Once the obscure cousin of the tech family, Nvidia now presides over the digital ballroom with a scepter forged from silicon and speculation. A few years ago, it was the secret handshake of gamers and crypto zealots; today, it’s the name etched on the stock market’s golden ticket. But let us not forget-when the emperor’s new clothes are threadbare, even a phantom can become king. Enter Broadcom, that elusive phantom in the stock market’s grand masquerade.

A $1.6 trillion colossus, Broadcom lurks in the seventh rank of corporate titans, yet most would struggle to tell you if it sells semiconductors or sorbet. This is the art of the con: to build a juggernaut while masquerading as a utility. But ah, the AI gold rush has a way of unmasking even the most disciplined of corporate magicians.

Behold, the coming storm: Broadcom’s AI business, that sly fox in a boardroom suit, is poised to inherit the crown. Its strategy? A two-act play: first, the invisible threads of connectivity switches that stitch data centers together like a digital spider’s web; second, the XPUs-its trump card, custom chips designed not for versatility but for the surgical precision of a scalpel. In a world where AI workloads grow as predictable as a bureaucrat’s coffee break, Broadcom’s XPUs are the swindler’s ace up the sleeve.

Nvidia’s GPUs are the Swiss Army knives of computation, but versatility, like a well-meaning uncle, is a liability when you need a scalpel. Broadcom’s XPUs, tailored to the user’s whims, are the stock market’s answer to a bespoke suit-expensive, efficient, and quietly devastating in its elegance. And with data center spending projected to swell into the trillions by 2030, one might say the pot of gold is no longer at the end of the rainbow but in the hands of those who sell the buckets.

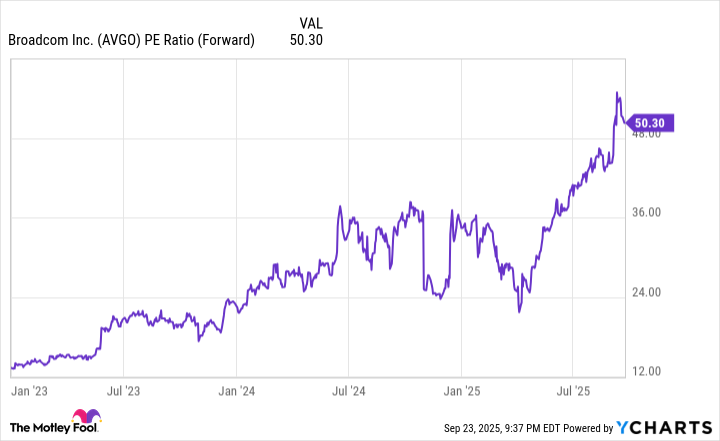

The numbers, dear reader, are a sonnet to greed: $15.9 billion in Q3 revenue, $5.2 billion in AI gold, and a Q4 forecast that makes Santa’s gift list look stingy. Yet the market, that fickle fashionista, has draped Broadcom in a gown of 50 times forward earnings. Is it overpriced? Perhaps. But in the theater of finance, the audience is always drunk on possibility.

Still, let us not confuse valuation with valor. Broadcom’s stock is not a bargain but a high-stakes poker game where the dealer is Nvidia. Yet for the long-sighted, the hand is worth playing: the AI arms race is not a sprint but a gladiatorial marathon, and Broadcom’s XPUs are its gladiator’s dagger. Whether it becomes a household name or a cautionary tale depends on whether the market prefers its heroes in capes or in custom silicon. 🚀

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- TON PREDICTION. TON cryptocurrency

- Warby Parker Insider’s Sale Signals Caution for Investors

- Beyond Basic Prompts: Elevating AI’s Emotional Intelligence

- Actors Who Jumped Ship from Loyal Franchises for Quick Cash

- Berkshire After Buffett: A Fortified Position

- Celebs Who Fake Apologies After Getting Caught in Lies

2025-09-27 13:18