The tech sector has been the party where everyone’s winning, but not everyone’s invited. Since 2010, the Nasdaq Composite has been the guest who keeps showing up with a 16% CAGR-like a friend who always brings the best snacks. Meanwhile, the S&P 500’s 12% is the one who says, “I’m just here for the ambiance.”

So, what’s a value investor to do? Two stocks that might outperform the “I’ll just take the elevator” crowd. Let’s dive in.

1. Tempus AI

First up: Tempus AI (TEM). If you’ve never heard of them, don’t worry-you’re not alone. It’s the startup that’s less “Silicon Valley” and more “I’m just here to solve cancer.” Founded in 2015, they’re like the nerdy kid who’s suddenly got a PhD in AI and genomics. Their revenue? $315 million, up 90% YoY. Gross margin? 61%. Net loss? $43 million. It’s like ordering a salad but getting a steak-happy, but slightly confused.

- $315 million in revenue, up 90% year over year

- $195 million in gross profit, representing a gross margin of 61%

- $(43) million in net loss, an improvement over its net loss of $(552) million one year ago

Their genomics testing business? 77% of revenue. Data and services? 23%. It’s the equivalent of a restaurant that’s great at burgers but also sells coffee. The question is: Can they turn the corner from “aspirational” to “profitable” without sounding like a PowerPoint slide?

2. Oracle

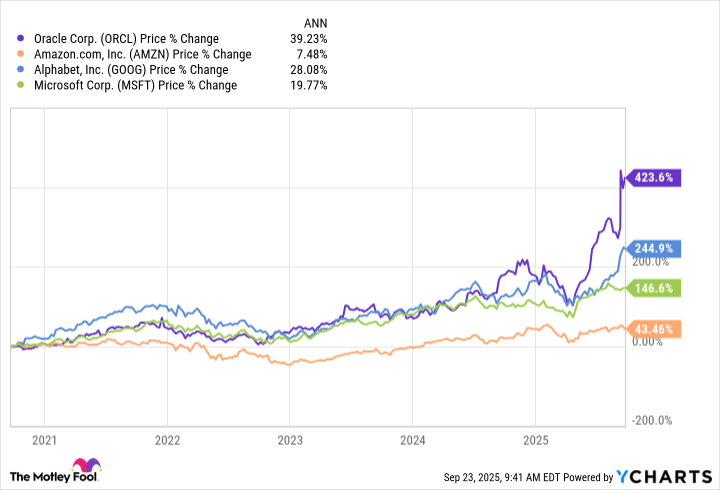

Next: Oracle (ORCL). This is the guy who once crashed harder than a toddler at a karate class, but now’s the one dominating the gym. Their 39% CAGR over five years? That’s like finally getting a promotion after years of doing the admin work. Amazon, Microsoft, Alphabet? They’re the ones still trying to catch up.

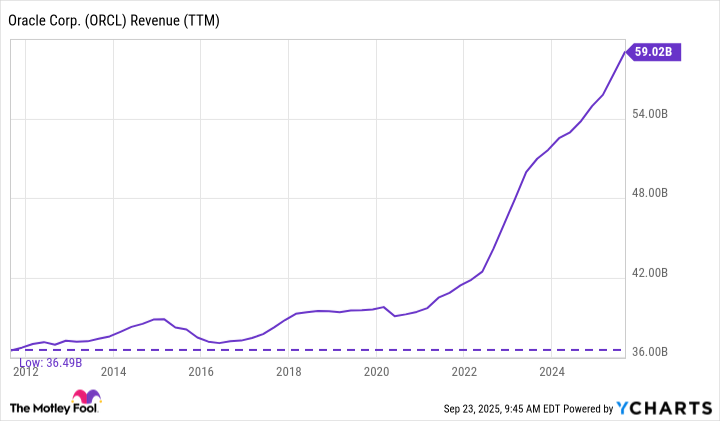

Oracle’s cloud push? It’s like Netflix for data centers. Companies needing AI power? They’re the ones handing out the Wi-Fi passwords. Revenue? $59 billion. That’s not just growth-it’s a “I’ve been working out” moment after a decade of “I’ve been binge-watching.”

So, why invest? Because Oracle’s not just riding the AI wave-they’re building the surfboard. Just don’t expect them to explain it in a meeting. They’ll probably say, “We’re optimizing the stack,” which means “I have no idea what I’m doing.”

In the end, both stocks are like that friend who says, “I’m not lazy, I’m just energy-efficient.” They’ve got the potential, the growth, and the occasional loss. But hey, isn’t that the point of investing? To bet on the underdog… while also checking the weather forecast?

📊

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-09-27 16:33