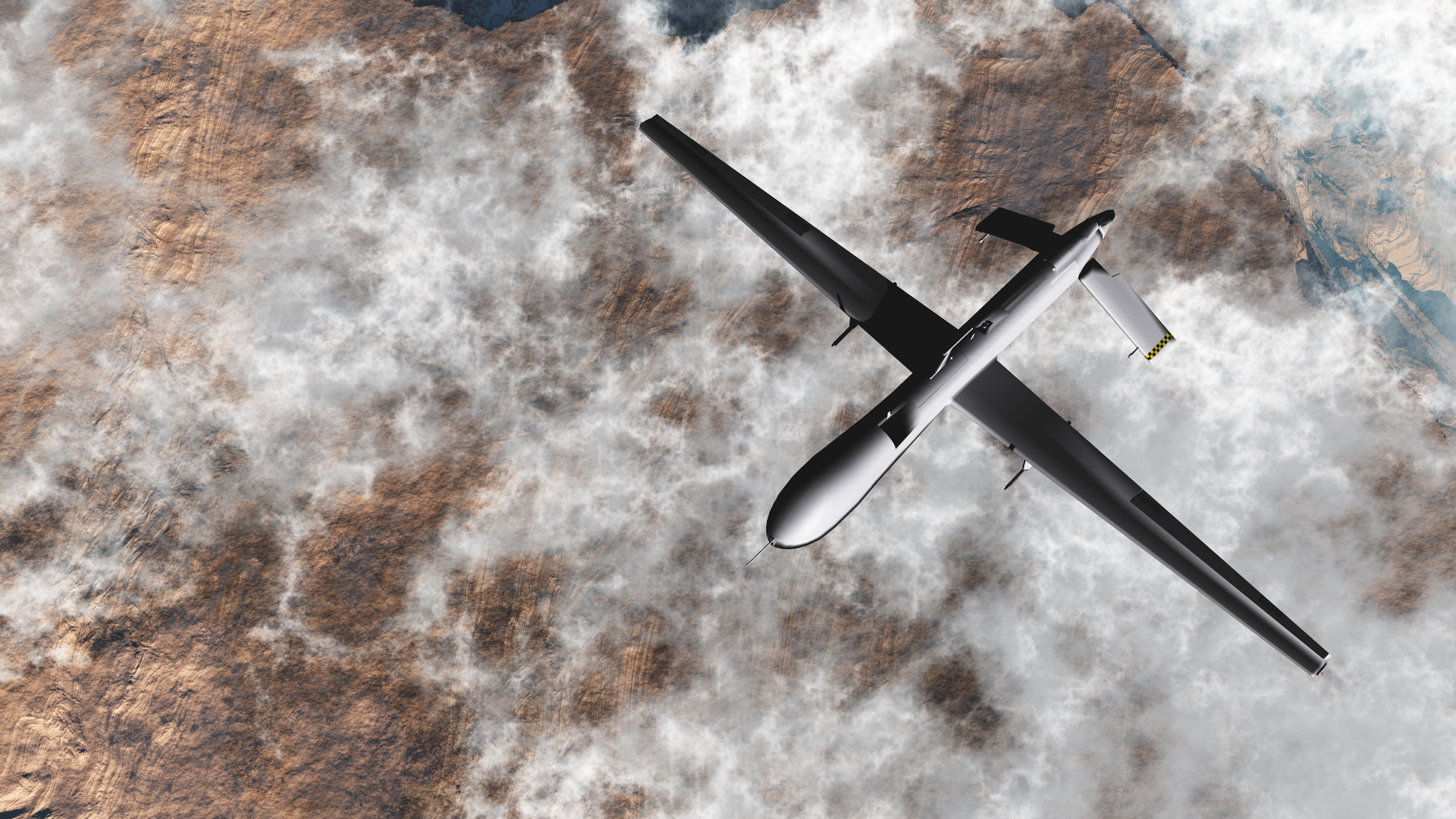

In the annals of speculative finance, few enterprises resemble a labyrinth as much as AeroVironment (AVAV). This week, its stock ascended like a phoenix from the ash of market indifference, rising 4.6% as if guided by the invisible hand of a Raymond James analyst named Brian Gesuale. His price target-$348 per share-was not merely a number but a key to a vault hidden in the corridors of the company’s investor day. Tomorrow, they will unveil the “new AV,” a phrase that echoes the cryptic proclamations of fictional scholars who map the infinite.

The Fly, that intrepid chronicler of market whims, reports the analyst’s decree. He expects the company to promise a doubling of revenue by 2030. A bold claim, one might say, for a firm whose earnings last year amounted to $1.55 per share-a paltry sum for a stock priced at $316. The P/E ratio of 200 is not a number but a riddle, solved only by those who mistake future promises for present realities.

The Mirror of Market Expectations

Meanwhile, the Defiance family of ETFs has constructed a curious edifice: the Defiance Drone & Modern Warfare ETF (JEDI). AeroVironment, it seems, occupies 6.1% of this portfolio, a fraction that may yet become a fulcrum for further ascent. The buying required to populate the ETF is a second tailwind, though whether it carries the stock to the promised land or merely fans the flames of hubris remains an open question.

Analysts, those modern-day cartographers of capital, predict AV’s revenue will climb from $820 million in 2025 to $3.5 billion by 2030. These figures form an infinite corridor, each year a recursive loop of optimism. Yet profits? They linger in the shadows. Last year’s earnings were a whisper; this year’s forecast is a loss. Even the 2030 projection of $7.70 per share, when divided by today’s price, yields a multiple of 41x-a riddle wrapped in a paradox, solved only by those who conflate hope with arithmetic.

The Investor’s Paradox

To call AeroVironment a buy is to suggest that the Library of Babel is a coherent text. Its ascent is a dance between the tangible and the abstract, a game of mirrors where the reflections are always out of focus. For the activist investor, the question is not whether the stock will rise but whether the labyrinth can be navigated without losing oneself in its recursive halls. The answer, as always, lies in the margins.

And so, the stock ticks upward, a Sisyphean endeavor in a world that confuses velocity for value. 🔮

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Best Actors Who Have Played Hamlet, Ranked

2025-09-29 19:44