Behold Ferrari (RACE), a company that produces not merely automobiles but a symphony of engineering, exclusivity, and the kind of brand mystique that makes even the most stoic investor clutch their pearls. Since its 2015 IPO, this crimson charioteer has outpaced the S&P 500 by a margin so vast it could be mistaken for a Grand Prix victory lap. But let us not gawk at the finish line-let us dissect the engine.

Two metrics, like two well-timed pit stops, reveal why Ferrari is not merely a carmaker but a masterclass in capital alchemy. The first: its operating cash flow-to-sales ratio. The second: return on invested capital. Together, they form a financial duet that would make even the most jaded bureaucrat weep into their spreadsheet.

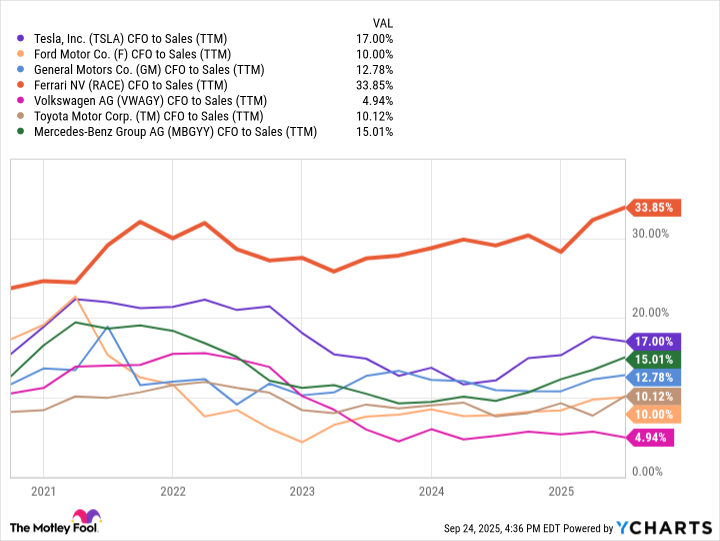

Cash Flow to Sales Ratio: A Dance of Efficiency

Operating cash flow (OCF) to sales is the financial world’s equivalent of a well-sharpened cheese grater-simple, effective, and capable of turning even the dullest numbers into something resembling a profit. Divide operating cash flow by net sales, and voilà: you have a ratio that whispers, “I am both solvent and solvently solvent.”

Observe the chart above. Ferrari’s ratio is not merely “respectable”-it is a symphony of dominance. Competitors, meanwhile, resemble a chorus of frogs attempting to harmonize. For three years, while rivals have dithered like officials at a bureaucratic tea party, Ferrari has accelerated like a Maserati through a tollbooth. The lesson? Cash flow is not a suggestion-it is a commandment.

This ratio, you see, is the financial equivalent of a well-tailored suit. It allows Ferrari to pay its debts, fund its growth, and-most importantly-avoid the indignity of asking shareholders for a loan. A company that generates cash is a company that plays the long game, a principle understood by those who’ve mastered the art of turning “maybe later” into “immediately.”

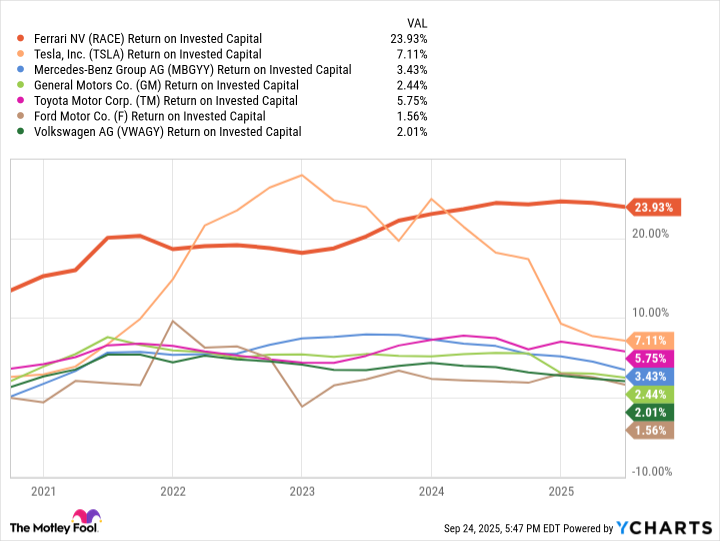

Return on Invested Capital: The Art of Making Money Make Money

Return on invested capital (ROIC) is the financial world’s version of a magic trick. It asks: “How much profit does this company conjure from every dollar it borrows, steals, or inherits?” The answer, in Ferrari’s case, is a sum that would make a Soviet commissar blush.

Behold the chart. Ferrari’s ROIC is not merely “impressive”-it is a financial acrobat performing on a tightrope over a lake of liquid nitrogen. At 46 times earnings, Ferrari trades at a valuation that suggests it is not merely a carmaker but a philosopher-king of capitalism. Its competitors, meanwhile, wallow in the mire of 17 times earnings, a price tag that screams “discount store for dreams.”

Why? Because Ferrari does not merely sell cars-it sells aspirations. The F80, with its $4 million price tag, is not a car but a passport to a life where money is merely the ink in which one writes one’s own legend. And in this game, Ferrari’s ROIC is the quill.

What It All Means: A Symphony of Greed and Genius

Ferrari’s success is not a fluke. It is the product of a brand so potent it could turn water into wine, and Formula One heritage so deep it could drown a lesser man in nostalgia. Its economic moat is not a ditch-it is a canyon, flanked by walls of exclusivity, loyalty, and a pricing strategy that would make a usurer weep with envy.

Residual values? Industry-leading. Customer loyalty? Bordering on cultish. Margins? Thicker than the soup in a Russian dacha. And yet, the pièce de résistance is its ability to turn capital into capital, a skill so refined it could be mistaken for witchcraft. In a world of bureaucratic bean-counters and get-rich-quick schemers, Ferrari is the rarest of beasts: a company that plays the long game while dancing on its head.

So, to the investor: buy this stock not because it is a carmaker, but because it is a story. A story of red leather seats, roaring engines, and the kind of financial alchemy that turns pennies into gold. Or, as Ostap Bender might say: “Why drive a taxi when you can drive a Ferrari-and then sell the taxi for profit?” 🚗💰

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Celebs Who Fake Apologies After Getting Caught in Lies

- Dividends: A Most Elegant Pursuit

- Venezuela’s Oil: A Cartography of Risk

- AI Stocks: A Slightly Less Terrifying Investment

2025-09-28 13:39