Eaton (ETN) has, for some years, been a delightful companion in my portfolio. Since my acquisition of the stock in 2015, when the company was still absorbed in the complexities of integrating Cooper Industries, I have found the company’s gradual metamorphosis to be one of considerable interest. The merger, no doubt, was no trivial affair, but its effects have proven to be of lasting consequence. Five years hence, I am inclined to believe that Eaton will present itself as an even finer establishment than it does today, with its growth potential clearly manifest.

What the Union with Cooper Brought

Eaton, established over a century ago, originally earned its reputation in the business of power management-a niche as enduring as it is essential. Beginning with the production of truck transmissions, a matter to which they still attend, the company’s trajectory was notably altered upon the acquisition of Cooper. Cooper, with its singular focus on the management of electricity, afforded Eaton greater exposure to this increasingly vital sector. Such a strategic move was a marriage of convenience, not unlike the coming together of two families for the sake of improved social standing.

The integration of Cooper, a venture requiring no small amount of patience and meticulous care, ushered in a period of streamlining for Eaton. The company, still known for its steady expansion through strategic acquisitions, also made notable exits from certain historically significant operations. Among these was the decision to distance itself from the highly volatile hydraulics sector, which had long been tethered to the cyclical whims of heavy construction markets. This move was surely as thoughtful as the decision to break off an unsuitable engagement-allowing the company to focus on ventures that would prove more stable and lucrative in the long term.

In the course of this reformation, Eaton pursued three primary objectives: first, to position itself for sustained growth; second, to focus on higher-margin enterprises; and third, to embrace a business model that could endure the vagaries of economic cycles. It is this final aim that will reveal its true worth in the coming five years-an endeavor that will, no doubt, be closely scrutinised in the near future.

What Eaton Has Achieved So Far

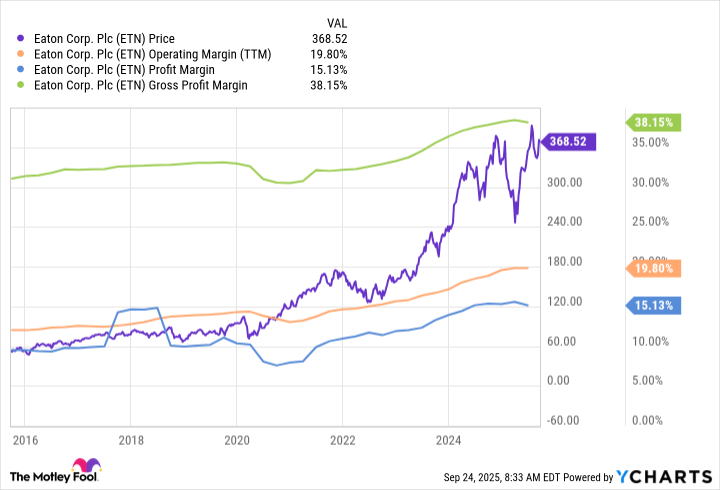

In the years I have held Eaton, its progress has been striking. The company’s focus on electricity-related enterprises now accounts for nearly seventy percent of its total revenue, a testament to the success of its strategic realignment. As the accompanying chart so clearly illustrates, the company’s profit margins have enjoyed a steady and, it must be said, rather enviable rise.

Under the stewardship of its management, Eaton appears to be diligently pursuing its long-term objectives. Yet, as with all ventures of considerable ambition, the ultimate proof of success is found in the ability to weather a true economic storm. While the brief and somewhat erratic recession brought on by the pandemic might not offer the clearest test, it is to be hoped that the next downturn-a more traditional affair, one assumes-will provide a more definitive measure of Eaton’s resilience.

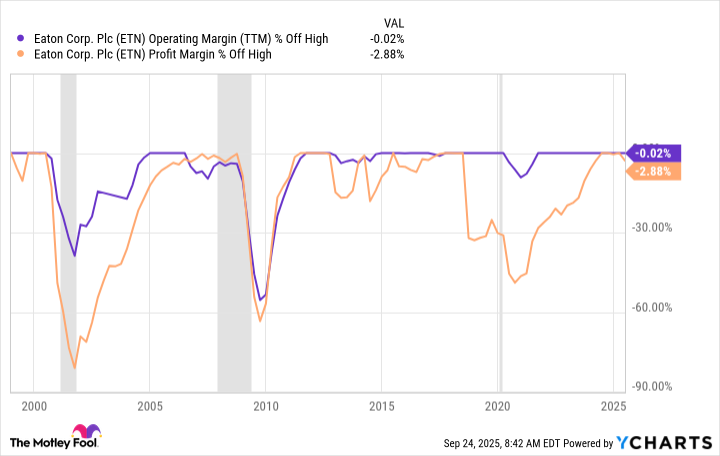

It would be unwise to expect Eaton to remain entirely unscathed during a recession, for even the most robust of industrial companies are inevitably affected by such economic upheavals. However, I do expect Eaton to endure a future downturn with greater fortitude than it has in previous years, having fortified itself with a more stable business model.

It is, of course, difficult to predict precisely how this will unfold, for the nature of the next economic contraction will play a crucial role. Yet, a look back at previous downturns-the dot-com bust and the Great Recession, for instance-provides useful perspective. As the chart above reveals, Eaton was not severely affected by the pandemic-driven recession. But this was an event unlike any other, brief in its duration and driven more by health concerns than by economic fundamentals. I am, therefore, eager to see how the company performs in a more prolonged and traditional recession before I am willing to pronounce its resilience fully tested. I remain confident, however, that Eaton is, today, in a stronger position than it has ever been.

Eaton: An Evolving Entity

Though Eaton’s foundations remain rooted in power management, the nature of that power has evolved considerably over time. The shift towards electricity, in particular, marks an important chapter in the company’s long history. In addition to this strategic change, Eaton has undertaken significant internal adjustments, fine-tuning its operations to achieve more consistent and higher margins. These advancements, I believe, will be fully evident in the coming five years, and I expect Eaton to navigate this period with both grace and efficiency.

The prospect of Eaton in the next five years, then, is one of measured optimism. The company has made notable strides, but the true test awaits in the economic cycles yet to come. As with any promising business, it is the future that will reveal the full extent of its success. I have no doubt that Eaton, having evolved from its humble beginnings, will prove itself a worthy and resilient entity in the years to come. 🤔

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- DOT PREDICTION. DOT cryptocurrency

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- NEAR PREDICTION. NEAR cryptocurrency

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Top 15 Insanely Popular Android Games

- USD COP PREDICTION

2025-09-27 21:00