Domino’s Pizza (DPZ) is the kind of brand that makes you think, “I’ve had this before… but did I like it?” It’s like that friend who’s always available but never really exciting. With 7,000 U.S. locations and a global reach, it’s the pizza equivalent of a corporate ladder-reliable, but not exactly a career move. And let’s not forget Warren Buffett’s $100 million bet on it. That’s like getting a gold star from the teacher of value investing.

But here’s the thing: over the past five years, Domino’s stock has been about as thrilling as a spreadsheet. A 1% gain? That’s the financial version of “meh.” The question is, will the third-quarter earnings report (Oct. 14) be the spark that turns this into a fire? Or will it be the corporate equivalent of a lukewarm latte-disappointing but not entirely awful?

How Domino’s has performed after previous earnings reports

Last July, Domino’s dropped a report that was like a surprise party with no decorations. Same-store sales rose 3.4%-better than analysts’ 2% guess-but the bottom line? A dud. Earnings per share came in at $3.81 vs. $3.95. It’s like ordering a pizza and getting a side of regret. The stock? It tanked faster than a CEO’s credibility after a bad quarter.

Looking at the last three earnings reports, Domino’s stock has been about as consistent as a toddler’s nap schedule. Up, then down, then crying. The chart? A rollercoaster with the safety bar broken. And let’s be real-pizza isn’t a tech stock. There’s no “disruptive” buzz here, just a steady stream of cheese and sauce.

The bigger problem? The world’s a mess. Tariffs, inflation, and the existential dread of “Is this the year I finally cancel my gym membership?” Investors aren’t exactly lining up to throw money at a company that’s as exciting as a PowerPoint presentation.

Domino’s trades at a high multiple given its growth

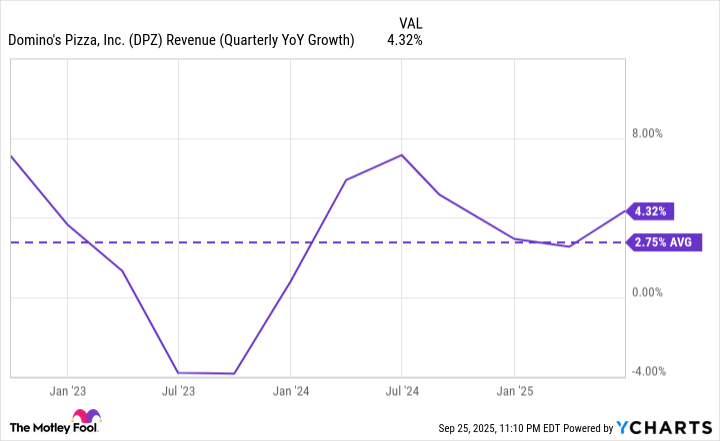

Domino’s isn’t cheap. Its P/E ratio is 25, which is like paying full price for a $5 pizza. The S&P 500’s average? Also 25. But here’s the catch: Domino’s isn’t growing like a startup. It’s growing like a suburban home-steady, but not exactly a mansion. If you’re paying 25 times earnings for single-digit growth, you’re basically betting on a slow cooker.

And let’s not ignore the elephant in the room: consumers are cutting back. If people are eating at home more, Domino’s is the equivalent of a coworker who’s always late. It’s not a disaster, but it’s not a win either. The stock’s valuation? A red flag waving in a hurricane.

I wouldn’t rush to buy Domino’s stock

Positive earnings reports can be the financial version of a viral TikTok-sudden and exciting. But unless Domino’s pulls off a “Wow, I didn’t see that coming” moment, don’t expect a stock surge. At best, a 2-3% bump if same-store sales stay strong. At worst? A faceplant. It’s like buying a lottery ticket with a 1% chance of winning and a 99% chance of regret.

The stock’s been as exciting as a spreadsheet this year. Unless you’re a fan of “wait and see,” there’s no rush. After all, what’s the rush? The market’s not going anywhere. And if you wait, you’ll have the luxury of watching the drama unfold from the sidelines.

So, should you buy? Maybe. But only if you’re okay with a stock that’s about as thrilling as a PowerPoint slide. 🍕

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- USD PHP PREDICTION

2025-09-29 04:23