When a company reaches the autumn of its days, it often opts to distribute dividends as a polite gesture to shareholders, much like a well-mannered host offering sherry to guests. Younger firms, meanwhile, hoard their resources like a miser in a frock coat, convinced that reinvestment will yield some miraculous alchemy of growth.

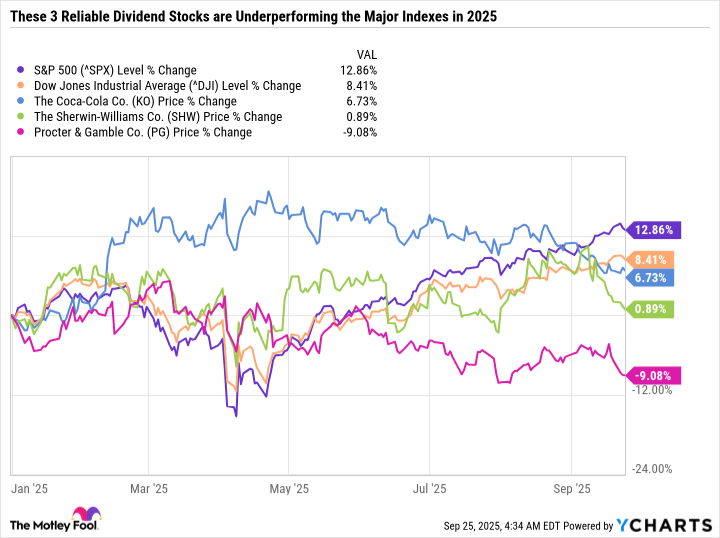

Coca-Cola (KO), Procter & Gamble (PG), and Sherwin-Williams (SHW)-three titans with more years behind them than most of us dare to count-have secured their places in the Dow Jones Industrial Average (^DJI) through sheer longevity and an uncanny ability to avoid the guillotine of irrelevance. Their dividend policies, like a well-tailored suit, have been refined over decades, growing in tandem with their earnings. Allocate £15,000 (or its equivalent in modern currency) to each of these equities, and you might expect a modest £1,000 in passive income annually-provided, of course, the market does not decide to play the violin in a minor key.

Let us begin with the beverage baron, whose recent performance has been as erratic as a jazz band in a teacup. Coca-Cola, once riding high on the crest of tariffs and geopolitical chaos, now finds itself adrift in calmer waters. Its stock price has slipped, trailing the S&P 500 (^GSPC) like a shadow at noon. Yet, the fundamentals remain as robust as a well-aged Bordeaux. The company has diversified its portfolio with healthier options-Coca-Cola Zero Sugar, for instance-while swapping high-fructose corn syrup for cane sugar. One might say it’s attempting to appear more virtuous without entirely abandoning its sweet tooth.

With a forward P/E ratio of 23.6 and a 3.1% yield, Coke remains a tempting proposition for those who prefer their dividends as reliable as a London fog. Sixty-three consecutive years of dividend increases-now that’s a record even a snob would admire.

P&G’s Restructuring: A Masterclass in Discretion

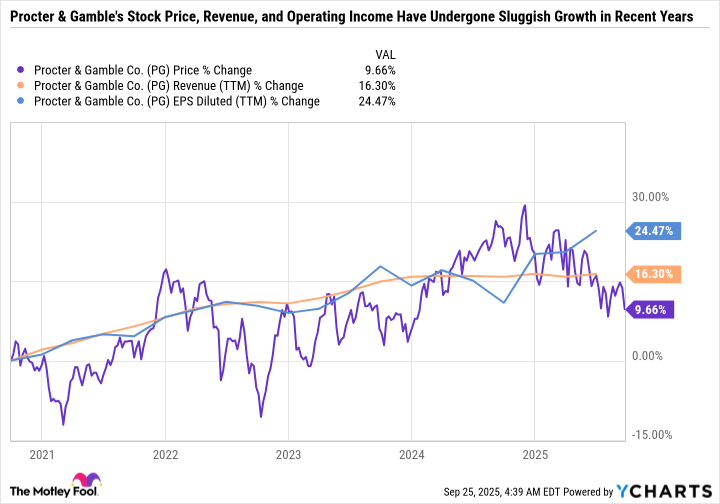

Procter & Gamble has taken a leaf from the playbook of every beleaguered aristocrat who’s ever had to sell off the silver. In June, it announced the shedding of 7,000 jobs and the abandonment of certain brands, all while its new CEO, Shailesh Jejurikar, prepares to take the reins in 2026. One imagines the boardroom conversations are as tense as a drawing-room drama, punctuated by the clink of ice in gin. The company’s reliance on price hikes-a strategy as sustainable as a house of cards in a gale-has led to a slowdown in organic growth. Still, with a P/E ratio of 23.4 and a 2.8% yield, P&G offers a curious blend of risk and reward for the patient investor.

For those who find the prospect of corporate upheaval as thrilling as a thunderstorm at sea, P&G’s current valuation-trading near a 52-week low-might prove irresistible. After all, what is investing if not a game of picking the right dance partner for the long haul?

Sherwin-Williams: A Painted Canvas of Opportunity

The paint magnate Sherwin-Williams (SHW), having recently ousted Dow Inc from the Dow, now finds itself underperforming due to interest rates that have stifled home improvement projects. One might liken its predicament to a gardener who has overwatered the tulips. Yet, with 46 consecutive years of dividend raises and a business model that spans retail, online, and partnerships with retailers like Lowe’s, Sherwin-Williams remains a study in resilience. Its 0.9% yield may seem modest, but consider that its stock price has surged 352% over the past decade-a feat even the S&P 500 would struggle to match.

Coatings for automotive, aerospace, and marine industries? How delightfully utilitarian. And yet, the company’s ability to adapt to shifting consumer tastes suggests it is less a relic and more a connoisseur of the modern age. A 0.9% yield may not set one’s heart aflutter, but in a world of vanishing cash, it is a small comfort.

Valuations with a Side of Sophistication

Coke and P&G trade at valuations that suggest the market has forgotten their virtues, while Sherwin-Williams remains anchored to its historical average. For the investor who finds tech stocks as tiresome as a bad pun at a dinner party, these three offer a refreshing alternative-dividends as dependable as a British summer, albeit with the occasional drizzle.

In conclusion, these equities are not the roaring lions of growth investing but rather the stately thoroughbreds of the dividend world. They may not gallop, but they will trot steadily to the finish line. And in the grand theater of finance, sometimes a steady trot is all one needs. 🍷

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-09-29 03:42