Behold, the tale of three stocks, each a character in this grand farce of finance. Warren Buffett, that venerable sage of capital, has long been the subject of adulation, yet one must wonder: does his wisdom truly transcend the whims of markets, or is it but another performance in the eternal comedy of human folly?

Let us dissect these “gems” with the scrutiny of a jaded spectator. For what is investing but a masquerade, where fortunes are made and unmade beneath the guise of prudence?

This new Buffett stock is flying under the radar

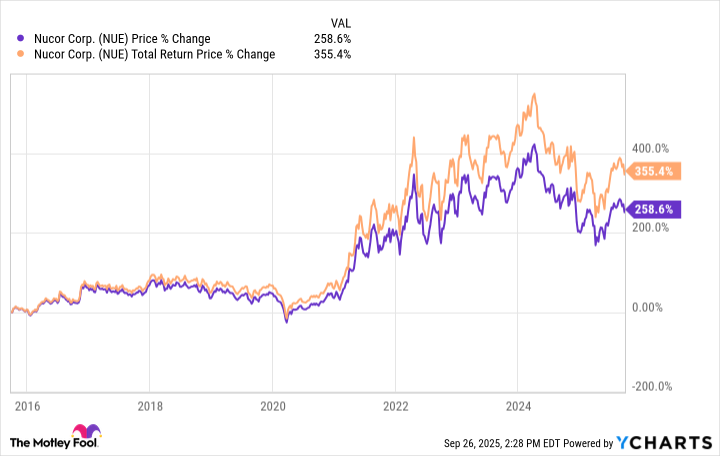

Enter Nucor, the steel titan, whose recent acquisition by Berkshire Hathaway has drawn the crowd’s applause. Yet, what is this “wide moat” but a metaphor for a fortress built on shifting sands? The company’s reliance on scrap and electric furnaces, while clever, is no guarantee against the tempests of demand. And lo! Its stock has faltered, not through any fault of its own, but because the market, that fickle courtier, demands more than mere resilience.

Oh, but the skeptics! They whisper that Nucor’s woes are but a “short-term blip,” a mere hiccup in the grand narrative. How easily we dismiss the present for the promise of a future that may never arrive.

The company’s backlog surges, its margins wane-yet the chorus sings of long-term growth. Is this not the same refrain that lured investors to dot-com dreams and real-estate bubbles? A tale as old as time, dressed in the garb of “economies of scale.”

A wealth-compounding Buffett stock

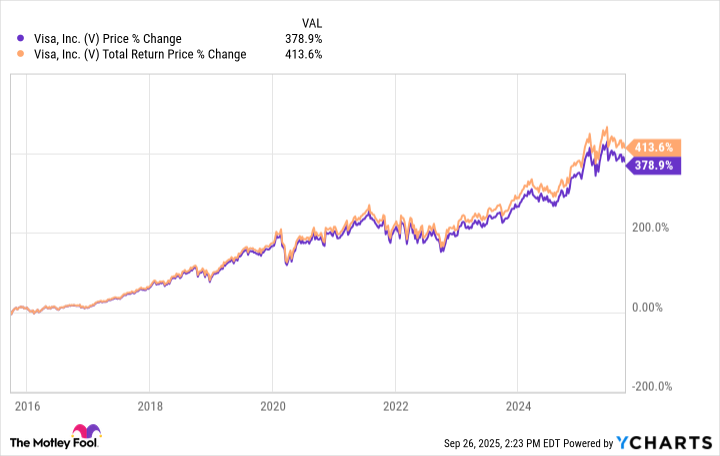

Visa, that paragon of payment processing, is hailed as a “wide-moat” marvel. Yet what is its empire but a house of cards, reliant on the ceaseless flow of transactions? The numbers are gilded: $15.7 trillion in volume, 65% margins, and a dividend that has “compounded” for decades. But what of the storm that may yet come? A shift in consumer habits, a regulatory upheaval, or the rise of digital currencies-each a potential dagger to the heart of this gilded age.

The company’s expansion into “non-card payments” is a spectacle of ambition, yet one must ask: is this innovation or mere diversification masquerading as progress? The crowd cheers, but the skeptic watches, ever wary.

A big acquisition puts this Buffett stock on the growth track

Chevron, that oil behemoth, is lauded for its “financial fortitude” and “dividend record.” Yet what is this fortitude but a veneer? The acquisition of Hess, a $60-billion spectacle, is hailed as a “game-changer,” yet the energy sector remains a volatile stage where fortunes rise and fall with the price of crude.

The promise of “incremental free cash flows” is but a siren song, luring the unwary into the arms of a market that rewards the bold and punishes the timid. And what of the “long-term returns”? A phrase as nebulous as the horizon, ever receding.

Thus, the farce concludes. Three stocks, three tales of hubris and hope. Let the investors dance, but the skeptic remains, ever watchful, ever questioning.

🧠

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- The Best Actors Who Have Played Hamlet, Ranked

- USD PHP PREDICTION

- 9 Video Games That Reshaped Our Moral Lens

2025-09-29 11:46