Nvidia, dear reader, is a towering figure in the realm of technological investment, akin to the mighty oak among mere saplings. And yet, despite its prodigious size and seemingly immovable stature, there are still whispers in the marketplace-a chorus of voices which urge us to take a closer look at this company’s path, for the future, like the very fabric of our destinies, remains ever mutable. In the world of artificial intelligence (AI), the construction of the grand architecture has merely begun, and Nvidia, with its esteemed leadership, seems poised to reap rewards that few could contest.

Now, gather ’round, for I shall present to you three compelling reasons why one might, nay, should buy Nvidia stock as if the morrow never existed.

Act I: The Endless Tapestry of AI Infrastructure

One might be led to believe that the vast sums already lavished upon AI data centers would exhaust the need for further expenditure. After all, is it not sufficient to have already spent billions? Yet, the high priests of AI-those hyperscalers-see no end to their desires. With such hunger comes the promise of even greater riches. Nvidia, ever the watchful steward of these ambitious undertakings, predicts that the global expenditure on data centers will balloon to a staggering $3 to $4 trillion by 2030. This is no mere folly, but a careful orchestration of capital.

But is it not a stretch to imagine such numbers? Doubt not, for we find that there are, at present, only two nations-one in the West and the other in the East-who fervently invest in the magic of AI. The United States and China hold sway, and though Nvidia has yet to acquire the coveted export licenses to resume trade with the latter, it is not a gate that will remain forever shut. Meanwhile, Europe, ever slow to awaken, stirs at last to the reality of AI, and who is there to better fill this demand than Nvidia?

And let us not forget the nature of data centers themselves. They are not born overnight, as one might expect of a hasty construction. These great behemoths take years to build, and as such, the seeds sown today shall grow into the mighty oak of tomorrow. Nvidia, in all its wisdom, has aligned itself with these ventures, ensuring that when the time for installation comes, the necessary computing units shall be in place.

Act II: The Grand Alliances

But what of the art of partnerships, that most cunning of devices? Nvidia, ever the architect of its future, has entered into several strategic alliances that shall serve to cement its place at the pinnacle of computing supremacy.

A Stock Still Within Reach

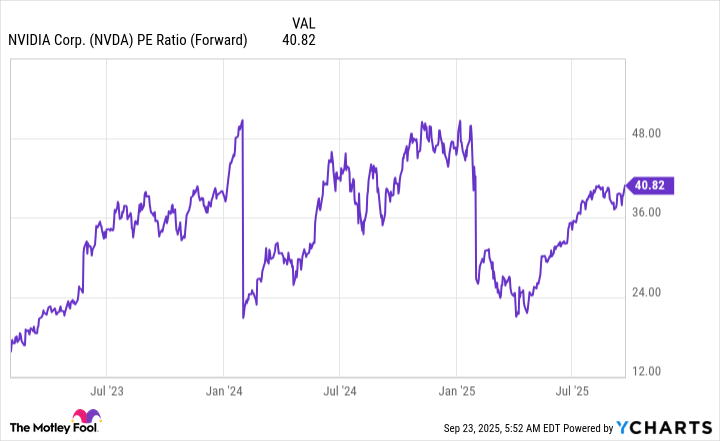

Despite all the victories, one might be tempted to question: is Nvidia not, in its current form, overpriced? A stock trading at 41 times its forward earnings is indeed a number that raises the eyebrows of even the most seasoned investor. Yet, as any wise observer of the market knows, numbers can lie, or at the very least, tell but a fraction of the story.

Consider, if you will, the rapid expansion Nvidia expects in the coming years. With growth rates that may continue to soar between 40% and 50% per quarter, the stock, though high by some measures, appears modest when placed within the context of future potential. When viewed over the long term, Nvidia’s valuation seems less the folly of an overzealous dreamer and more the calculated move of a chess master planning several moves ahead.

Thus, with all things considered, Nvidia remains a worthy investment-an opportunity not to be passed by, as surely as one would not let slip a treasure chest left unattended in the streets.

In conclusion, the future of Nvidia is one of abundance, foresight, and, dare I say, inevitability. To resist it is to ignore the very tides of fortune that carry us all. ⚡

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Actors Who Jumped Ship from Loyal Franchises for Quick Cash

- Berkshire After Buffett: A Fortified Position

- Celebs Who Fake Apologies After Getting Caught in Lies

- AI Stocks: A Slightly Less Terrifying Investment

- USD PHP PREDICTION

2025-09-27 12:31