So, here we are, five years later, and the question is: should we trust the stock market again? It’s not like it’s ever been great at keeping its promises. But let’s not get dramatic-this is just a story about ships, money, and how humans are terrible at planning.

2020 was the year the world collectively decided to stop moving. Cruise ships, those floating party machines, were the first to go. Imagine being a billionaire who owns a fleet of $1 billion party machines, and suddenly, they’re just… sitting there. Like a toddler’s toy left in the rain.

But here’s the thing: people are weirdly stubborn. Even when the world is on fire, they still want to go on cruises. It’s like they’re saying, “Sure, the planet might be dying, but can I get a margarita on the deck?”

Boom, Then Bust, Then Boom Again

By 2022, the cruise industry was back to 84% of pre-pandemic levels. Not bad, right? But then, in 2023, something weird happened-people kept coming. Like, they didn’t just return; they doubled down. It’s as if the pandemic taught them that life is short, and also, they really like free Wi-Fi.

2024 saw record numbers, and 2025 is already looking like a sequel. The only thing more predictable than cruise demand is the fact that I’ll probably never afford one. But hey, at least the stocks are doing well. Or as I like to call it, “the rich getting richer while the rest of us stare at charts.”

Stocks Are Up, But Is This a Good Bet?

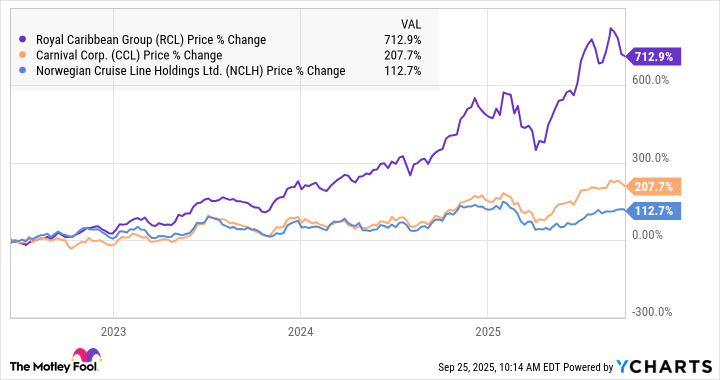

Norwegian Cruise Line? Up 112%. Carnival? Tripled. Royal Caribbean? A 711% gain. It’s like watching a friend who’s been through a rough patch suddenly start dating someone who’s way too good for them. You’re happy for them, but also slightly jealous.

The numbers are impressive, sure. But let’s not forget: this is a business that depends on people wanting to be somewhere they’re not. And let’s be honest, humans are terrible at making decisions. What if the next pandemic is… a really good beach day?

Here’s the thing: if you’re thinking about investing, you’re probably not the person who can afford to lose money. Which is a shame, because the cruise industry is basically a metaphor for life-full of ups, downs, and a lot of people pretending they know what they’re doing.

| Company | Revenue (TTM) | Revenue Growth (Most Recent Quarter) | Forward P/E Ratio | Market Cap/Debt |

|---|---|---|---|---|

| Royal Caribbean | $17.2 billion | 10.4% | 19.5 | $88.5 billion/$19 billion |

| Carnival | $26 billion | 9.5% | 14.5 | $39.9 billion/$28.7 billion |

| Norwegian Cruise Line | $9.56 billion | 6.1% | 10.8 | $11.3 billion/$14.9 billion |

The Big Question: Should You Take the Plunge?

If I were you, I’d ask myself: do I want to bet on a business that’s basically a giant, floating casino? Royal Caribbean has the best balance sheet, but even they have more debt than a college student after finals week. And let’s not forget-this is a company that’s counting on people wanting to be somewhere they’re not. Which, honestly, sounds like a terrible plan.

But hey, if you’re feeling lucky, go for it. Just don’t blame me when the next crisis hits and you’re stuck on a ship with no Wi-Fi. 🚢

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-09-27 16:43