As the eve of autumn beckons, ushering in the final three months of the year 2025, a curious breed of investors emerges-those on the hunt for fervent growth stocks possessing the audacity to flourish, and others searching amongst the shadows for beleaguered assets that beckon with promising valuations to amend their passive income streams.

While the behemoths of the stock indexes appear poised at lofty heights, with but a select few titans influencing the venerable S&P 500 (^GSPC), some may sense a slight disquiet, a whisper suggesting they ought to submit to the thrall of market momentum. Yet, it is within the folds of diligent research and instinct that opportunities truly reveal themselves, illuminated for those with discerning eyes.

Consider, then, these worthy contenders-a spectrum between 11% decline and a staggering 66% retreat from their 52-week pinnacles-wherein lie the illuminating prospects of PepsiCo (PEP), Coca-Cola (KO), Energy Transfer (ET), Vertex Pharmaceuticals (VRTX), and The Trade Desk (TTD), each deserving of your earnest contemplation this October.

A dividend titan amidst the rustling leaves

Demitri Kalogeropoulos (PepsiCo): In a period when many stocks, particularly the technological marvels, kiss the heights of their vernal aspirations, looms the opportune moment to interweave a stalwart dividend titan into one’s investment tapestry. Today, PepsiCo, paradoxically, nets a sweetened allure, having experienced a retreat this year, unlike the resoundingly vibrant march of the broader market.

True, the venerable purveyor of snacks and libations finds itself contending with eroded demand and the creeping specter of rising expenses. The essence of organic sales saw a modest rise of merely 2% amidst the first half of the year, as core earnings languish at a sadder 3% decline. Yet, as history reveals, the firm’s sales in the previous year mirrored this humble acceleration, while profits danced upward by nearly 10%.

Wise investors might choose to overlook the flat forecast of profits this year and seize the opportunity to acquire a cash-flush enterprise poised for a rejuvenation of dividends. This past July, PepsiCo instilled confidence among its shareholders by declaring a return of $8 billion in dividends within the breadth of the year, all the while engaging in nominal stock buybacks. A glimmer of sales resurgence suggests the company may yet surprise in the quarter’s third act. As one awaits the earnings report come October 9, watch for signs of nascent growth and profitability blossoming.

At present, Pepsi yields over 4%, an attractive offering when one reflects upon its legacy as a Dividend King, having enhanced its distributions for a remarkable 52 consecutive years. This unbroken lineage of dividend increases is poised to continue, allowing investors to recline with patience while the company rekindles its torpid expansion. In a market barren of compelling bargains, PepsiCo emerges as an oasis of opportunity.

Coke: A steadfast choice amidst the autumn chill

Daniel Foelber (Coca-Cola): Building upon my colleague’s reverent acknowledgment of Pepsi’s merits, I submit that the esteemed Coca-Cola emerges as another compelling option for the income-conscious investor this October.

In adherence to the venerable tradition held by the Dividend Kings, Coca-Cola has graced its adherents with an increase in dividends, now spanning the 63rd consecutive year. Boasting a yield of 3.1%, it promises a steady haven amidst uncertainties.

Coca-Cola faces trials akin to those of its peer-a populace besieged by inflation and the woes of costlier living. Yet, it navigates these waves with remarkable resilience, securing organic growth by adapting its classic offerings, favoring lower-sugar alternatives, and replacing high-fructose corn syrup with cane sugar in its hometown. With forecasts of 5% to 6% organic revenue growth on the horizon, considering the contorted circumstances of the modern marketplace, one could certainly commend its tenacity.

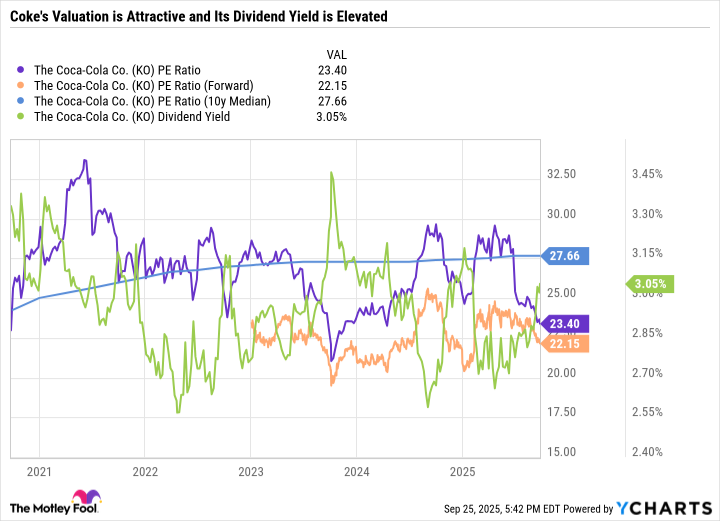

In the grand tableau of S&P 500 companies renowned for consistent dividends, the count diminishes to mere handfuls. Currently, Coca-Cola remains singularly tantalizing as its shares trade at a notable discount against its 10-year average price-to-earnings ratio. Historical trends suggest that when the yield surpasses 3%, it is an indicator of such alluring valuation that one may not wish to contemplate too deeply.

With businesses like Coca-Cola, the entry point into the stock carries greater weight than in enterprises whose valuations can soar on the wings of swift growth. The company projects an organic growth trajectory of 4% to 6% annually alongside a more tempered 7% to 9% currency-neutral earnings per share growth. Thus, securing a fair entry price becomes paramount for investors seeking wholesome total returns that rely not solely upon dividends.

Coca-Cola commands an elegant simplicity. Its business model rings true, the results shine brighter than anticipated, and its valuation beckons thoughtfully for long-sighted investors. Together, these factors converge to render this dividend powerhouse a fitting choice for the discerning investor in October, particularly those hedging against avarice and aimless speculation.

A steadfast wealth compounder through turbulent tides

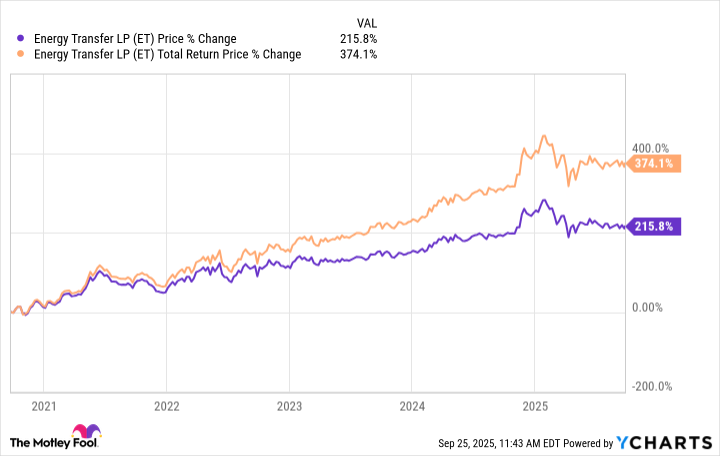

Neha Chamaria (Energy Transfer): The world of oil and gas stocks, replete with tempestuous volatility, is balanced by a cadre of companies delivering indispensable services to the economy, securing cash flows that remain relatively steadfast, even amid price tumult. One such guardian, Energy Transfer, is resolutely investing $5 billion into growth this year alone, eyeing a sustainable 3% to 5% annual dividend growth that emanates from its very core. If perhaps the notion of dividend growth appears lacking in grandeur, I present a five-year chronicle illustrating the profound impact reinvested dividends have wrought upon the totality of its returns-all hail Energy Transfer.

During this present year, when Energy Transfer shares falter at about a decline of 11%, the stage is set for those emboldened to seize the moment. Engaged in the processing, storage, and transportation of natural gas, crude oil, and their siblings in liquid form, Energy Transfer orchestrates a sprawling pipeline of over 140,000 miles, shepherding nearly 30% of the natural gas produced across this great nation.

Ambitious expansions are underway, particularly within the Permian Basin, where symphonic plans unfold-projects like the Hugh Branson pipeline, traversing 16 Texas counties, harnessing the fervent demand energy from burgeoning data endeavors. Additionally, the Nederland Flexport NGL terminal stands poised as a colossal NGLs export facility, second only in stature globally.

Moreover, Energy Transfer’s entwinement with Sunoco (NYSE: SUN), holding a commendable 34% stake since their joint venture birthed mutual ventures in the rich grounds of the Permian Basin, comes as a pleasant development-a merger of assets that whispers of synergy and potential. The fruits of Prosperity entwine with Energy Transfer’s diverse expansions, hinting at future avenues for revenue and cash flow growth that should underpin its ambitious dividend goals and compelling yield of 7.6%, heralding favorable returns for patient investors. As always, one must navigate the technicalities of this master limited partnership, familiarizing oneself with the complexities of Schedule K-1 Federal Tax Forms.

Fortitude and promise amid uncertainty

Keith Speights (Vertex Pharmaceuticals): I have expressed my trepidations regarding the current market landscape, which seems to beckon one towards the precipice of expectation. This sentiment is echoed by none other than Federal Reserve chair Jerome Powell, reflecting a collective intuition among vigilant investors. Still, should a market decline manifest in its foreboding guise, I harbor veritable confidence that Vertex Pharmaceuticals may stand resilient against the storm.

Vertex has carved a niche in the annals of medical triumphs, offering the only approved therapies capable of rectifying the misfoldings in CFTR proteins that lead to the harrowing affliction of cystic fibrosis (CF). A tumultuous market correction will not stifle physicians’ prescribing instincts nor halt the bravery of patients longing for relief. As I ponder the strength of Vertex’s robust defensive shield through its CF line, I find even more promise in its potential for unimaginable growth.

Vertex’s latest addition, Alyftrek, presents the allure of once-daily dosing-a more convenient offering than its renowned precursor, Trikafta/Kaftrio. Moreover, it promises a lower royalty burden, allowing the company’s wealth to flourish profoundly.

I remain particularly enthused by Vertex’s foray into pain management with its innovative drug, Journavx. As anticipation builds, the early commercial trajectory promises bounteous prospects, compelling the company to invest earnestly in its marketing endeavors.

Furthermore, the horizon looms with riches in Vertex’s pipeline, expecting regulatory advances with two late-stage programs slated for approval next year; both zimislecel, fighting severe type 1 diabetes, and povetacicept, targeting IgA nephropathy-a malady plaguing a society more extensive than that of CF. The eyes of this investor remain keenly fixed on inaxaplin, which may soon claim the honor of being the first approved therapy for APOL1-mediated kidney disease, affecting a populace doubly in number compared to those enduring CF.

The adtech stalwart, illuminated by opportunity

Anders Bylund (The Trade Desk): In the current climate, the digital advertising maestro, The Trade Desk, appears somewhat beleaguered by seasonal declines. The digital advertising realm, still grappling with the aftermath of inflation’s icy grasp in 2022, witnesses many erstwhile spenders retreating into cautious crevices. The Trade Desk grapples with discontent among its clientele regarding elevating fees, allowing an unwelcome adversary like Amazon (NASDAQ: AMZN) to encroach upon their territories with sylph-like grace and a gentler price point.

Nevertheless, The Trade Desk does announce triumphs whispered amidst the winds of change. Their Unified ID 2.0 (UID2) technology bears the herald’s staff, promising a future bereft of the third-party tracking cookies that once defined the landscape of ad-buying. Amid macroeconomic burdens, history assures us that downturns are seldom eternal. Purchasing at such a modest discount may well set the stage for auspicious fortunes as The Trade Desk ventures forth atop the cyclical tide when it returns-though I confess, foretelling this resurgence remains elusive.

Indeed, I entirely empathize with those who recoil at The Trade Desk’s valuation metrics. Here lies a stock trading at 57 times trailing earnings and 8.6 times sales, an extravagant figure, yet it languishes, down 60% year to date, and even further from its celestial zenith of $141.53 reached in the twilight of last December. The curtain hides a steep discount, sonorous with the echoes of past success that plays on in both lush and barren market climates, offering confidence that this recent descent shall reveal an upward swing.

I wonder if we will ever encounter such an affordable prospect again, nestled within the complex script of its valuation ratios. All encompassed, The Trade Desk emerges as one of my preferred acquisitions in this peculiar season of investment.

Thus, dear reader, as we traverse the autumnal landscape of the stock market, may these prospects quiet your apprehensions and kindle the passions of your financial journey. 🍁

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Dividends: A Most Elegant Pursuit

- Venezuela’s Oil: A Cartography of Risk

- AI Stocks: A Slightly Less Terrifying Investment

- The Apple Card Shuffle

2025-09-28 13:07