The S&P 500 index (^GSPC), that old riverboat captain of markets, has ferried investors 242% upstream over the last ten years. A fine vessel, to be sure, but one that’s earned its keep by meandering through calm waters. For those with a taste for the wild rapids-where fortunes are made and lost in the blink of an eye-growth ETFs offer a different kind of voyage. They’re like hiring a guide who promises to row you to the moon if you’ll just toss him a few gold doubloons. Whether he delivers is another matter entirely.

Growth stocks, you see, are the wild horses of the financial plains-neither predictable nor gentle, but brimming with the kind of energy that can gallop past the pack. A growth ETF is just a corral for these steeds, and while no trader worth his salt claims to predict the future, there are three particular pens on Wall Street’s ranch that might just outpace the old S&P 500 herd. Or so the rumor goes.

1. Schwab U.S. Large-Cap Growth ETF

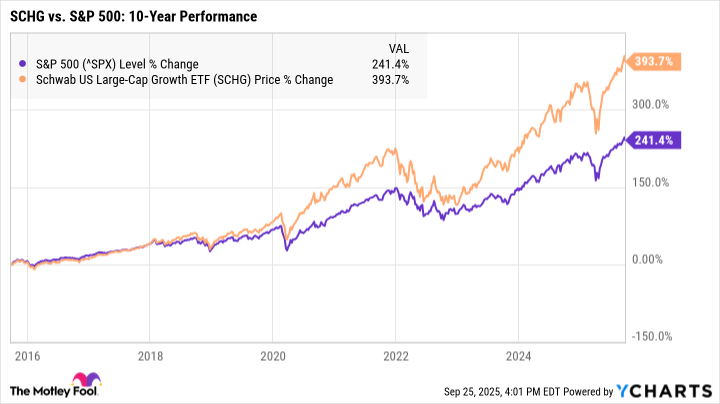

The Schwab U.S. Large-Cap Growth ETF (SCHG) is a curious beast. It herds 197 large-cap stocks, nearly half of which are tech titans. Now, large-cap stocks-those with a market cap of $10 billion or more-are like the seasoned oxen of the business world. Sturdy, reliable, and not prone to sudden leaps. Yet here they are, corralled into a growth fund, which is a bit like asking a donkey to dance the waltz. And yet, by the numbers, it’s worked: 394% total returns over ten years, compared to the S&P 500’s 242%. If you’d invested $10,000 a decade ago, you’d be sipping lemonade on a yacht while the S&P 500’s boat is still in the harbor.

But hark! Past performance is no guarantee of future glory. It’s the same as betting on a horse because it won yesterday’s race-just because it’s fast doesn’t mean it won’t trip over a pebble tomorrow. Still, the Schwab fund’s focus on growth stocks is a gamble worth considering, provided you’ve got the patience of Job and the stomach for a bumpy ride.

2. iShares Core S&P 500 Growth ETF

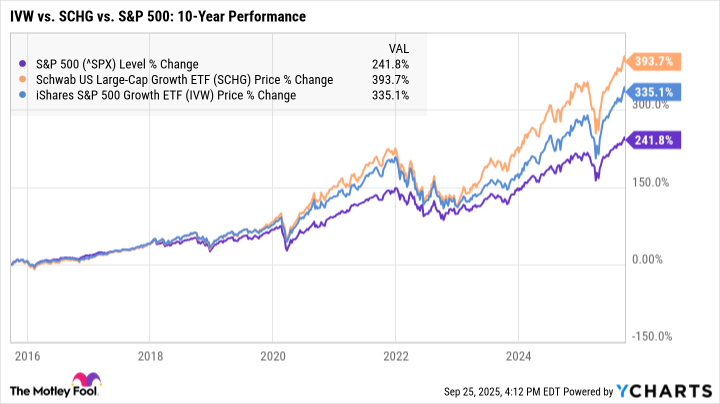

The iShares Core S&P 500 Growth ETF (IVW) is the Wall Street equivalent of a velvet rope club. Only the crème de la crème of the S&P 500 get a seat at the table, and even then, they’re expected to dance when the music plays. This fund’s holdings are all large-cap stocks, but unlike the Schwab, it’s curated from the S&P 500’s exclusive roster. That’s like picking only the five-star generals to lead your army-strict, disciplined, and with a tendency to rally when the cannons start booming.

Its returns, at 335% over ten years, are a shade less dazzling than Schwab’s but still enough to make the S&P 500 blush. It’s the financial equivalent of a well-tailored suit: not flashy, but dependable. For those who want to limit risk while still chasing growth, this ETF is a safe bet-so long as you’re not too eager to cash in during a market storm.

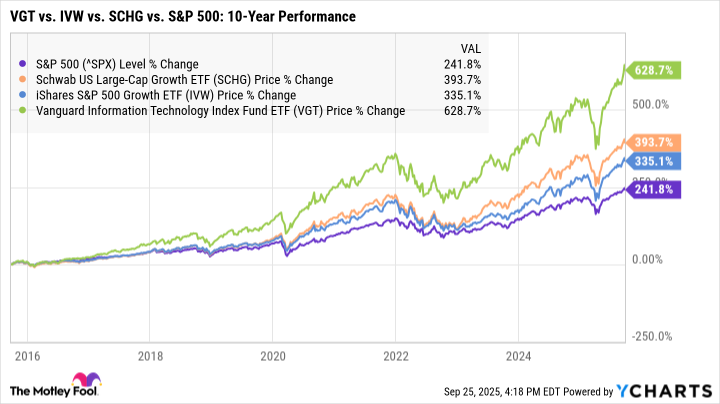

3. Vanguard Information Technology ETF

If you fancy yourself a daredevil with a penchant for the volatile, the Vanguard Information Technology ETF (VGT) is the rodeo you’ve been waiting for. This beast is pure tech, with Nvidia, Microsoft, and Apple among its top three holdings. It’s the digital Wild West, where fortunes are made by coding wizards and broken by a single software glitch. Over the last decade, VGT has returned 630%-a performance that would make even the most jaded Wall Street shark raise an eyebrow.

But mind you, this is no leisurely stroll through the garden. The tech sector is a rollercoaster that’s prone to loop-the-loops and steep drops. If you’re not prepared to ride it for the long haul-or at least have a spare set of trousers for the mess you might find yourself in-this ETF isn’t for you. Diversify, my friends, or risk becoming the next cautionary tale in the almanac of Wall Street folly.

In the grand scheme of things, these ETFs are like the old-timers’ tales of the Mississippi: full of promise, peril, and the occasional crooked riverboat gambler. The longer you hold on, the likelier you are to see the river’s end. Just don’t forget to bring a paddle. 🐍

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Lilly’s Gamble: AI, Dividends, and the Soul of Progress

- Celebs Who Fake Apologies After Getting Caught in Lies

- Nuclear Dividends: Seriously?

- Berkshire After Buffett: A Fortified Position

- Chips & Shadows: A Chronicle of Progress

- A Few Pennies to a Fortune

2025-09-27 22:42