Exchange-traded funds, those sly alchemists of modern finance, have woven themselves into the tapestry of portfolios as deftly as a spider spins silk. Yet not all ETFs are equal; they are not mere vessels of capital but palimpsests of strategy, each bearing the fingerprints of its architect. Vanguard, that stoic custodian of the passive, offers 98 such creations-each a mirror polished to reflect the whims of indexes, yet none quite as beguiling as the Vanguard S&P 500 Growth ETF (VOOG) and the Vanguard Information Technology ETF (VGT). These two, I submit, are not merely investments but invitations to a waltz with fortune, if one dares to dance.

The Best of the S&P 500, or a Garden of Giants

The S&P 500 Growth ETF, that botanical curator of growth stocks, prunes its garden with the precision of a Renaissance gardener. It hoards 213 stocks, though the true heart of its collection beats in the chests of Nvidia, Microsoft, Meta, and Apple. These titans, like Goliaths in a David-and-Goliath narrative, loom over smaller specimens such as Moody’s and Sherwin-Williams, whose dividends offer a faint scent of stability amid the perfume of ambition. The ETF’s diversification is a mosaic of 200 pieces, enough to shield the investor from the sharper edges of volatility, yet not so many as to dilute the essence of growth.

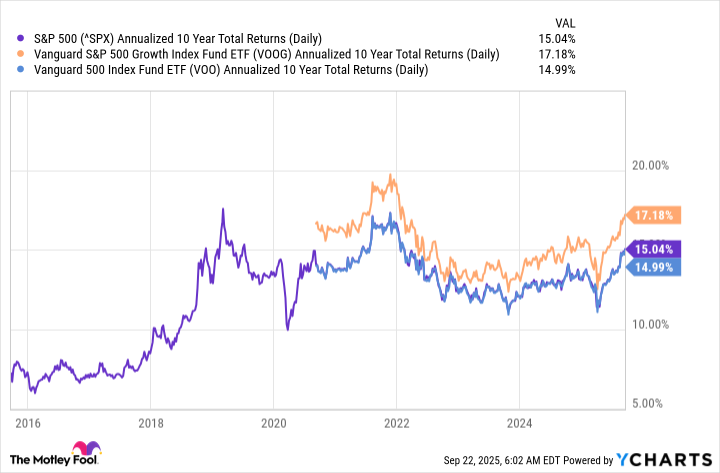

Its passive nature is a virtue. The index, that silent arbiter, weaves and unwears its tapestry with mechanical indifference. Stocks that falter are unceremoniously discarded, while new darlings ascend, their names whispered into the portfolio like incantations. This ritual has elevated VOOG to the fifth-highest-gaining Vanguard ETF over a decade-a feat all the more impressive given its modest expense ratio of 0.07%, a toll as light as a moth’s wing against the industry’s gilded 0.93%.

Yet let us not mistake this for a haven for the timid. Its risk level, the second-highest in Vanguard’s stable, is a siren song for those who crave the thrill of the climb. To own VOOG is to sit in the shadow of giants, hoping the wind shifts in your favor.

High in Tech, High in Hubris

The Information Technology ETF, that tempestuous lover of innovation, is a different creature altogether. Of Vanguard’s 98 ETFs, it reigns supreme in gains over the past decade, a crown earned through its feverish embrace of the digital age. Its top three holdings-Nvidia, Microsoft, and Meta-are not merely stocks but leviathans, their combined weight a staggering 45% of the portfolio. Beyond them lies a menagerie of AI darlings like Palantir Technologies and Advanced Micro Devices, their names etched in the margins of the investor’s ledger like runes.

This ETF is a paradox: a high-risk, high-reward proposition cloaked in the guise of index-tracking. Its expense ratio of 0.09% is a minor concession to the gods of cost, while its 316 components-a veritable bestiary of tech-offer exposure to the obscure and the obscure-to-come. Here, the investor gambles not only on known quantities but on the alchemy of potential, betting that the next Meta or Nvidia lies dormant in the shadows.

But let us not romanticize. The IT ETF is a blade sharpened by volatility, its gains as fleeting as a mirage. Growth stocks, after all, are the market’s mercurial acrobats-soaring when the sun shines, plummeting when clouds gather. Yet for those who dare, it is a key to the vaults of compound interest, a thread in the tapestry of long-term wealth. Provided, of course, one survives the storm.

And there, dear reader, lies the rub: the art of investing is not merely arithmetic but a ballet of risk and reward, where the seasoned investor must play both choreographer and spectator. Choose wisely, for the market is a fickle muse. 🧵

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Banks & Shadows: A 2026 Outlook

- 9 Video Games That Reshaped Our Moral Lens

- The Best Actors Who Have Played Hamlet, Ranked

- Games That Faced Bans in Countries Over Political Themes

2025-09-29 18:08