The realm of dividend-emitting stocks and their cousins, the exchange-traded funds (ETFs), purportedly serve as the veritable elixirs of passive income. Yet, one cannot help but feel a twinge of irony when these lofty, high-yield pursuits stumble before the gleaming altar of the S&P 500 (^GSPC), which, with much flourish, struts about, flaunting its ostentatious returns like a peacock in the midst of a financial zoo.

Ah, dear investors! Let us not be ensnared by the need to vanquish the market each year. Nay, let us instead entertain nobler financial ambitions-perhaps the pursuit of a precise amount of passive income, or a humble supplement to one’s golden years. Such goals yield a more dignified and sustainable type of wealth, rendering this profane market less daunting.

Contemplate, if you will, the consideration of $28,000 biennially split between the stalwart divisions of ExxonMobil (XOM), Whirlpool (WHR), and the unpretentious Vanguard Utilities ETF (VPU). This cheerful trifecta may well produce an annual yield surpassing $1,000, a fortune of passive income rendered almost magical in its simplicity. Now, let us peer into the oddities behind these choices, for October holds secrets worth uncovering.

ExxonMobil: A Dividend Tale for the Ages

Scott Levine (ExxonMobil): Here we unfurl our tale of ExxonMobil, a veritable titan of dividends, which has graciously bestowed its bounty upon shareholders for no less than 42 consecutive years. One might wonder how this steadfast institution manoeuvres through the turbulent, tempestuous waters of energy prices, maintaining buoyancy amidst such cyclical madness.

The elegance of their dividend-even as it beckons with a 3.4% yield-lies not in mere numbers on a ledger but in a profound commitment to sustain these payouts, a promise etched into the very fabric of corporate philosophy. “The dividend, dear shareholders, is our lifeblood,” management would implore us, akin to the confessions of a wayward priest seeking absolution.

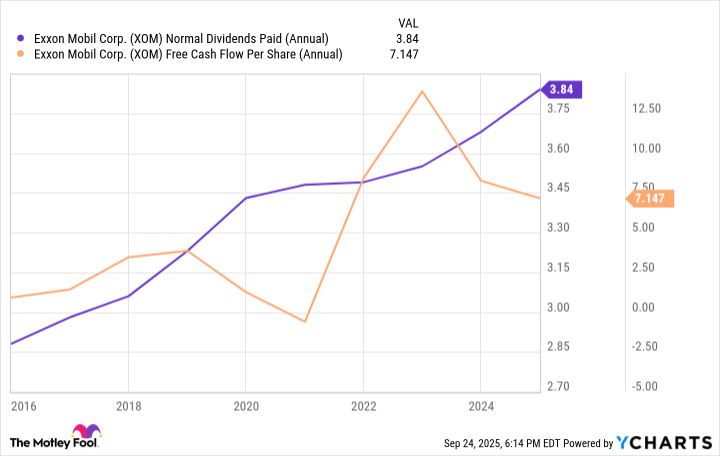

Yet, the wise investor must wield skepticism like a cape to thwart any unwarranted optimism, for even promise can be but a dream if not substantiated by rigorous analysis. History whispers that Exxon has maintained a conservative payout ratio of 68% over the past five years-a vestige of prudence in an otherwise ostentatious world.

And behold! A torrent of free cash flows compounds the magic, ensuring that the dividends are as secure as the very foundations of the company itself, a veritable engine pushing the cart of passive income forward.

A Curious Turn: The Whirlpool Effect

Lee Samaha (Whirlpool): In an unexpected twist rife with irony worthy of the finest dramas, we witness the Federal Reserve, in a moment of misguided benevolence, slashing rates, only to have the market recoil, selling off Whirlpool stock with the panicked fervor of a town crier caught in a weave of rumors and news. Ah, the frenzy of public sentiment as unpredictable as a tempest in a teacup!

The true absurdity lies in the fact that Whirlpool, sensitive as it is to interest rates, flourishes under lower rates, which ought to stimulate housing sales. Alas! Many an investor, apparently thwarted by logic, rushes to abandon ship. Yet, dear readers, do not allow outer perceptions to cloud your judgment!

Our journey into the price-setting quagmire reveals that tariffs upon Asian rivals have prepped the field for Whirlpool, transforming it from mere player to commanding enforcer in the marketplace. As competitors hastily preloaded inventories, they sow the seeds of their own undoing-a bitter harvest looming on the horizon.

With a 4.7% dividend yield, this stock stands tall amid a flurry of turbulence, embracing both the income seekers and the speculative dreamers with open arms, like a benevolent but slightly deranged czar bestowing gifts of reparations.

The Unseen Hand of Demand Powering Utilities

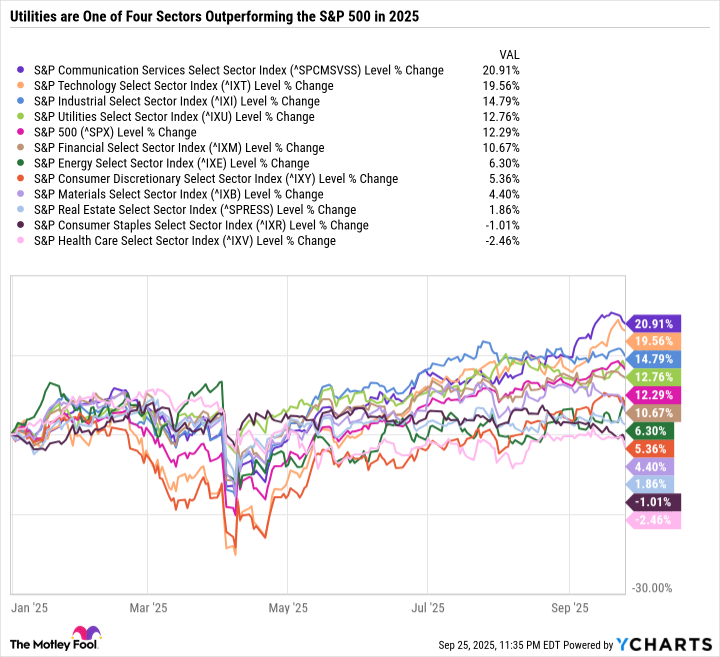

Daniel Foelber (Vanguard Utilities ETF): As we turn our gaze to the electric utilities realm, we find ourselves amid peculiarities yet again. The sectors that typically unfurl their banners of prosperity during bull markets-technology, industrials, and their brethren-dance gaily, boasting growth that would send a well-fed boar into a spin from envy.

Here, the utilities sector, usually famed for its sober demeanor, finds itself, ironically, flourishing-hovering near the heights like a moth drawn to the flame of the S&P 500. In this peculiar theater, the regulated electric utilities, through their negotiations with governmental apparatchiks, secure steady income flows amidst a cacophony of power demands that would make any overworked generator weep.

Ah, but enter artificial intelligence, that specter of the modern era! It demands a torrent of energy that our aging grids scarcely comprehend. Solutions such as small modular reactors-think of them as the sprightly elves of the energy world-begin to draw investors’ gazes. Flooded with excitement over the endeavors of hyperscalers constructing data centers, they overlook the vital undercurrents of the utility sector.

As for the Vanguard Utilities ETF, it emerges, drenched in a modest expense ratio of 0.09%, a veritable bargain for anyone interested in the burgeoning need for energy across this great land. And with a yield of 2.8%, it beckons with promises of generating passive income, contrasting the lowly yields often offered by the shiny trinkets of the high-tech world.

Thus, dear investors and readers, the tapestry of dividend stocks and ETFs weaves a most curious narrative, wrought with complexities, contradictions, and opportunities masquerading in the guise of mere financial instruments.

✨

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Banks & Shadows: A 2026 Outlook

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-09-28 14:09