Many years later, as the servers in the heart of a data center hummed like drowsy cicadas, the engineers would remember the day Nvidia’s stock price began its ascension as if it were a prophecy whispered by the silicon itself. In the year 2023, when the world still clung to the memory of paper bills and coin purses, the stock had already begun its dance-a slow waltz of exponential returns that left latecomers clutching their wallets like children clutching moth-eaten blankets. By 2024, it had risen 800%, a number so absurd it made even the most jaded investors pause to check if their coffee had finally boiled over. Those who had thrown in the towel at the start of 2024, convinced they’d missed the boat, would soon find the tide rising beneath their feet once more, this time with a 33% surge that made their regrets taste like saltwater and second chances.

Yet the story of Nvidia is not merely one of numbers. It is a fable of silicon and ambition, where graphics processing units (GPUs) became the modern-day alchemists, transmuting data into gold. These chips, with their feverish parallel computations, were the muscle behind generative AI models, their clusters humming like choirs in a cathedral of code. When a data center ordered hundreds of thousands of them, it was as if the gods had decided to auction off their own divine calculations. Nvidia’s management, with the confidence of soothsayers, claimed 50% of the cost for a gigawatt AI factory-a share that, though it excluded the cost of land and bricks, still gleamed like a treasure map in the dim light of boardroom meetings.

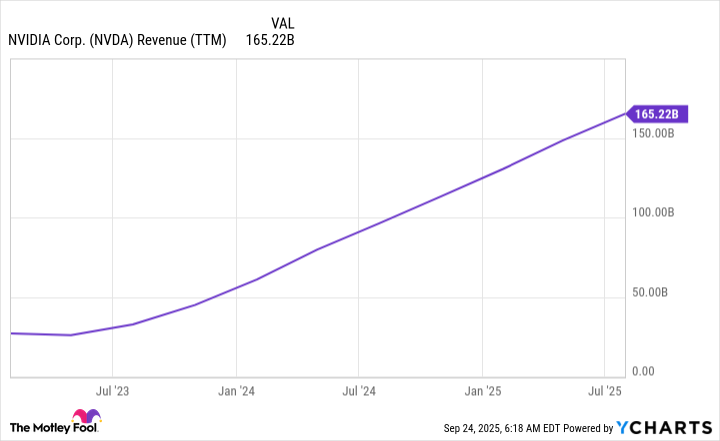

The AI hyperscalers, those titans of the digital age, had already whispered their 2026 capital expenditure plans to investors, their voices trembling with the weight of trillions. By 2030, global data center spending was expected to reach $3-4 trillion, a sum so vast it could drown continents. Yet here, in the present, the air smelled of urgency and opportunity. If Nvidia could secure 20% of this future-a conservative guess, some said, a pious hope for others-it would mean $600 billion in revenue by 2030. At a 50% profit margin and a 30x valuation, the stock’s market cap would swell to $9 trillion, a figure so staggering it would make the moon blush.

But the road ahead is not without shadows. Broadcom’s custom AI accelerators, like a rival sorcerer’s spell, threaten to chip away at Nvidia’s dominion. And in the East, where China’s markets loom like a sleeping dragon, export licenses remain a bureaucratic riddle. Yet even these obstacles seem mere footnotes in the epic of Nvidia’s rise. The stock’s current price of $178, at a $4.3 trillion valuation, hints at a future where $370 is not a number but a destiny-a 100% upside that outpaces the market’s glacial doubling cycle. To invest now, some argue, is to buy a ticket to the next chapter of the digital age, where the air is thick with the scent of innovation and the future is written in code. 🚀

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Banks & Shadows: A 2026 Outlook

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-09-29 13:56