Palantir Technologies (PLTR) has been a curious spectacle this year. Its stock has surged over 140%, a meteoric rise that places it among the S&P 500’s top performers. Yet, for all its brilliance, the question lingers: does this ascent reflect substance, or merely the fever of a crowd chasing shadows?

The machine churns on, but at what cost? Palantir’s software, a labyrinth of artificial intelligence, was once the province of governments. Now, it spills into the commercial realm, a siren song for corporations eager to wield its power. Yet, the price of entry is steep-a $2.5 million annual fee for a single client. Such sums are not for the many, but the few. And the few, it seems, are the ones fueling the fire.

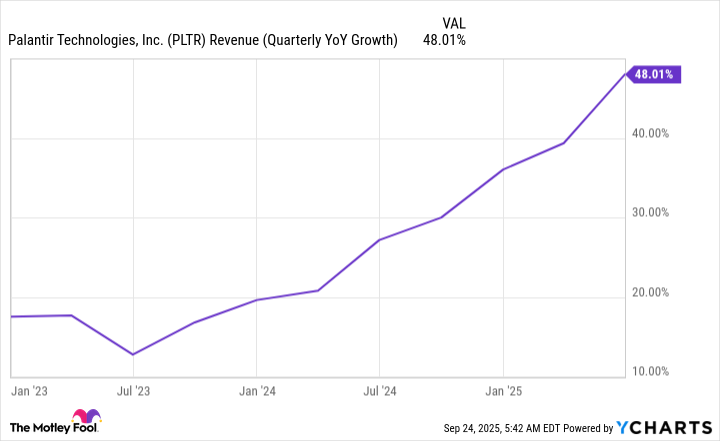

AIP, Palantir’s crown jewel, automates workflows with the precision of a factory floor. Its Q2 revenue leapt 48%, a number that dazzles. But what of the workers? The gig economy’s forgotten souls, who toil beneath the weight of such ambitions, find no solace in these figures. They see only the widening chasm between the haves and the have-nots.

The U.S. commercial segment, with its 93% growth, is a beacon of promise. Yet, 485 customers-fewer than the number of workers in a single factory-paint a different picture. This is not expansion; it is a trickle. The software’s cost, a fortress of wealth, bars the door to the masses. The system, ever hungry, feeds on the privileged, leaving the rest to scrape by.

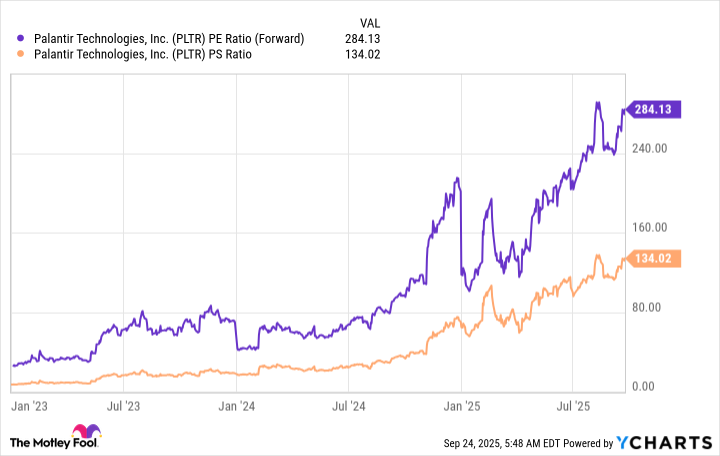

But will this hunger be sated? The numbers tell a tale of disparity. Palantir’s revenue has grown 81% since 2023, while its stock has ballooned 2,740%. Such a gap is not a sign of health, but of a bubble. A stock trading at 134 times sales and 284 times earnings is not a investment-it is a gamble, a high-stakes game where the stakes are the dreams of the working class.

Compare this to Nvidia, whose revenue has tripled in quarters, yet trades at a fraction of Palantir’s multiples. The contrast is stark. Where Nvidia’s growth is grounded in tangible progress, Palantir’s is a mirage, a fleeting illusion. The market, ever fickle, may one day turn its back, leaving investors to face the ruins of their hopes.

The common man, who toils in the shadows of these giants, watches with weary eyes. He sees the stock charts, the numbers, the promises. But he knows the truth: a company cannot sustain a price that outstrips its purpose. Palantir’s rise is a tale of excess, a warning to those who would chase the next big thing without question.

So, should one invest? Perhaps. But with caution. For in the end, the stock is not a promise-it is a gamble, and the odds are stacked against the many.

🚨

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

2025-09-28 15:17