In these modern times, Bitcoin finds itself perched at the dizzying height of $109,449, boasting a market capitalization of $2.18 trillion, and a 24-hour trading volume that bespeaks of $20.54 billion in transactions. The intraday movement is as tightly confined as a ballet between $109,276 and $109,761, providing traders with enough excitement to inspire a twitch but not the jubilation of a grand success.

Bitcoin

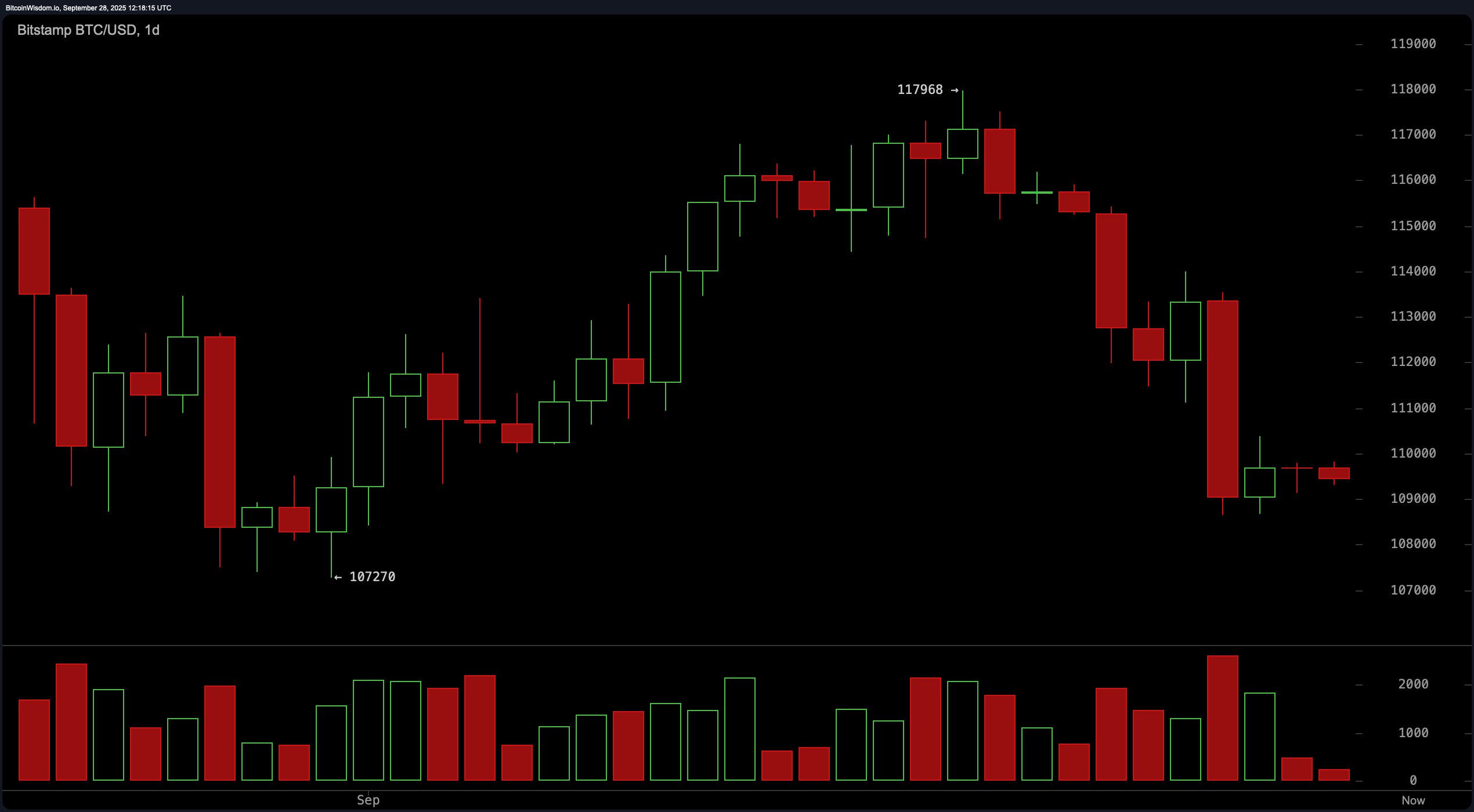

Consider, if you will, the daily chart of our digital curiosity today: it whispers a solemn narrative akin to a monotonous church choir or, indeed, a biting monologue delivered by a world-weary man trapped between existential ennui and cautious hope. With a bearish trend gripping its soul after a fleeting ascent to $117,968 and a fall to $107,270, the current price range betwixt $109,000 and $110,000 reveals an air of mute consolidation.

The sellers have made merry recently, but signs suggest that their nocturnal festivities may be drawing to a timely conclusion. Support rests humbly at $107,000 to $107,500, whilst resistance firmly stands its ground between $114,000 and $117,000. Break through $111,000, and the bulls may find cause to briefly renew their vigour, or so the conjecture goes.

When we draw closer and turn our gaze upon the 4-hour chart, we observe that this downward journey remains as clear as one’s understanding of one’s own character. A descending channel persists post-breakdown from the $114,000 realm; price action is confined, much like a social ladder at a provincial ball, between $108,600 and $109,800, forming a bearish flag. Yet, the declining volume of the bears hints at a market either spent or simply yearning for respite. Should Bitcoin make a deliberate descent past $108,600, the $107,000 target regains its potential prominence.

Upon the 1-hour chart, Bitcoin’s movements resemble a passage to nowhere-an entanglement where progress is as uncertain as life itself. Ranging narrowly between $109,100 and $109,800, with a failed attempt to ascend at $109,830, the low volume might signify discreet accumulation or a gathering of indifferent giants. Scalpers might find fleeting merriment with long positions near $109,100 and protection at $108,900, or embarking on shortness should resistance maintain its post at $109,800-though one must be quick and resourceful amid such fits and starts.

The financial oscillators convene like a gathering of querulous scholars, each imparting their conflicting counsel. The relative strength index at 38, the Stochastic oscillator at a modest 10, and the commodity channel index entrenched far into bullish depths at -130, convey a picture rife with hesitation. Momentum, showing a stark decline to -7,666, joins the chorus of bears. With the moving average convergence divergence languishing at -926 and the Awesome oscillator mildly negative, the technical seers are united in their vision of pressures towards selling.

Amidst the tumult, the moving averages lie strewn in a counsel of red. From the 10-period exponential moving average resting at 111,617 to the 100-period simple moving average lingering at 113,600, nearly every short to mid-term indicator declares its indictment with a resounding “bearish.” Only the long-term allies of 200-period EMA and SMA, standing at 106,256 and 104,439, respectively, remind us of possibilities that lie beyond the immediate fray. In essence, the bulls face a herculean undertaking should they wish to herald a resurgence.

Bull Verdict:

Should Bitcoin surge above $111,000 with volume surging through the upper limits of its current holding, the scenario suggests potential for a short-term remedy. Signs of sellers’ weariness coupled with persistently encouraging long-term averages lay testimony that the battle for the bullish resurgence might yet continue.

Bear Verdict:

With every key short- and mid-term moving average proffering a critical umbra and indicators beseeching towards the bears, the path of least resistance remains unmistakably downwards. A breach of $108,600 support, and a revisitation of the $107,000 level-or somewhere further still-becomes not just plausible, but possibily inexorable.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- The Best Actors Who Have Played Hamlet, Ranked

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Games That Faced Bans in Countries Over Political Themes

2025-09-28 16:29