, flickers brightly but casts no warmth for the dividend hunter.

| Metric | 2026 Consensus Revenue Estimate | 2027 Consensus Revenue Estimate |

|---|---|---|

| Revenue | $5.6 billion | $7.6 billion |

| Implied forward P/S multiple | 76.8 | 56.6 |

A Buy or a Bet?

At $430 billion, Palantir’s market cap is a cathedral built on sand. The question for investors is not whether the stock will rise further, but how much of its future is already etched into its price. Stanley Druckenmiller’s exit from the fund’s position is a silent requiem for the dreamers who bought high and sold higher.

A prolonged correction feels inevitable, like the tolling of a distant bell. When it comes, the market may forget the company’s contracts and remember only the lack of dividends. For the dividend hunter, there is no elegance in speculation-only the quiet dignity of patience.

Palantir’s stock is a symphony of potential, but the conductor has yet to write the final movement. The market will continue its dance, and the dividend hunter will watch, sipping tea in the wings, waiting for the music to resolve into something worth holding. 🌿

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- The Best Actors Who Have Played Hamlet, Ranked

- Games That Faced Bans in Countries Over Political Themes

- 9 Video Games That Reshaped Our Moral Lens

- Banks & Shadows: A 2026 Outlook

2025-09-29 20:59