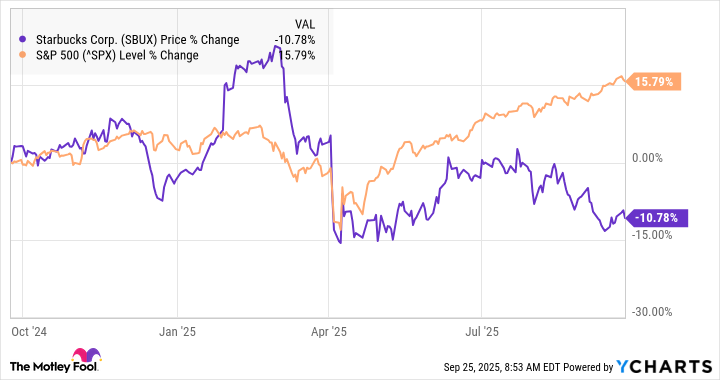

The arrival of Brian Niccol at Starbucks last year stirred the sort of quiet hope one feels when a spring rain begins – promising at first, yet all too often insufficient to quench the drought. His reputation as a savior of beleaguered brands preceded him, having coaxed Chipotle back from the brink of an E. coli-induced abyss. Investors, ever eager for miracles, sent shares soaring 25% in a single day. But time, that unrelenting accountant of truth, has tallied a different ledger. The stock now languishes like a forgotten cup of cold brew, half-drained and gathering dust.

Niccol’s “Back to Starbucks” initiative reads like a poet’s manifesto – baristas penning personal notes, stores scrubbed to a showroom gleam, ceramic mugs clinking like church bells. One imagines him wandering the aisles like Chekhov’s own Astrov, muttering about “the proper arrangement of the furniture in a country estate.” Yet for all its pastoral charm, the strategy resembles attempting to mend a cracked vase with floral arrangements: the flaws remain, artfully concealed but unmistakably present.

Corporate pruning and the illusion of renewal

The decision to shutter underperforming locations carries the clinical precision of a surgeon’s scalpel, though the patient’s prognosis remains uncertain. Some 200 stores will vanish like autumn leaves, while 900 corporate roles dissolve into the ether. The remaining shops will receive what Starbucks quaintly calls “texture” – a decorator’s euphemism for spending money one doesn’t quite have.

Howard Schultz would recognize this dance. In 2008, he closed 600 stores, blaming “the relentless pursuit of more” for diluting the brand’s “third place” mystique. That gamble paid dividends, restoring the sheen of exclusivity like polishing antique silver. But today’s Starbucks resembles a once-grand estate fallen into disrepair, its heirs squabbling over dwindling inheritances while newer, hungrier rivals circle like crows.

The slow drip of investor patience

Same-store sales continue their downward spiral, a merry-go-round spinning in reverse. Economic headwinds blow cold – consumers tighten belts, baristas juggle apps, and the P/E ratio stretches past 30 like a pensioner attempting yoga. Niccol’s 2026 vision of “unleashing innovation” sounds as tangible as a mirage in the desert, beautiful from a distance but evaporating upon approach.

One suspects the old masters would understand this predicament. Chekhov’s characters often waited interminably for trains that never arrived, just as Starbucks investors now wait for profits that remain stubbornly out of reach. Perhaps closure lies not in numbers but in accepting the eternal truth: that all things – empires, coffee fads, and even stock tickers – are transient, like the steam rising from a freshly poured cup.

☕

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- TON PREDICTION. TON cryptocurrency

- Warby Parker Insider’s Sale Signals Caution for Investors

- Beyond Basic Prompts: Elevating AI’s Emotional Intelligence

- Actors Who Jumped Ship from Loyal Franchises for Quick Cash

- Berkshire After Buffett: A Fortified Position

- Celebs Who Fake Apologies After Getting Caught in Lies

2025-09-27 13:20