Warren Buffett’s portfolio is like that one neighbor who always knows which recycling bin to use – maddeningly consistent. While Berkshire Hathaway’s (BRK.A) (BRK.B) track record speaks for itself, copying Buffett isn’t as simple as stealing his cable box. Some holdings are priced like a $50 parking meter, others are clunkers that even a junkyard wouldn’t touch. Let’s dissect two worthy buys and one that’ll leave you with buyer’s remorse.

Buy: American Express

Berkshire owns 17% of American Express (AXP) – their second-largest holding. Why? Because Buffett treats AmEx like a country club membership: exclusive, slightly overpriced, and impossible to leave. Visa (V) and Mastercard (MA) get mere crumbs by comparison. The Oracle of Omaha’s loyalty? A masterclass in passive-aggressive investing. He’s saying, “This is the only credit card I’ll accept for dinner reservations.”

AmEx isn’t just a payment middleman. It’s a full-service guilt-trip: $900 annual fees for “perks” like hotel credits and cashback. It’s the financial equivalent of paying extra to sit in an airplane exit row – you’ll never use the legroom, but you’ll pay for it anyway. Yet Buffett’s stuck with it since the ’90s, like a man who refuses to update his VHS collection. The affluent clientele? Immune to recessions, layoffs, or basic financial anxiety. Their Q2 results? A 9% revenue jump. CEO Stephen Squeri practically dared the economy to stop them: “Come on, bro, I’ll buy another round.”

Buy: Kroger

Kroger (KR) isn’t Buffett’s headline act – more like the quiet guy in the back row who always knows the answer. Berkshire’s stake flies under the radar, which makes sense: grocery stores aren’t sexy until you realize they’re the only ones making money when everyone’s broke. With 2,731 stores and $150B in sales, Kroger’s the friend who brings snacks to a poker game – not flashy, but essential.

Growth? Glacial. Profit margins? Paper-thin. But Kroger’s dividend increased 250% over a decade – like finding a $20 bill in an old jacket pocket every year. Buybacks halved shares outstanding, turning reinvested dividends into a stealth weapon. The S&P 500? Please. Thirty years of Kroger’s dividend drip would’ve been the financial version of always getting the last parking spot near the door.

Avoid: UnitedHealth Group

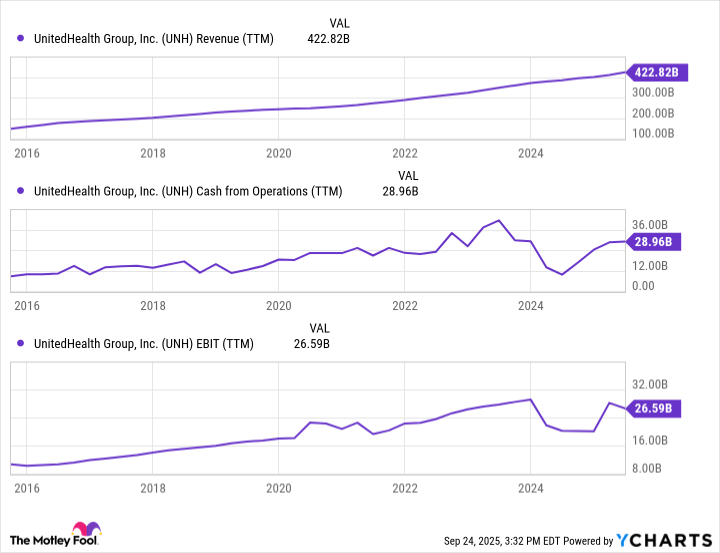

Buffett bought $2B of UnitedHealth (UNH) in July. Big mistake. Not because the stock fell 60% – no, because UNH is the healthcare equivalent of a buffet with a “no double-dipping” rule. Everyone breaks it, and now the DOJ’s hovering with a ladle. First-quarter earnings missed? CEO Andrew Witty quit “for personal reasons” – a phrase so vague it’s basically an insult. Then the FTC sued their pharmacy arm for jacking up insulin prices. OptumRX’s defense? “Everyone’s doing it!”

Healthcare’s a minefield: Medicare billing probes, pricing lawsuits, and a government that suddenly cares about affordable care. Buffett’s “be fearful when others are greedy” mantra doesn’t apply here. This isn’t fear – it’s exhaustion. UnitedHealth’s revenue keeps growing, but profits? Stagnant. EBITDA? Flatlined. It’s like buying a toaster that only burns bread on one side. Wait for the regulatory dust to settle. Or don’t – I hear OptumRX is working on a loyalty program with 900 annual points toward… insulin co-pays? 🎩

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Wuthering Waves – Galbrena build and materials guide

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- Most Famous Richards in the World

- The Most Anticipated Anime of 2026

- Top 20 Educational Video Games

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2025-09-28 03:20