In the grand theatre of global geopolitics, where every political chess move is a gambit for power and influence, one act has played itself out with a particularly glittering sheen: tariffs. And where the ever-intriguing United States is concerned, that shimmer is being reflected in the world of rare-earth metals, the modern equivalent of alchemical gold-vital for anything from your pocket-sized gadgets to the unspoken engines of defense.

And here, gallantly striding onto the stage, is MP Materials (MP), a name that, in these trying times, rings like the clang of a hammer striking hot iron in a foundry. A U.S.-based company dealing in those very metals China, with its perennial flair for leveraging economic power, has so deftly limited. But does MP Materials, this unlikely protagonist, represent the smartest buy amidst the furious rush for rare-earth fortune? Let us muse over its potential for the long-term dividend hunter.

The Symphony of Tariffs and Their Discontents

To the casual observer, tariff politics might seem a tedious orchestra of raised voices and jangling cymbals, but to the seasoned ear, it sings a different, more menacing tune. Under a new administration, Washington D.C. has unleashed an unabashed concert of tariffs, aimed squarely at foreign markets. China-an almost mythical titan in the realm of export-has, naturally, responded in its own tempestuous way. With tariffs on the rise, China has squeezed the global supply of those rare-earth metals essential to the high-tech infrastructure of tomorrow.

Ah, but it is here that the tale of MP Materials truly begins. A company, founded with the utmost foresight, poised to harvest these metals from within the borders of the United States, far from the geopolitical tempest that swirls around its Chinese counterpart. This is no fleeting moment of opportunity-it is a burgeoning enterprise, as artful and sophisticated as any grand opera. And, it would seem, the timing of MP Materials could not have been more prescient.

The Enigma of Investment: A Tale of Two Partnerships

The crescendo of MP Materials’ significance was marked by not one, but two grandiose investments-each one a stroke of financial genius. On July 10, the U.S. government, in its infinite wisdom, saw fit to bestow a $400 million investment upon the company, along with the allure of convertible securities. Five days later, Apple, that gleaming titan of consumer technology, announced a $500 million partnership with MP Materials. One might say the ink on these deals was still wet when MP’s stock price surged upwards, as if pulled by some magnetic force.

The market, with its insatiable hunger, devoured the news with all the enthusiasm of a hungry beast. MP Materials responded by offering $650 million in stock at an attractive price-so attractive, in fact, that demand forced the offering to be upsized. Such is the power of a story well told, and MP Materials’ tale has certainly been compelling. Yet, as the wise investor knows, every tale has its caveats.

Execution: The Sword of Damocles

It is, alas, the challenge of execution that hangs like a sword of Damocles over MP Materials’ long-term prospects. The company, while flush with cash, is still in the throes of building its business. A lofty endeavor, indeed-mining, refining, and processing rare-earth metals is no simple affair. And thus, the ghost of execution risk looms large. Should the business falter in its expansion, the once-rising star of MP Materials could plummet into the abyss of investor disillusionment.

Compounding this is the delicate ballet of tariffs. Should these tensions between the U.S. and China ease in the coming months, MP’s meteoric rise may very well lose its luster. The company’s income statement, like an abstract painting of a thousand conflicting forces, is still deeply red. This loss, expected in the short term, reflects the very nature of building a new empire.

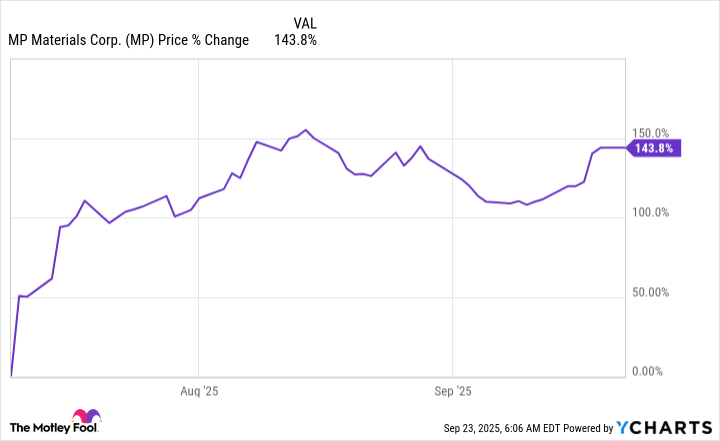

The startling rise in MP Materials’ stock-over 140% since July 9-might tempt one to declare the company an investment paradise. Yet, dear reader, one must tread carefully. The market’s response, swayed by the rare-earth metals narrative, may not reflect the true complexities of building a company from the ground up. Thus, the short-term frenzy could easily spiral into a sobering reckoning, should the execution fail to meet the sky-high expectations.

Patience and the Dividend Hunter’s Wisdom

For those whose ambitions lie beyond the fevered rush of short-term gains, the key here is patience. The opportunity for MP Materials is certainly an attractive one, but its long-term viability requires more than a mere glance at the headlines. Investors looking to benefit from this rare-earth bonanza must steel themselves for a potentially long and rocky road.

At present, much of the good news has been priced into MP’s stock. Therefore, those seeking to venture into the company’s shares must adopt the mindset of a patient investor-one whose eye is fixed on dividends to be reaped over the years, not the quick, ephemeral thrills of the stock market’s volatile swings. Conservative investors, those cautious architects of wealth, might prefer to wait and observe, seeing whether MP Materials can turn its considerable capital into a long-lasting enterprise.

In the end, MP Materials may very well be the modern-day equivalent of a gold mine-rich with promise, yet fraught with the unpredictability of human endeavor. A dividend hunter’s dream, perhaps, but one that requires the calm of the long-term planner, and the sharp mind of a careful observer.

🥂

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- TON PREDICTION. TON cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Warby Parker Insider’s Sale Signals Caution for Investors

- Beyond Basic Prompts: Elevating AI’s Emotional Intelligence

- Actors Who Jumped Ship from Loyal Franchises for Quick Cash

- Berkshire After Buffett: A Fortified Position

2025-09-27 14:52